Whether you have a storefront, online store, or both, clothing stores need New Jersey business insurance to protect themselves from unexpected accidents.

Clothing stores have several options when it comes to customizing their business insurance, which is why it's easiest to work with a New Jersey independent insurance agent. They'll get to know your business and your products and find you the right protection. Here's why you need insurance for your clothing store.

What Is Clothing Store Insurance?

Clothing store insurance is a type of customized business insurance that protects your store, inventory, and employees from a variety of losses and lawsuits.

"Clothing stores with sales of five million dollars or less can generally be covered by a New Jersey business owners policy," said insurance expert Jeffrey Green. "This includes commercial property, liability, and business interruption insurance. Inventory is covered under the commercial property," explained Green.

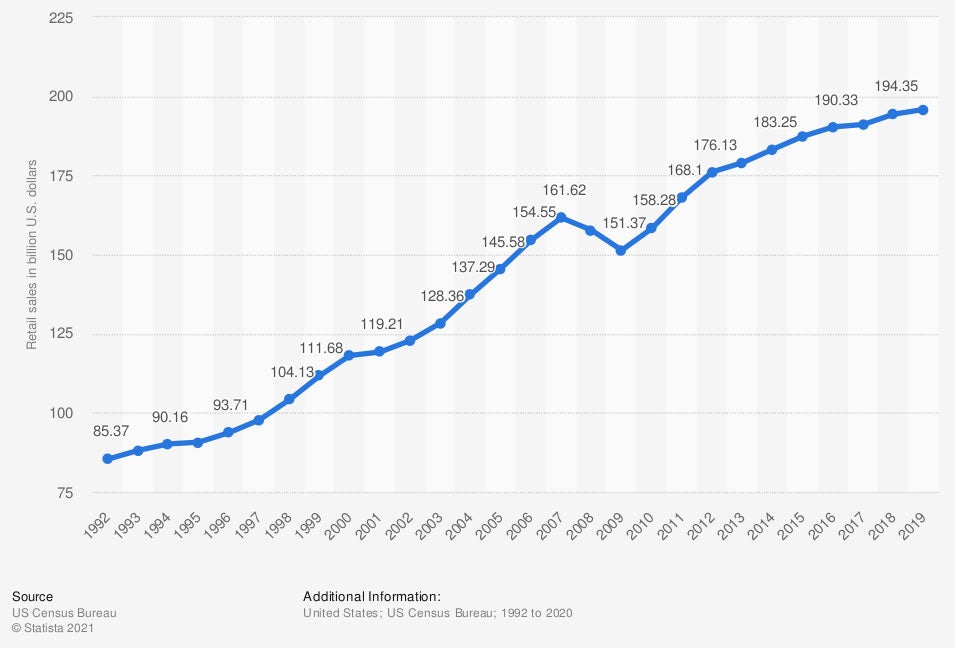

Clothing store sales in the US from 1992 to 2019 (in billion US dollars)

Clothing stores continue to increase in popularity and sales. Clothing store insurance is critical to protecting your store.

What Does Clothing Store Insurance Cover in New Jersey?

A standard business insurance policy will include liability, commercial property, and business interruption insurance.

- Commercial property insurance: Pays for any damage that is done to your store structure or inventory as a result of fire, wind, storm, and other similar events.

- General liability insurance: Pays for any legal fees, court costs and medical bills associated with a third-party injury.

- Business interruption insurance: Pays for any lost wages and other important bills if your clothing store is damaged by a fire or similar event and has to temporarily shut down.

Additional insurance coverages to consider include

- Workers' compensation: New Jersey requires all businesses to carry workers' compensation unless employers are covered by a federal program. This pays for any employee injuries or illnesses that occur on the job.

- Commercial auto insurance: If your clothing store uses vehicles to move or deliver merchandise, commercial car insurance helps pay for any accident damage by employee drivers.

- Inland marine insurance: Pays for any damage done to your merchandise while in transit.

- Inland marine insurance block insurance: According to Green, if your clothing store carries high-value items like furs, you may want to consider block insurance. It covers damage to high-value item inventory, both on the premises and while being shipped.

Every clothing store is unique, which is why it's valuable to chat with a New Jersey independent insurance agent. They can make sure there are no gaps in your coverage.

What Doesn't Clothing Store Insurance Cover in New Jersey?

The good news about clothing store insurance is you can build your policy package to include all of the necessary coverages you need. However, some exclusions exist in a standard business insurance policy.

- Flood damage

- Earthquake damage

- Data breaches

- General wear and tear

- Intentional or fraudulent acts

- Damage from nuclear war

- Customer property that is being stored at your business

Risks like flooding, earthquakes, and data breaches can be covered by adding additional policies to your insurance package.

How Much Is Clothing Store Insurance in New Jersey?

The cost of clothing store insurance is calculated using a variety of different factors. Insurance companies will consider all the potential risks to your store, and the more the risks, the higher the premiums will be.

The following are taken into consideration by insurance companies:

- Location: Stores located on the coast are at higher risk of hurricane damage. Insurance companies will also consider how close the nearest fire station is.

- Structure type: What your building is made out of makes a big difference to insurance companies. Wood burns more easily than metal, so a wood building will cost more to insure.

- Risk of natural disaster damage: New Jersey experiences fires, floods, wind storms, extreme winter weather, and more. If your business is located somewhere that is more prone to a specific natural disaster, it will increase your premium.

- Value of your merchandise and other property: If your store burns, down your insurance will be in charge of paying the cost of the lost merchandise and other property. A store selling fur coats will pay more than a T-shirt store.

- Previous claim history: If your business has a history of making claims, insurance companies will consider you more likely to make another claim in the future.

Your New Jersey independent insurance agent can pull quotes for clothing store insurance premiums and discuss different options with you.

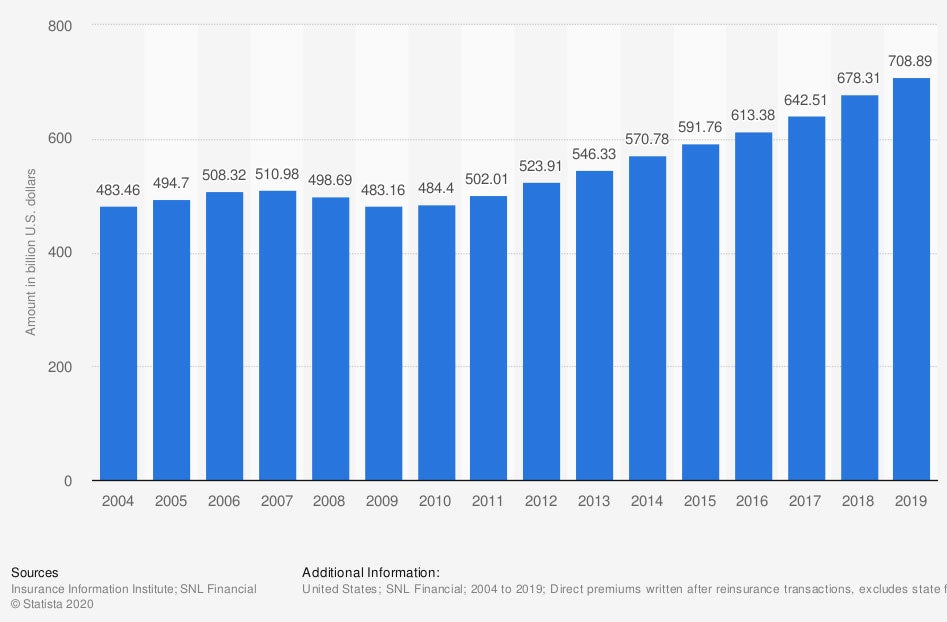

Direct premiums of property and casualty insurance in the US from 2004 to 2019 (in billion US dollars)

In 2019, the gross premiums of the US property and casualty insurance industry amounted to approximately $708.9 billion.

Do I Need Valuable Items Coverage in New Jersey?

One of the most important things to understand about your clothing insurance coverage is the policy limits. This will tell you how much you'll get reimbursed for should you have to file a claim.

If you sell high-value items like jewelry or furs in your clothing store, there's a chance that your standard New Jersey business insurance will not have sufficient policy limits.

You can work with your New Jersey independent insurance agent to increase your policy limits or purchase coverage for valuable items. You can typically purchase coverage based on the type of item. Your insurance expert can help you find the insurance you need.

How Can a New Jersey Independent Insurance Agent Help?

Insurance agents understand your clothing store and what you need to be protected. A New Jersey independent insurance agent will work with you, free of charge, to put together a business insurance plan that fits your needs.

Agents will shop different carriers and provide you with a variety of affordable options that will fully protect your clothing store. Work with a New Jersey independent insurance agent today.

Author | Sara East

Article Reviewed by | Jeffery Green

https://www.nj.gov/labor/wc/workers/workers_index.html#:~:text=The%20law%20requires%20that%20all,be%20approved%20for%20self%2Dinsurance.&text=You%20don't%20have%20to,principle%20operators%20of%20the%20business.

https://www.iii.org/publications/insuring-your-business-small-business-owners-guide-to-insurance/insurance-for-specific-businesses/small-retail-stores

© 2024, Consumer Agent Portal, LLC. All rights reserved.