Odds are, no matter what your profession is, a disgruntled customer, guest, or other third party can find a way to sue you for something. Without the proper coverage in place, you could end up paying the expenses from a hefty lawsuit out of your own pocket. That’s why it’s critical to have the right liability insurance.

Luckily a New Jersey independent insurance agent can help you find the right liability insurance for you. Even better, they’ll get you set up with this critical protection long before you ever need to file a claim. But before we get too far ahead of ourselves, here’s a closer look at this crucial coverage.

What Is Liability Insurance Coverage?

Liability insurance protects you in the event you get sued by a third party. It protects you from costly legal fees if someone presses charges against you, claiming personal property damage or bodily injury.

There are several forms of liability coverage available, and coverage can be purchased by individuals or businesses. The coverage is tailored to the policyholder and their specific needs. A New Jersey independent insurance agent can help you find the best kind of liability coverage for you.

What Is Commercial General Liability Insurance?

Commercial general liability insurance is a form of New Jersey liability coverage designed to protect businesses from lawsuits filed by third parties. Customers, delivery workers, or other visitors may press charges against a business for claims of personal property damage or bodily injury on the business’s premises, or caused directly by a worker or operation of the business.

If a business gets sued, its commercial general liability insurance kicks in to cover expensive legal fees, including attorney and court costs, and even settlement fees if they lose the case. A New Jersey independent insurance agent can help your business get set up with the right commercial general liability insurance.

What Is Professional Liability Insurance?

Professional liability insurance is another form of liability coverage designed to protect professionals against errors that cause harm to their customers, clients, etc. Lawyers, counselors, and other professionals who give advice to the public are common examples of workers who need this type of coverage.

If a client or someone else sues a professional for claims of harm in some way due to their services, a professional liability policy will step up to pay for the legal costs. A New Jersey independent insurance agent can help you find the right professional liability insurance for your needs.

Liability Coverage Stats for the US

When shopping for the right liability coverage, you might be curious about just how commonly this insurance is purchased. Check out some recent stats for general liability insurance in the US.

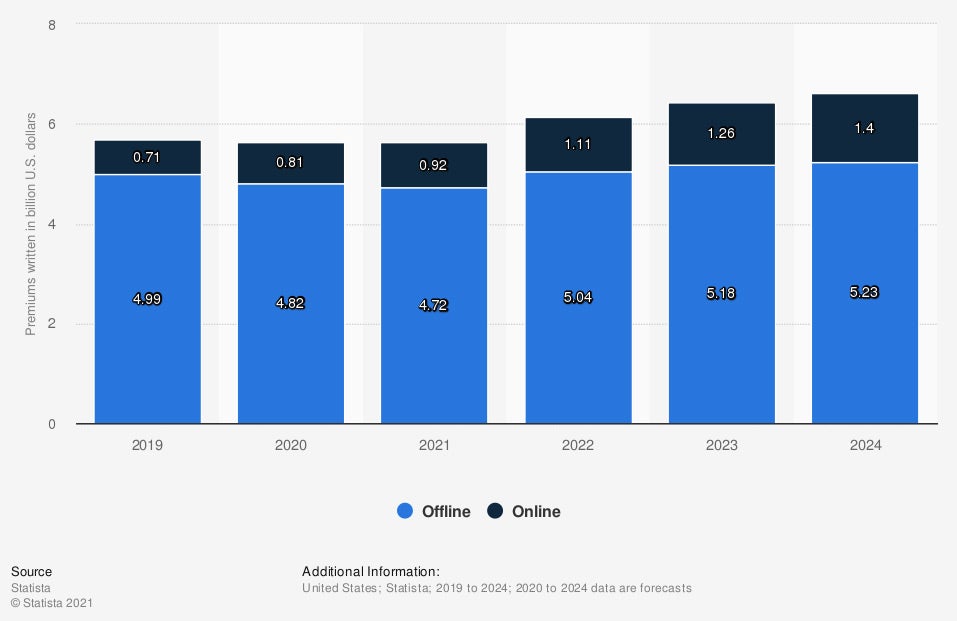

Value of business-to-consumer general liability insurance premiums written online and offline in the United States

In 2021, general liability insurance premiums written offline in the US are projected at $4.72 billion, with another $0.92 billion written online. By 2024, these numbers are expected to increase to $5.23 billion written offline, and $1.4 billion written online.

A New Jersey independent insurance agent can provide further detail about how common general liability coverage is in your specific niche, and why it’s so important.

What Is Liability Car Insurance Coverage?

According to insurance expert Paul Martin, there are two major forms of liability coverage for drivers under standard New Jersey car insurance policies:

- Bodily injury liability: Protects against lawsuits stemming from claims of injuries or death that occur during an accident you’re involved in.

- Property damage liability: Protects against lawsuits stemming from claims of property damage to another vehicle or building, fence, telephone pole, etc., caused by your vehicle.

A New Jersey independent insurance agent can help you get set up with all the car liability coverage you need to be safe on the road.

What Is Liability Coverage on Home Insurance in New Jersey?

Unfortunately, lawsuits can even happen within your own home. Whether a visitor you invite over or another third party like a postman suffers injury or property damage at your home, you could get sued for it. Fortunately New Jersey homeowners insurance provides liability coverage, too.

The liability coverage in home insurance covers:

- Bodily injury: If someone slips on your sidewalk, trips down your stairs, or otherwise sustains an injury on your property, bodily injury liability insurance will protect you from legal costs.

- Property damage: If a guest or other third party claims to have suffered personal property damage at your home, luckily the property damage liability coverage in your home insurance policy will cover the legal costs.

A New Jersey independent insurance agent can help ensure your home insurance’s liability coverage is enough to make you feel protected.

Here’s How a New Jersey Independent Insurance Agent Can Help

When it comes to protecting individuals and professionals against lawsuits and all other disasters, no one’s better equipped to help than an independent insurance agent. New Jersey independent insurance agents search through multiple carriers to find providers who specialize in liability coverage insurance, deliver quotes from several sources, and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

stats - https://www.statista.com/statistics/1119019/value-b2c-liability-insurance-premiums-written-usa/

https://www.iii.org/article/auto-insurance-basics-understanding-your-coverage

https://www.iii.org/article/homeowners-insurance-basics