Your New Jersey home is full of personal possessions and valuable items, but they may not all be covered under your standard homeowners policy. Contents coverage is what helps pay for any losses that occur to your personal stuff, so it's important to understand what your policy offers.

Fortunately, a New Jersey independent insurance agent can help you understand your contents coverage limits and exclusions, and fill any gaps. To start, let's talk more about contents coverage insurance.

What Is Contents Coverage Insurance?

Contents coverage insurance is part of your New Jersey homeowners, renters, or condo insurance policy that helps pay to replace or repair your personal stuff should it be damaged by a covered risk. It's often referred to as personal property coverage.

When purchasing contents coverage insurance, you'll have the option to choose between replacement cost coverage and actual cash coverage.

- Replacement cost coverage: Will provide you with enough money to replace the item with something of similar quality and value.

- Actual cash value coverage: Pays the value of the item when it was destroyed or damaged and factors in any depreciation.

What Does Contents Coverage Insurance Cover in New Jersey?

From your furniture to your jewelry, if you start to look around your home at all of your possessions, the value will add up quickly.

According to insurance expert Jeffrey Green, contents coverage typically covers the following items:

- Furnishings

- Appliances

- Electronics

- Clothing

- Entertainment items and technology

- Decor

- Sporting equipment

The risks that are covered under your contents coverage are the same as your homeowners policy. This includes:

- Fire

- Wind and hail

- Theft and vandalism

- Lightning

- Falling objects

Insurance carriers write their policies differently, so it's important to sit down with your New Jersey independent insurance agent to make sure you understand what risks are covered.

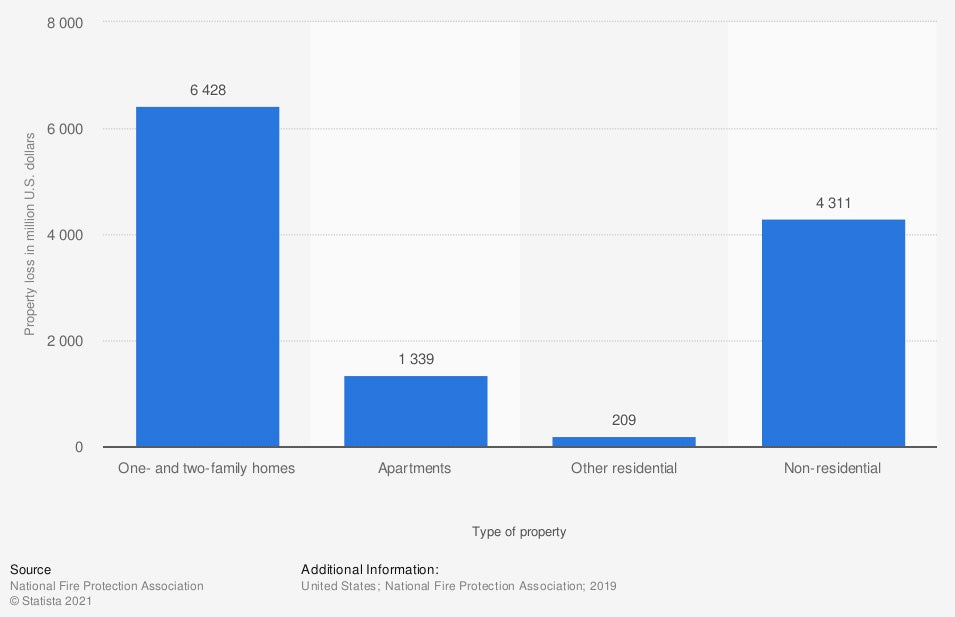

Property loss due to fires in the US

One- and two-family homes are the properties that most commonly experience fire loss.

What Doesn't Contents Coverage Insurance Cover in New Jersey?

Contents coverage will protect your items whether they're in your home or being moved to a new home. However, it's designed to have overall limits on specific items. "Items like jewelry, currency, securities, firearms, artwork, silverware, credit cards, and electronics will all have payout limits," said Green.

If you need additional coverage for any of these items, Green suggestedpurchasing coverage individually using a personal items floater.

Knowing your payout limits will help you understand how much you'll be reimbursed should a specific item be damaged or destroyed. In addition to the overall limit, your New Jersey contents coverage policy will exclude the following:

- Animals

- Birds

- Fish

- Motor vehicles

- Property used for business

- Property of renters

If you have specific possessions you need coverage for, your New Jersey independent insurance agent can help find you the right coverage.

How Much Does Contents Coverage Cost in New Jersey?

Since contents coverage is included in your New Jersey homeowners policy, your premium will be the cost of your homeowners insurance. In New Jersey, the average cost of homeowners insurance is $1,192. Of course, this does not include any floaters you add to your policy.

Additionally, not everyone will want all of their possessions insured. Since every home is different, the cost of insurance varies greatly. After discussing the items you want to be insured, your insurance agent can provide you with estimated costs for your policy.

What Are Some Factors That Can Influence My Rates?

When insurance carriers are calculating premiums, they take a variety of factors into consideration. For contents coverage, the most common things that impact premiums include:

- Value of your possessions

- Whether you choose replacement cost or actual cash value

- Location of your home

- Potential for damage from weather

- Fire risk

- Theft risk

- Claim history

- Any floaters or add-ons for premium items

Green added that your deductible and your credit rating will also affect the cost of your contents coverage insurance. Typically, higher deductibles lead to lower premium costs.

Is Contents Coverage Insurance Necessary in New Jersey?

Your possessions are valuable, and they are the personal items that make your house a home. While no one likes to think about a fire or storm ruining their home, accidents happen. In addition, home thefts are still common.

New Jersey property crime rates

- 118,637 property crimes per year

- 13.36 property crimes per 1,000 residents

- 16,399 burglaries

- 91,902 thefts

For most New Jersey residents, homeowners insurance will be required, so you'll receive contents coverage through that policy. If you have high-value items, personal item floaters are affordable add-ons that will help pay to replace or repair those items if they're damaged.

How Can a New Jersey Independent Insurance Agent Help?

When shopping for contents coverage insurance, you want an insurance expert who understands homeowners insurance. A New Jersey independent insurance agent is there to help you, free of charge.

They'll work with you to make a list of your possessions and help determine how much coverage you need per item. They'll advise you on whether to purchase replacement cost or actual cash value coverage and guide you to getting complete coverage for your valuable belongings.

Author | Sara East

Article Reviewed by | Jeffery Green

https://www.neighborhoodscout.com/nj/crime

iii.org (homeowners data from GEO data spreadsheet)

https://www.iii.org/article/what-covered-standard-homeowners-policy

© 2024, Consumer Agent Portal, LLC. All rights reserved.