Average Cost of Pet Insurance in New Jersey

Pet insurance cost depends on the animal’s age, health, and the chosen level of coverage. Expect an older animal to cost more to cover. In fact, some providers have age limits on pet health insurance plans. Certain pre-existing conditions and specific breeds are not insurable by some carriers.

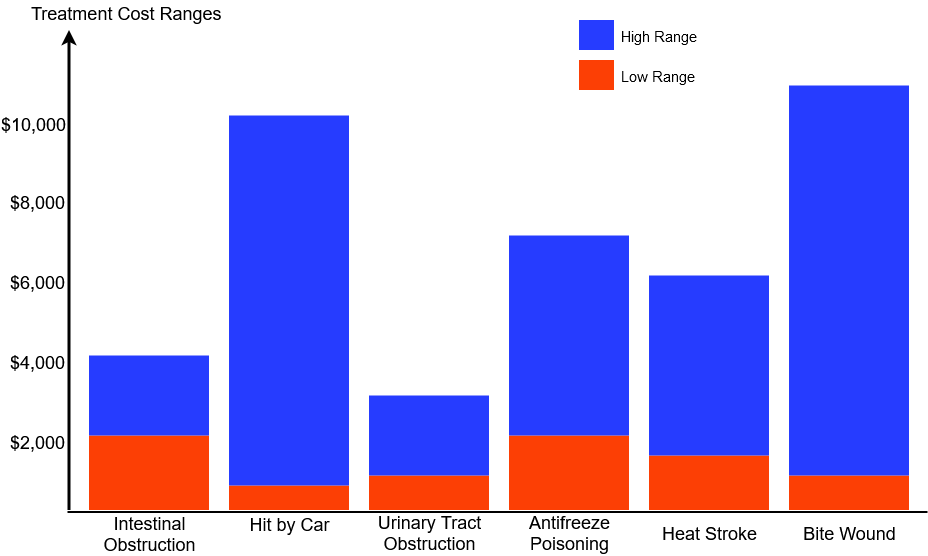

Average Uninsured Cost for Common Veterinary Emergencies