Do I Really Need Additional Umbrella Liability Insurance in N.J.?

If you can’t afford to risk your existing assets (such as income, retirement savings, college funds, salary), umbrella coverage may be right for you. Homeowners, auto, motorcycle and boat insurance policies include a monetary maximum amount for liability coverage. If you or your negligence cause an accident requiring you to pay a settlement or legal judgment, your liability policy will cover your legal defense and the settlement/judgment, up to the policy’s limits. Without the umbrella insurance, any payment above the coverage max is your responsibility. This can quickly exhaust your existing assets.

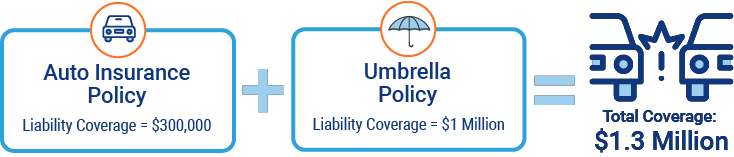

Choosing to add umbrella insurance can increase the maximum coverage amount for multiple policies simultaneously, truly acting as an "umbrella" over your risks and your finances. It also provides coverage for some claims that may be excluded by your liability insurance plan. Best of all, umbrella coverage premiums in New Jersey average just $200-$300 annually.

Example of Total Auto Liability Coverage with Additional Insurance in New Jersey