New Jersey is home to 884,000 small businesses. If you're a small business owner, you want a comprehensive insurance package that won't break the bank. That's what a business owners policy can provide.

Business owners policies protect small to medium businesses from common risks. Shopping business insurance can feel overwhelming, which is why a New Jersey independent insurance agent can help. First, let's talk more about business owners policy insurance.

What Is Business Owners Policy Insurance?

A business owners policy, also known as a "BOP," is a type of bundled business insurance policy that's designed for small to medium businesses.

Under a business owners policy, you receive general liability insurance, property insurance, and business interruption insurance. These are the three most common business insurance coverages typically purchased by small businesses. A BOP combines these into one affordable policy.

What Does a Business Owners Policy Cover In New Jersey?

As a business owner, you need protection from liability claims, property damage, and any risks that may result in financial loss for your company. A business owners policy covers these risks through multiple policies.

- General liability insurance: Covers any legal feels and medical bills for claims related to a third-party injury. Also covers any property damage.

- Property insurance: Covers any financial loss that you experience to your physical property, such as your office or company inventory, from risks such as fire, storms, wind, etc.

- Business interruption insurance: Covers any loss of income if you have to temporarily close due to a fire or similar risk.

Depending on the type of business you have, you may need additional coverage outside of what’s included in a BOP to meet unique risks. These can be purchased in individual policies that your New Jersey independent insurance agent can help you find.

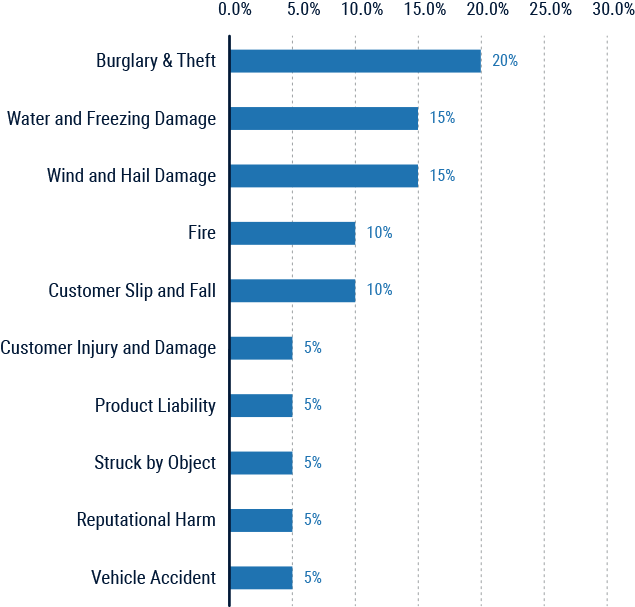

Top 10 insurance claims for small businesses

What Doesn't a Business Owners Policy Cover in New Jersey?

While a business owners policy provides comprehensive coverage for small businesses, there are some exclusions that could affect your New Jersey business that you'll want protection for.

The most common business insurance coverages that will not be included in a business owners policy include:

- Flood damage: Flood damage is never included in a standard business insurance policy. You'll need to purchase separate flood insurance to receive coverage.

- Professional liability: Also known as "errors and omissions," a BOP policy will not protect your business if you're sued for negligence or another type of professional liability.

- Automobiles: If vehicles are part of your business operations, you'll want to purchase a commercial auto insurance policy.

- Workers' compensation: New Jersey law requires all businesses to have workers' compensation. This must be purchased separately from your business owners policy.

In addition to these, insurance expert Paul Martin pointed out that a business owners policy will also not cover any intentional acts.

How Much Does a Business Owners Policy Cost in New Jersey?

Your business owners policy premium will depend on a variety of factors, including the size, location, and materials that you use in your business. Insurance carriers will also consider any past claims and potential weather risks.

There's no exact cost matrix for business owners policies, but Martin said that a small business with minimal risks, such as a coffee shop, may only pay $200 a month. A more risky business, like an auto repair shop, could pay $2,000 a month.

Your New Jersey independent insurance agent can shop BOP quotes for you and provide an estimate of monthly and annual premiums.

Additional Coverages for a Business Owners Policy

Business owners policies are great for providing liability, property, and business interruption protection. However, many businesses need more protection than this. The following are the most common additional coverages to consider.

- Flood insurance: New Jersey experiences flooding throughout the state.

- Professional liability: If you provide professional services and are at risk of being sued for a mistake or negligence, professional liability insurance can protect you.

- Commercial auto insurance: If you own company vehicles, a commercial auto policy will cover your vehicles and the employees driving them.

- Boiler & machinery coverage: This equipment insurance covers any electric equipment, including AC units and boilers, should they break down or experience a power surge.

- Liquor liability: If your business sells alcohol, you'll want a liquor liability insurance policy.

- Cyber security: A data breach can leave your customers exposed and your business at a major financial loss.

- Product liability: Protects manufacturers, sellers and distributors should a product defect result in personal injury or damage while being used.

There are additional business insurance options that you may want to consider, depending on your risks. Your New Jersey independent insurance agent can go over your business and any add-ons or extensions to include.

Who Needs a Business Owners Policy in New Jersey?

A business owners policy is designed for small to medium businesses. There are guidelines for deciding who qualifies for a BOP, eliminating some businesses. The usual requirements are:

- Must have 100 employees or less

- Revenue is $5 million or less

- Must be low-risk

However, even if your business fits these above criteria, a business owners policy might not be right for you. Common businesses that benefit from a BOP include restaurants, veterinarians, retail stores, salons, and professional services.

Any small business that wants to protect itself against major financial loss, lawsuits, and basic things like theft and property damage should consider a business owners policy.

How Can a New Jersey Independent Insurance Agent Help?

When shopping for a business owners policy, a New Jersey independent insurance agent is an expert in all coverages. They'll take the lead on speaking with different carriers and pulling a variety of quotes. They'll also make recommendations on any additional coverages that your business could benefit from.

Author | Sara East

Article Reviewed by | Paul Martin

https://www.iii.org/article/understanding-business-owners-policies-bops

https://www.weather.gov/safety/flood-states-nj#:~:text=There%20are%20currently%2020%2C000%20homes,ranks%20as%20North%20Jersey's%20worst

https://advocacy.sba.gov/2019/04/24/2019-small-business-profiles-for-the-states-and-territories/

© 2024, Consumer Agent Portal, LLC. All rights reserved.