Food and agriculture bring in billions of dollars to the state of New Jersey annually. With 9,900 farms operating 750,000 acres of farmland, if you're a New Jersey farmer growing crops you'll want to protect your commodities with crop-hail insurance.

Fortunately, crop-hail insurance can be purchased at any time, but a New Jersey independent insurance agent can make sure you're set up with this protection long before you need it.

What Is Crop-Hail Insurance?

Crop-hail insurance is a type of private farm and ranch insurance that helps pay for any losses or damage that your crops sustain from hail, fire, or other weather-related events.

"Farmers can buy crop insurance so they can get money back for some of what is destroyed in a crop disaster," said insurance expert Paul Martin.

Crop-hail insurance is designed to protect crops before they are harvested and are still in the field.

What Does Crop-Hail Insurance Cover in New Jersey?

Crop-hail insurance covers non-harvested crops against a variety of risks and natural disasters. Any damage that is sustained from the following weather patterns will be covered in a crop-hail insurance policy:

- Hail

- Fire

- Lightning

- Theft

- Wind

- Vandalism

- Malicious mischief

If your crops are ruined by one of these events, crop-hail insurance will help cover the costs of product loss, labor, and lost profits.

According to Martin, unlike general crop insurance, crop-hail insurance is purchased by the acre and can be bought from private companies. Crop insurance can only be purchased through the Federal Crop Insurance Program.

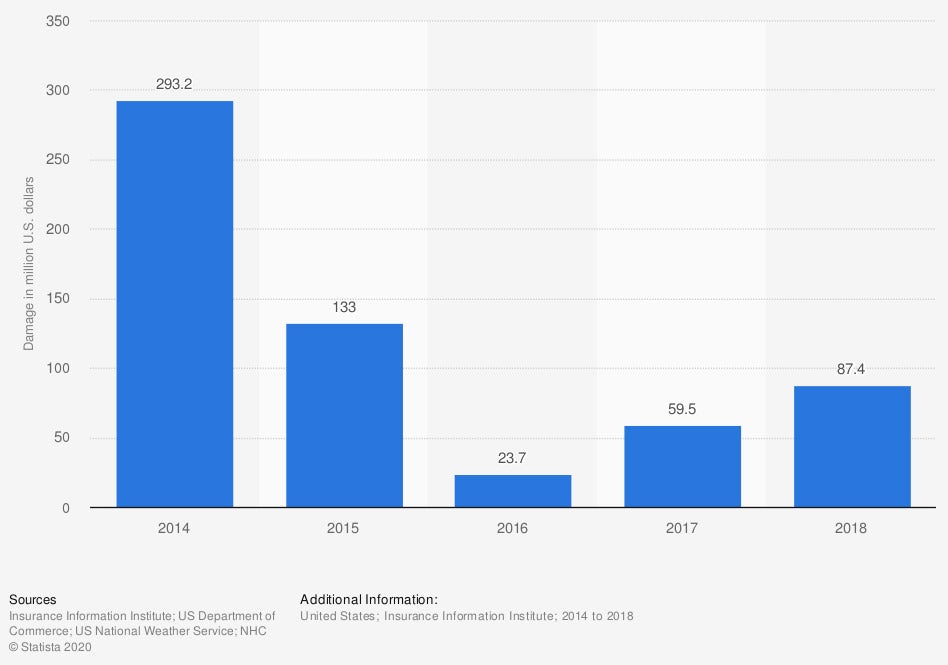

Crop damage from hail in the US from 2014 to 2018 (in million US dollars)

The United States experienced $87.4 million in crop hail damage in 2018. This was almost $28 million more than was experienced the previous year.

What Doesn't Crop-Hail Insurance Cover in New Jersey?

While your crops will be protected from a variety of weather-related risks, there is a handful of disasters that crop-hail will not cover. This includes:

- Frost

- Drought

- Excess moisture

- Change in crop prices

- Flood

Fortunately, a New Jersey crop insurance policy will cover the above scenarios. While New Jersey is not known for having droughts, the state does experience frost.

Your independent insurance agent can help you put together a farm and ranch insurance policy that keeps you fully covered.

How Much Does Crop-Hail Insurance Cost in New Jersey?

Crop-hail insurance costs will vary greatly depending on the type of crops you're insuring, how many acres you need to be protected, your farm's location, and the weather risks in your area.

The benefit of being able to purchase crop-hail on an acre-by-acre basis is that you can keep your premium costs low. You'll start by selecting a dollar amount of coverage and then have the option to choose from different deductibles, which can lead to lower premiums.

The value of private crop-hail insurance in New Jersey is $250,000.

Is Crop-Hail Insurance Necessary in New Jersey?

New Jersey is a top grower of fruit crops like blueberries and cranberries, as well as field crops such as soybeans, corn, and wheat.

Every year, the state's crops contribute to $1.1 billion to the state's economy. However, the state is no stranger to extreme weather.

The most common natural disasters in the state include severe storms, tropical storms and hurricanes, floods, winter storms, wildfires, extreme heat, drought, landslides, and power outages. All of these events can destroy your crops before they're harvested.

While you can't get ruined crops back, you can get reimbursed for the money you've lost as a result of not being able to harvest and sell your crops.

Crop-hail insurance isn't required in New Jersey, but it's worth considering for any high-yielding crops on your farm.

Value of crops in New Jersey

How a New Jersey Independent Insurance Agent Can Help

Crop-hail insurance is frequently confused with crop insurance, but they serve different purposes. Crop-hail must be purchased privately, and a New Jersey independent insurance agent can help you shop carriers.

Not only will they pull quotes for you, but they can also advise on how much of your acreage to insure. Should you need to use your crop-hail policy, your independent insurance agent can walk you through the claims process to make sure you get your money.

Author | Sara East

Article Reviewed by | Paul Martin

https://www.nass.usda.gov/Quick_Stats/Ag_Overview/stateOverview.php?state=NEW%20JERSEY

https://www.nj.gov/agriculture/about/overview.html#

https://cropinsuranceinamerica.org/new-jersey/

https://www.statista.com/statistics/722477/value-of-private-crop-hail-insurance-coverage-usa-by-state/

© 2025, Consumer Agent Portal, LLC. All rights reserved.