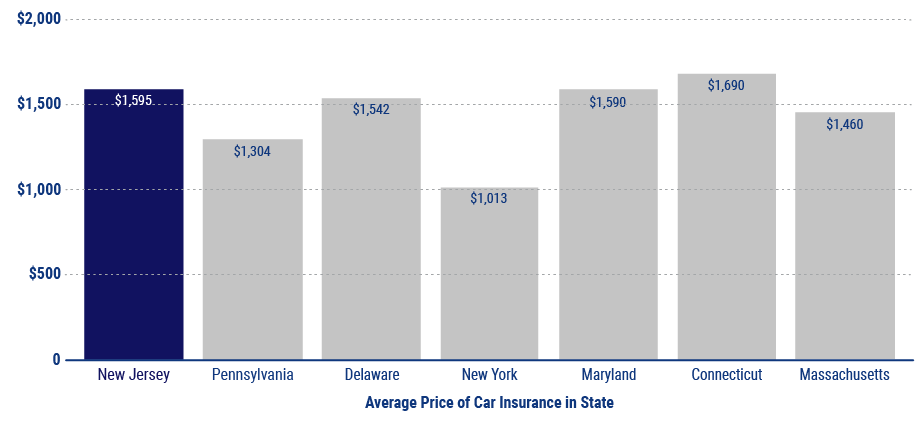

Cost of Car Insurance in New Jersey

Americans pay an average of $1,311 a year for their car insurance. In New Jersey, rates run slightly higher with an average annual cost of $1,375. Car insurance rates are based on several considerations, including details about you, such as your age, occupation, and driving record; and details about your car, such as its year, make, and model. Your cost for coverage can even be influenced by your credit score. Independent agents make it easy to shop around for a great policy at a competitive rate.

Average Cost of Car Insurance Per Year