A home is a place of refuge and comfort for most property owners. When much is given, much is required, and that includes proper protection. Fortunately, New Jersey homeowners insurance can help cover damage from a lightning strike if you know where to look.

A New Jersey independent insurance agent will have access to multiple carriers with highly rated coverage. They do the shopping for free, making it a no-brainer. Connect with a local expert for custom quotes to get started.

What Is Home Insurance?

In New Jersey, your homeowners policy will have coverage for a variety of claims. Take a look at how home insurance can help:

- Homeowners insurance: This type of property insurance covers your home for losses due to severe weather, fires, theft, vandalism, bodily injury, and property damage.

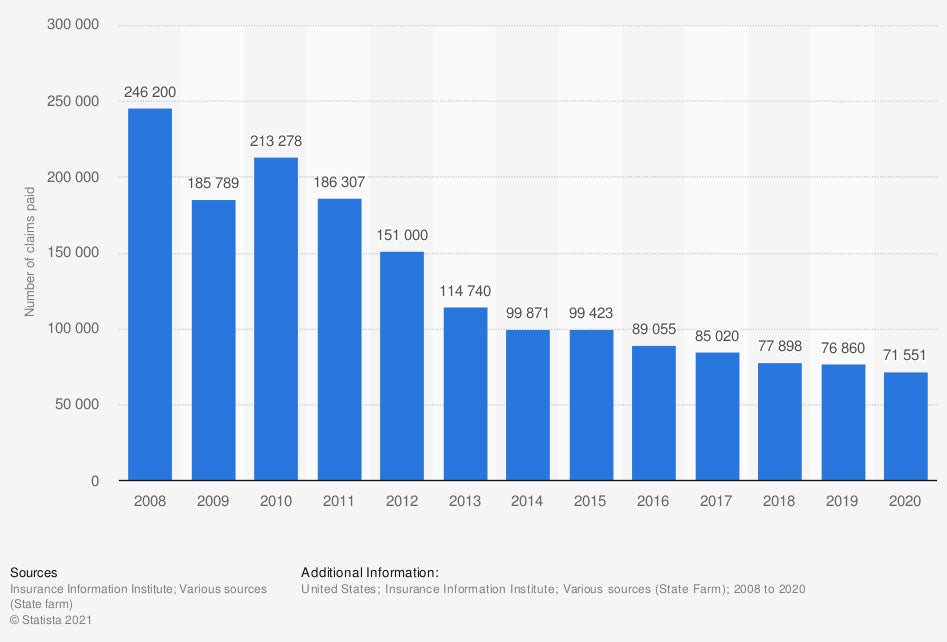

Number of homeowner insurance claims paid due to lightning losses in the US

Some losses are unavoidable, no matter how proactive you are. If you have the right coverage in place, you won't have to worry about paying out of pocket for lightning damage or otherwise.

What Does Homeowners Insurance Cover in New Jersey?

Like any policy, standard coverages apply and are included in most homeowners insurance. The following limits are used in the majority of New Jersey home policies:

- Dwelling limit: Pays for the replacement or repair of your home itself when a covered claim occurs.

- Personal property: Pays for the replacement or repair of your personal belongings.

- Personal liability: Pays for bodily injury, property damage, or slander claims against a household member.

- Additional living expenses: Pays for your temporary stay at another property when a claim renders your home unlivable.

- Medical payments: Pays for the first $1,000 - $10,000 of a medical expense when a third party gets injured on your property.

Different Catastrophes That Affect Your Home in New Jersey

The place you call home has to weather the elements and a variety of losses. In New Jersey, 1,078,146,000 homeowners claims were filed in one year alone. Check out which catastrophes happen the most in New Jersey:

- Severe storms and lightning

- Hurricanes and tropical storms

- Flooding and water damage

- Heavy snow

- Burglary and other property crimes

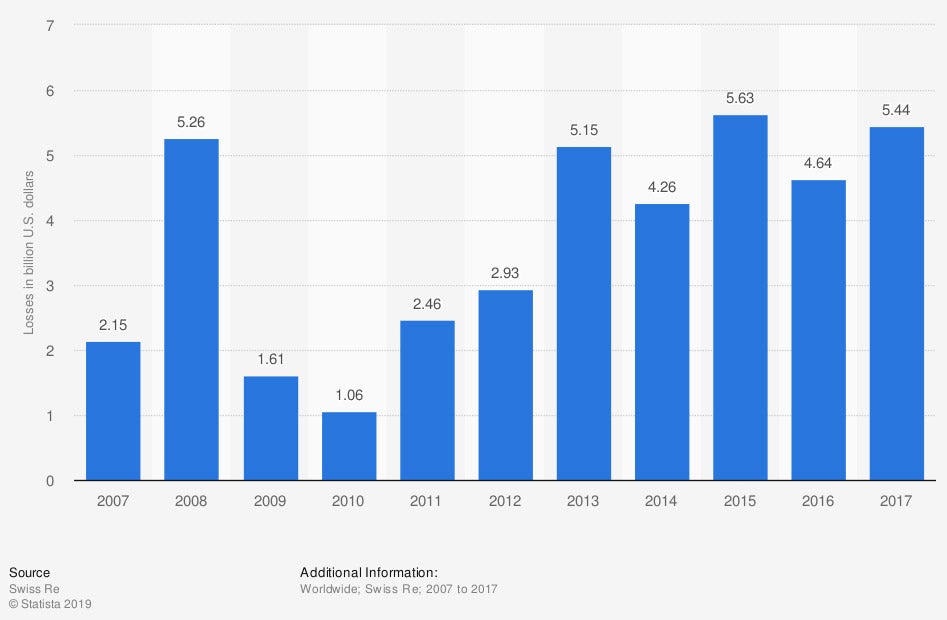

Global insured losses caused by major fires and explosions

Lightning damage is a top risk exposure in New Jersey. When you have proper coverage, you'll be protected from financial devastation if a lightning strike or other disaster occurs.

Is All My Property Protected from a Lightning Strike in New Jersey?

All of your personal belongings inside your home will be covered at the preselected limit. If lightning damage occurs to your New Jersey home, your structure and personal property will have coverage. Check out what your insurance protects in the event of a lightning strike:

- Electrical and plumbing systems

- Foundational elements

- The structure itself

- Detached garages

- Well water tanks and pumps

- Personal belongings

Does Homeowners Insurance Cover Lightning Strike Damage in New Jersey?

If your New Jersey home gets struck by lightning, it can be a shock, literally. Your home and belongings will be covered under your policy up to the amount listed. Your property can be covered in a couple of different ways that you need to be aware of:

- Replacement cost: Pays to replace your property to its like kind and quality when a claim occurs, including storm damage.

- Actual cash value: Pays to replace or repair your property to the current market value. This typically only applies to roofs but can apply to the actual home itself if old enough.

How a New Jersey Independent Insurance Agent Can Help

Consider using a trained professional when searching for the best homeowners insurance to protect against all the what-ifs. If lightning strikes and creates damage to your property, you could be out some serious cash without proper coverage. Fortunately, a trusted adviser can review your limits for no cost.

A New Jersey independent insurance agent will do the shopping through their network of highly rated carriers. This supplies you with competitive options without doing the work. Connect with a local expert on trustedchoice.com to get started today.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

https://www.statista.com/statistics/217232/paid-claims-by-us-homeowners-insurers-due-to-lightning-losses/

https://www.statista.com/statistics/281054/insured-losses-caused-by-major-fires-and-explosions-worldwide/

http://www.city-data.com/city/New-Jersey.html