Apple picking can be a fun hobby for people and kids, but New Jersey apple orchard owners know they need to protect their orchards from events that can be financially disastrous. Whether it's an unexpected weather pattern or operation liability, having apple orchard insurance is crucial.

Seeing as there are multiple risks to your orchard, you'll want an expert to assist in finding the best coverage. A New Jersey independent insurance agent not only understands apple orchards but also the unique risks to farmers in the state.

What Is Apple Orchard Insurance?

Apple orchard insurance is a type of New Jersey farm and ranch insurance that is specialized to meet the needs and demands of an orchard farm using different business insurance policies.

"When talking about insuring an apple orchard, you're talking about agricultural products," explained insurance expert Paul Martin. "You need protection for your apples when they're in the ground outside and also after they've been picked."

Apple orchards are protected by New Jersey crop insurance, which we'll discuss more shortly. Once your apples are picked and being stored, they become your property and are protected by property insurance.

What Does Apple Orchard Insurance Cover in New Jersey?

When you sit down with your New Jersey independent insurance agent, you'll discuss the variety of property, assets you own, and potential risks your apple orchard faces. Every policy will vary, but several coverages are common in apple orchard insurance.

- Crop insurance: A federally offered insurance program that pays for any damage to the apples produced by your trees from events like wind, fire, hail, freezing, drought, and similar.

- Property insurance: Pays for damage to your structures or apple stock after it's picked if it experiences a loss from a fire, storm, or other covered event.

- Farm land liability insurance: Will cover costs related to third-party bodily injury or property damage claims that take place on your apple orchard.

- Equipment breakdown insurance: Provides coverage for your machinery and equipment that you use to operate your orchard farm.

"When apples are still outside and on trees, insurance coverage is more complicated," said Martin. "You want to find a New Jersey independent insurance agent that understands apple orchard insurance so they can make sure you're protected whether your apple stock is outdoors or already picked."

Are There Any Other Policies That Can Provide Additional Protection?

Yes, there is a variety of additional coverages that you should consider for your apple orchard.

- Workers' compensation: If your apple orchard has employees, you'll be required to purchase workers' compensation. This will pay for any work-related injuries or illnesses, as well as payroll if an employee is on temporary leave.

- Crop-hail insurance: Crop-hail insurance can be purchased as supplemental coverage to crop insurance. Hail is not covered under crop insurance, so you'll want this coverage if your farm is at risk of hail damage.

- Commercial auto insurance: If your apple orchard has company vehicles that are used to assist in operations, a commercial auto policy will pay for any accidents that may occur.

- Business interruption insurance: Should a fire or other peril damage your apple orchard, you may need to temporarily cease operations. Business interruption insurance can help pay for ongoing bills and lost income.

What Doesn't Apple Orchard Insurance Cover in New Jersey?

Protection for apple orchards has increased in recent years, but there are still gaps when it comes to insuring apple trees vs. the apples that grow on the trees.

While crop insurance is necessary to protect your apples, it will not cover any damage to your apple trees. Federal crop insurance companies now offer programs that will insure apple orchard trees in addition to the apple production, but it is not yet available in New Jersey.

In addition, the following exclusions exist in most apple orchard insurance policies

- Flood and earthquake damage

- Damage from nuclear war

- General wear and tear on equipment

- Chemical drift

Your New Jersey independent insurance agent can clarify any limitations or exclusions that exist in your policy.

How Much of My Merchandise Is Covered by New Jersey Apple Orchard Insurance?

Once you pick the apples off your trees and bring them indoors, they become covered by your commercial property insurance policy. At this point, they're considered stock, according to Martin.

You'll work with your New Jersey independent insurance agent to select your policy limits to determine the amount of coverage you need. You'll probably select a specific dollar amount of coverage based on the amount of merchandise you have.

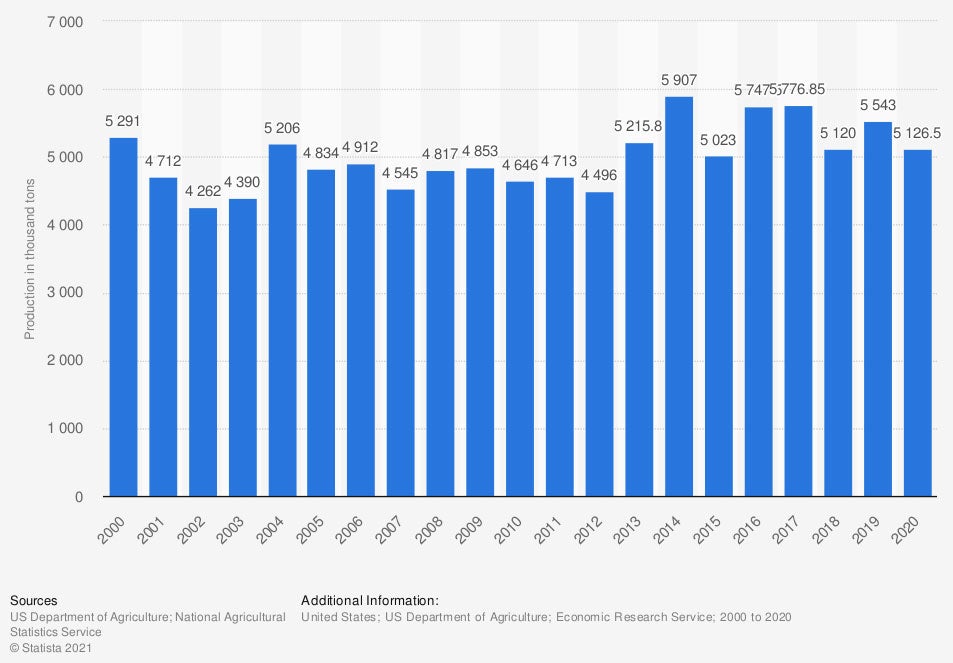

Total amount of apple production in the US

Last year, around 5.13 million tons of apples were produced in the US.

How Can a New Jersey Independent Insurance Agent Help?

Apple orchards are expensive to create but worth the effort. When you're shopping for apple orchard insurance you want to make sure you're working with a New Jersey independent insurance agent that has experience insuring risks of your type. A local TrustedChoice agent will speak with you, free of charge.

Your agent will know the right questions to ask you and insurance carriers to fully protect your apple orchard. They'll shop policies and aid you in securing a comprehensive insurance package that protects your property, orchards, and apples.

Author | Sara East

Article Reviewed by | Paul Martin

Cost of starting apple orchard: https://howtostartanllc.com/business-ideas/orchard

https://www.iii.org/article/understanding-crop-insurance

https://www.farmbureausellscropinsurance.com/apple-tree-insurance-new-crop-insurance-program/

© 2025, Consumer Agent Portal, LLC. All rights reserved.