Whether you're in the business of renting equipment or books, you need the proper business insurance to protect the items you're renting out and your business.

New Jersey has the eighth-highest amount of commercial insurance claims paid by state in the country. That's why it's important to work with a New Jersey independent insurance agent to understand and find the unique insurance coverage you need if you own a rental store.

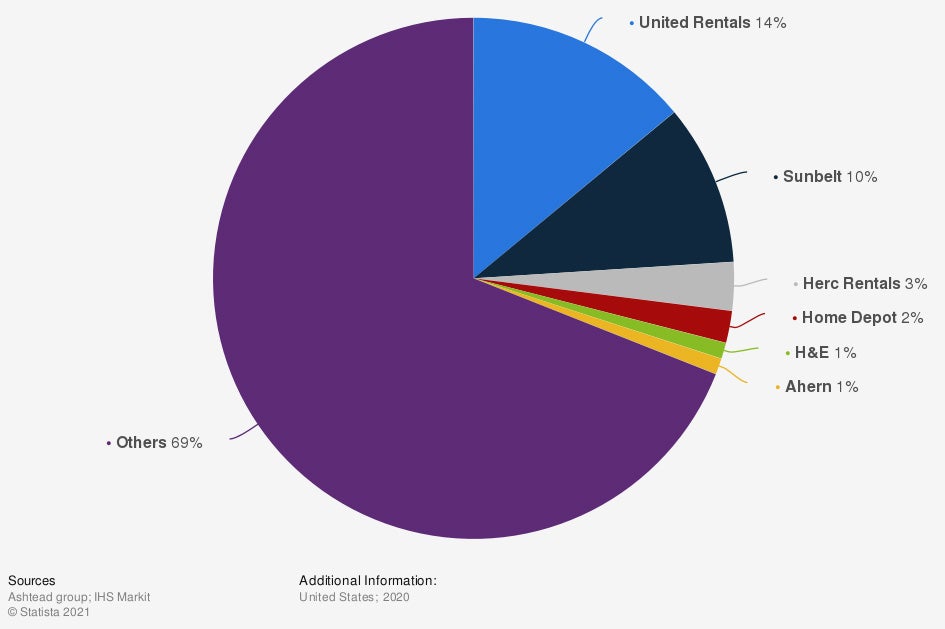

Market share of the leading equipment rental companies in the US in 2020

United Rentals, Sunbelt, and Herc Rentals were the leading three companies for equipment rental services in the United States in 2020.

What Is Rental Business Insurance?

Rental business insurance is a special type of business insurance that protects your rental equipment and any risks associated with renting it out.

According to insurance expert Jeffrey Green, basic rental store insurance includes general liability, commercial property, commercial auto, and business interruption insurance.

"Rental store owners should also consider additional inland marine, product liability, and equipment breakdown coverages," said Green.

What Does Rental Business Insurance Cover in New Jersey?

A rental business insurance package includes a variety of coverages against any potential risks or injuries to your business, the equipment you rent, and the customers renting from you.

Standard business insurance coverages include:

- General liability: Provides coverage against third-party injury claims or property damage caused by you or your employees.

- Property insurance: Protects your rental items as well as your business store and property from any damage that may occur. Your rental items are covered while being stored or rented out.

- Workers' compensation: Pays for medical bills and lost income should an employee get injured or fall ill while on the job. New Jersey law requires all businesses not covered by Federal programs to offer workers' compensation coverage.

- Commercial auto insurance: Protects any company vehicles that are used for operational purposes. Commercial auto insurance will help pay for accidents and employee injuries.

Your rental business may benefit from these additional insurance options:

- Commercial umbrella insurance: Depending on the type of rental business you run, the coverage limits on a standard liability policy may not provide enough protection. A commercial umbrella policy can provide additional coverage above and beyond your general policy.

- Inland marine insurance: If your rental business includes items that are movable or transferrable, an inland marine policy will cover your equipment while in transit. Inland marine protects your assets whether they're being shipped or transported via roads.

- Equipment breakdown insurance: Helps pay for any repair or replacement on heavy machinery such as tractors and combines. This insurance is particularly important for New Jersey construction and farm owners.

- Product liability insurance: Helps pay for any lawsuits related to product defects that are the fault of the manufacturer.

- Business interruption insurance: If you have to close your doors as a result of a covered event, business interruption insurance helps pay for bills, lost income, and other expenses.

Every rental business will need unique coverage. A New Jersey independent insurance agent can help you find the policies that best fit your business.

What Doesn't Rental Business Insurance Cover in New Jersey?

Similar to your standard business insurance policy, your rental business insurance will exclude several events and claims.

- Floods: Flood insurance must be purchased separately from any business insurance policy.

- Earthquakes: Earthquake insurance must also be purchased separately from your business insurance policy. It can be purchased as a stand-alone addition or added onto your standard policy as an endorsement.

- Professional liability: If your services include providing a service or professional advice, you may want to consider professional liability. A standard policy will not cover any claims related to negligence or malpractice.

- Automobiles: Your typical business rental insurance policy will not cover automobiles unless you have purchased a commercial auto policy.

- Catastrophic events: Business insurance never covers damage related to a catastrophic event such as a nuclear war or military action.

Many exclusions are in policies because they are covered by another. Your New Jersey independent insurance agent can go through all of your policies and find any gaps in coverage.

Do Rental Businesses In New Jersey Need Insurance?

Every business needs insurance to be protected from expected and unexpected risks. The simplest slip and fall can result in a lawsuit that costs thousands of dollars.

For rental stores, the risks are increased by the fact that you're taking equipment and items you own and allowing someone else to use them.

"Rental stores have some unique risks because their equipment is not operated by employees under their supervision," says Green.

Once your rental item leaves your store, you have no control over how it's treated. Rental business insurance is necessary to protect your property, employees, and items whether they're in your or someone else's possession.

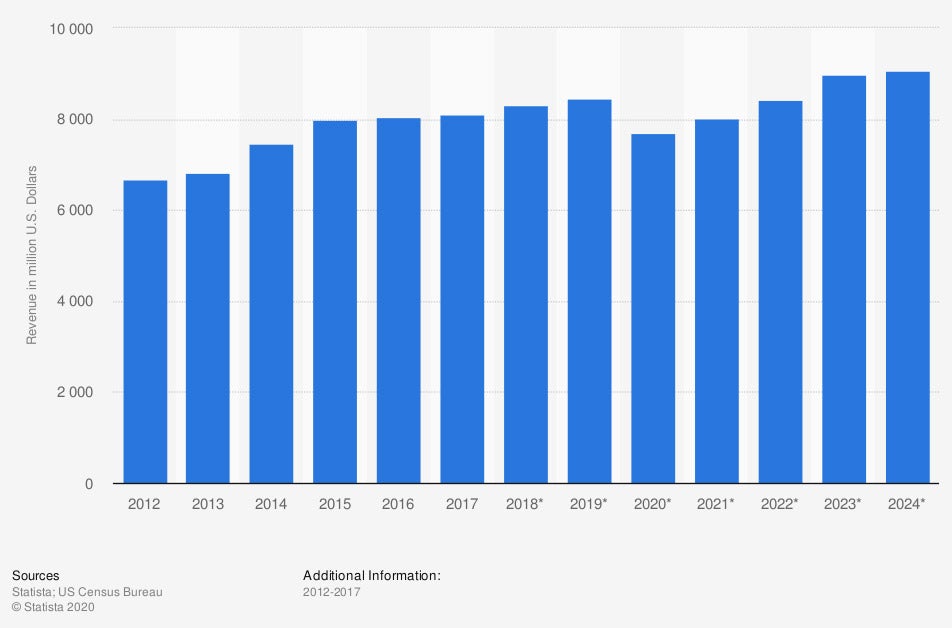

Industry revenue of “consumer electronics and appliance rental“ in the US from 2012 to 2024 (in million US dollars)

It is projected that the revenue of consumer electronics and appliances rental in the US will amount to about $9.0610 million by 2024.

How Much Does Rental Business Insurance Cost in New Jersey?

Your rental business insurance premiums will depend on a variety of factors. The most important is the type of equipment or items that you rent. Every business has different needs, and premiums can range from several hundred to several thousand dollars a year.

Factors that affect rental business insurance premiums:

- Type of business

- Age of business

- Previous claim history

- Type and amount of rental equipment

- Value of rental equipment and property

- Number of employees

- Potential risks

Fortunately, a New Jersey independent insurance agent has helped hundreds of businesses get insurance. They can provide you with a cost estimate and help you find insurance that stays within your budget.

Does General Liability Insurance Cover Rental Businesses?

Yes, a general liability policy will protect your rental business from a variety of risks and claims. However, it's important to note that it will not cover your rental equipment.

The most common incidents covered under a general liability claim include:

- Bodily injury: If a customer is injured on your business property

- Property damage: If you or an employee causes property damage to a third party

- False advertising: If your company is sued for making false advertising claims

- Legal fees: Any legal fees should your company face a liability lawsuit

Rental businesses will need additional coverage to protect their equipment and the potential damage it can cause to those renting it.

How a New Jersey Independent Insurance Agent Can Help

Rental businesses are unique in that a third party is involved in the use of items that you own. A standard business insurance policy does not provide adequate coverage for most rental businesses. A New Jersey independent insurance agent can help you shop policies, pull quotes, and build a business insurance package that protects your property, rental items, employees, and business.

Author | Sara East

Article Reviewed by | Jeffery Green

https://namesfrog.com/rental-business-ideas/

https://advocacy.sba.gov/2019/04/24/2019-small-business-profiles-for-the-states-and-territories/

© 2024, Consumer Agent Portal, LLC. All rights reserved.