More than 385,000 properties in New Jersey are at high risk of flooding. That number is expected to increase more than 19% over the next 30 years, which is why homeowners need to be protected with flood insurance.

Your New Jersey homeowners insurance policy will not cover flooding. It must be purchased separately through the National Flood Insurance Program (NFIP). Your New Jersey independent insurance agent can help determine if your home is at risk and how to secure proper flood insurance.

What Does Flood Insurance Cover in New Jersey?

Flood insurance provides up to $250,000 in coverage for your home's structure and up to $100,000 for your belongings if they receive water damage from a covered event.

The following personal possessions are covered by flood insurance

- Furniture

- Clothing

- Washers and dryers

- Electronics

In addition, the following property is covered by flood insurance

- The foundation

- Built-in appliances and refrigerators

- Electrical and plumbing

- Permanently installed carpet

- Window blinds

- Detached garages

- Debris removal

What Isn't Covered By New Jersey Flood Insurance?

Exclusions for flood insurance are based mainly on the type of flood that causes water damage.

The NFIP considers a flood "a general and temporary condition of partial or complete inundation of 2 or more acres of normally dry land area or of 2 or more properties (at least 1 of which is the policyholder's property) by natural waters."

This means that damage from burst pipes, sewer backups, or overflowing bathtubs would not be covered.

Your New Jersey flood insurance will also have restrictions on the property that is located in your basement, according to insurance expert Paul Martin. He explained that washers and dryers, food freezers, and portable air conditioners are the only items that would be covered if they're located in a basement.

Is My New Jersey Home Protected with Flood Insurance?

Your New Jersey home is not protected with flood insurance through your standard homeowners policy. You must purchase flood insurance.

The policy can include building coverage and contents coverage. The building coverage portion of your policy is what will protect the structure and property inside your home.

You'll work with your New Jersey independent insurance agent to set policy limits on your flood insurance. You'll talk through the value of your home and what you want to be covered. They'll ensure that your limits will provide enough coverage should an event occur.

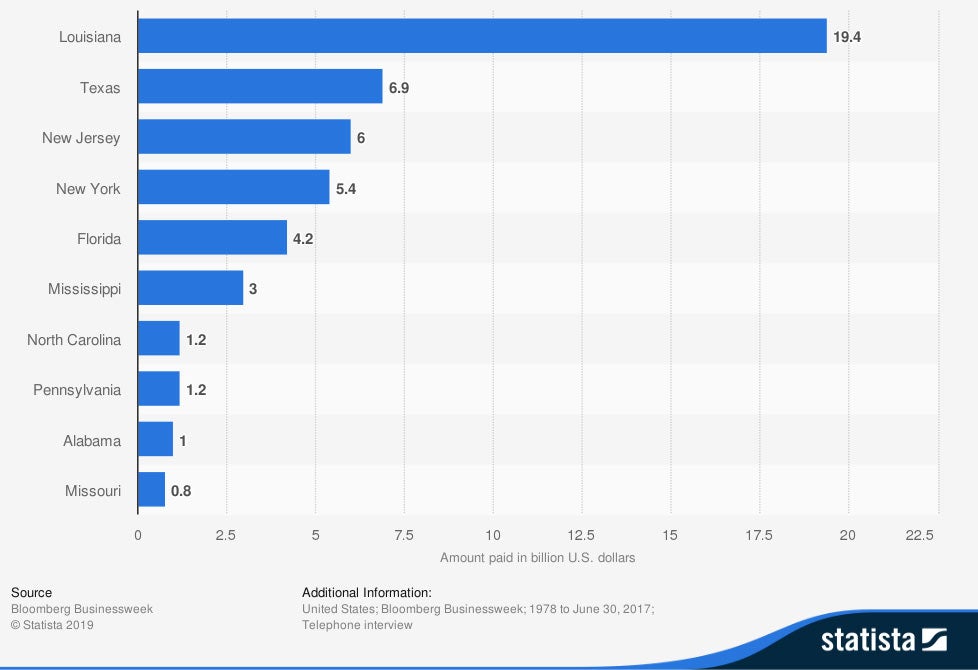

Highest national flood insurance program payments in the US

New Jersey is in the top five states to receive the highest NFIP payouts in the US. In the past, $6 billion in flood insurance claim payouts has gone out to New Jersey residents.

Is My Car Protected with Flood Insurance in New Jersey?

If your car receives water damage due to a flood-related event, it is covered under your New Jersey car insurance policy.

You must have comprehensive insurance to receive coverage. It is designed for events that are out of your control, and is often referred to as "other than collision" insurance.

Is My New Jersey Commercial Property Protected with Flood Insurance?

If your business has water damage from the covered flood events outlined in your flood insurance policy then it will be covered. Similar to your home, your commercial property will receive coverage for the building and contents.

Floodwaters must cover at least two acres or affect two properties to be covered by NFIP insurance. Any other water damage would be covered by your commercial property insurance.

How Can a New Jersey Independent Insurance Agent Help?

Severe storms are the most common threat to New Jersey homeowners. Your home is also at higher risk if you're located near the coast or in a high-risk flood zone.

A New Jersey independent insurance agent understands flood risks, zones, and where to purchase insurance. They'll chat with you, free of charge, and get you the right amount of coverage so that if water damage hits your home, you'll be protected.

Author | Sara East

Article Reviewed by | Paul Martin

https://assets.firststreet.org/uploads/2020/06/first_street_foundation__first_national_flood_risk_assessment.pdf

https://www.fema.gov/flood-insurance

https://www.floodsmart.gov/coverage

https://www.iii.org/article/do-i-need-flood-insurance-for-my-home#

© 2024, Consumer Agent Portal, LLC. All rights reserved.