You’ve worked hard to earn your home and set it up just the way you like. Your home is your happy place and it deserves special treatment, so it’s only logical that you’d want to equip it with the appropriate protection. By far your best chance at keeping your home safe for many years to come is to learn all about New Jersey homeowners insurance so you can get set up with the right coverage.

What Is New Jersey Homeowners Insurance?

No matter where you live, homeowners insurance is essentially an agreement between the homeowner and an insurance company in which the insurer agrees to cover financial losses relating to damages and liabilities. Of course only the specific perils stated in the policy will be covered by the insurance company. Homeowners insurance is designed to help protect homeowners from losing their home should disaster strike.

What Does New Jersey Homeowners Insurance Cover?

A home is more than just the actual concrete or brick structure, it’s also the personal belongings within and surrounding it, the family inhabiting it, and the friends who visit. Homeowners insurance is set up to protect all aspects of the home, not just the physical building itself. The more complex your home, the more coverage you may need. Here are the four major coverage areas included in standard New Jersey homeowners insurance policies:

- Structural damage: Covers what insurance companies refer to as the “dwelling,” or the structure of the home itself. Damage to or destruction of the dwelling by covered perils falls under this category. Coverage often extends to detached structures such as sheds as well.

- Personal property damage: Covers your personal belongings like furniture, clothing, electronics, knickknacks, silverware, etc., from perils such as fire or theft. Items stored within the home as well as external storage units are covered, though property stored off premises may have a lower coverage limit.

- Liability: Covers legal expenses such as attorney and court fees in the event you are sued for bodily injury or property damage to a third party. Settlements you’re ordered to pay if you lose the case are covered as well. Coverage extends to all members of the family living within the home, including pets. Many incidents that occur away from the home are also covered.

- Additional living expenses: Covers living expenses in the event your home gets badly damaged or destroyed and you’re forced to live elsewhere while awaiting repairs. Your insurance company provides reimbursements for things like hotel rooms, eating out, extra gas mileage, and more. Additional living expenses cover the difference in spending to maintain your normal lifestyle while living away from the home.

These four components compose the core of homeowners insurance packages. Work together with a New Jersey independent insurance agent to get the right amount of coverage in each category for your unique home.

What Does New Jersey Homeowners Insurance Not Cover?

Like every other kind of insurance out there, homeowners insurance comes with a list of specified covered perils as well as non-covered perils. Becoming familiar with what your homeowners policy doesn’t cover can save you the hassle of filing claims that are bound to get denied, and in the event of certain non-covered natural disasters can help you find the right kind of policy to protect your home.

New Jersey homeowners insurance does not cover the following perils:

- Certain natural disasters (i.e., floods, earthquakes, and mudslides)

- Maintenance-related losses

- Wear and tear damage (i.e., failure of the homeowner to maintain upkeep of the home)

- Insect damage or infestations

- Damage from war or nuclear fallout

- Business-related liability

If you run a business out of your home, homeowners insurance typically won’t cover any liability-related mishaps. Homeowners policies also tend to limit liability coverage for certain types of vehicles including aircrafts, ATVs, and boats, and they have very specific exceptions for certain powered vehicles such as ride-on lawnmowers. Double-check your specific policy to be sure of coverage for special vehicles.

In order to protect your home against flood or earthquake damage, you’ll need a flood insurance or earth movement policy. Flooding is certainly a concern in New Jersey thanks to its coastal location. Flood insurance policies are only available through the National Flood Insurance Program which is a part of FEMA. Homeowners in New Jersey may want to seriously consider getting a policy, especially those located in areas prone to flooding.

What are the Benefits of New Jersey Homeowners Insurance?

You’ve worked hard to afford a home you love, so it deserves to be protected. Having adequate insurance coverage can prevent a homeowner from going bankrupt and losing their home following a particularly costly disaster. Standard homeowners insurance packages provide coverage for many common threats to the home.

New Jersey homeowners insurance typically provides coverage for the following perils:

- Theft

- Vandalism

- Explosion

- Fire and smoke

- Water damage

- Aircraft or vehicle damage

- Riots

- Falling objects (and trees)

- Certain natural disasters (i.e., windstorms, hail, lightning, and blizzards)

Your New Jersey independent insurance agent can help you review your homeowners insurance policy to answer any remaining questions about your coverage. They’ll also be able to help you figure out whether you’ve got enough coverage, or if you should purchase more.

How Much Does Homeowners Insurance Cost in New Jersey?

Many factors influence the cost of a homeowners insurance policy, including the size and location of your home, the value of the structure and the contents inside, and any upgrades you’ve made. As of 2019, the average annual homeowners premium in New Jersey is $1,092.00. Of course, this is just an average figure and your exact location will further influence your premium’s cost.

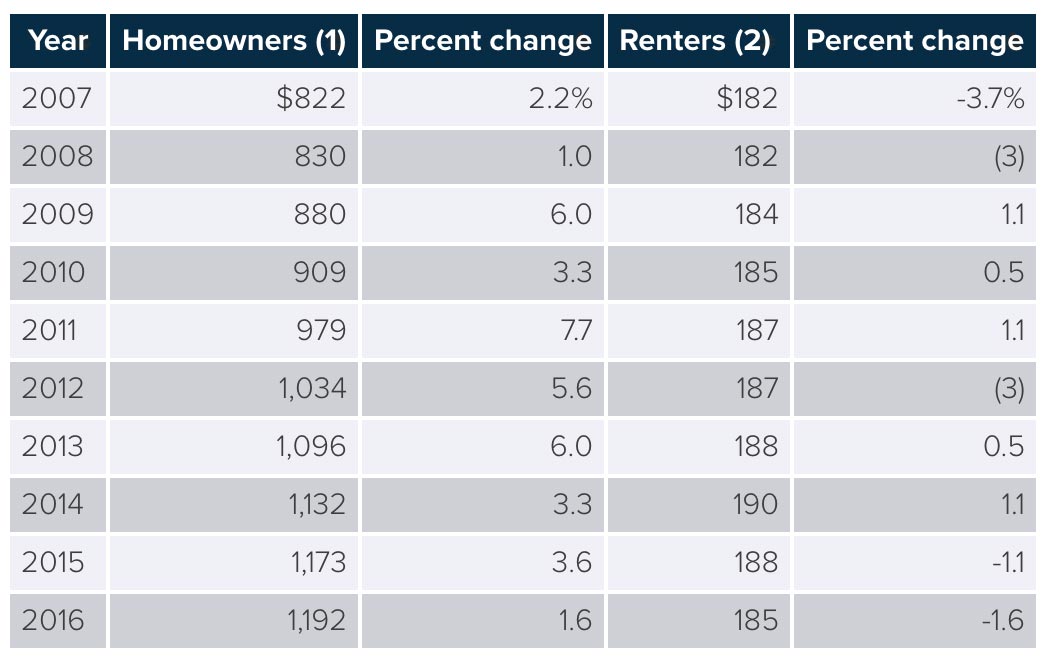

Homeowners insurance premiums also tend to increase gradually over time, as you can see below.

Average premiums for homeowners and renters insurance, US 2007-2016

Why Work with a New Jersey Independent Insurance Agent?

In order to get the protection you need and deserve, you’ll want to work with a trusted expert, and who could be better for the job than a local agent who shares your area code? Independent insurance agents act as your own personal insurance shoppers, offering you tons more options than one-policy companies. With just one call, they’ll hook you up with multiple quotes.

New Jersey independent insurance agents are armed with knowledge on what coverage is needed in your area, and they’ll get you set up with just enough of it — not too little, not too much. They’ll handle all the heavy lifting so you can rest assured you’ll be set up with the right coverage at the right price.

They’re not just there at the beginning, either. If disaster strikes, your New Jersey agent will be there to help walk you through the claims process and make sure you’re getting the benefits you're entitled to. Now that’s thinking ahead.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

www.iii.org

© 2024, Consumer Agent Portal, LLC. All rights reserved.