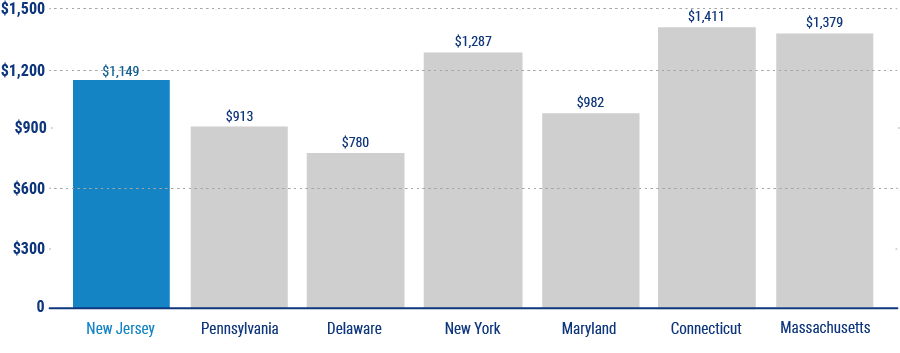

Average Cost of Homeowners Insurance in New Jersey

The average cost of home insurance in the US is $1,173 a year. In New Jersey, rates are slightly lower with an average cost of $1,149. Your rates will be based on factors such as the age, size, and value of your house, the crime rate and weather risks in your ZIP code, your claims history, and even your credit score. Every insurance company calculates costs in a different way, so shopping around can save you hundreds of dollars. Independent agents make comparison shopping easy.

Average Price of Homeowners Insurance