Being a coastal state, New Jersey is no stranger to flooding. Unfortunately, the problem is only getting worse as the state’s climate becomes increasingly wet over time. To stay safe and dry during natural disasters, it’s important to understand local flood zones and where both your home and work fall on the spectrum. Read on to learn all about flood zones in New Jersey and how to determine your personal risk level.

What Is a New Jersey Flood Zone?

The Federal Emergency Management Agency (FEMA) labels various geographic areas as flood zones based on their estimated flood risk. FEMA determines flood zones by studying storm trends in each location over time and by consulting hydrologist studies. Flooding can occur due to heavy rainfall, melting snow, hurricanes, and other disasters. The way an area is laid out affects how easily water is able to move through and out which correlates to its risk of flooding.

Flood Damage Statistics in New Jersey

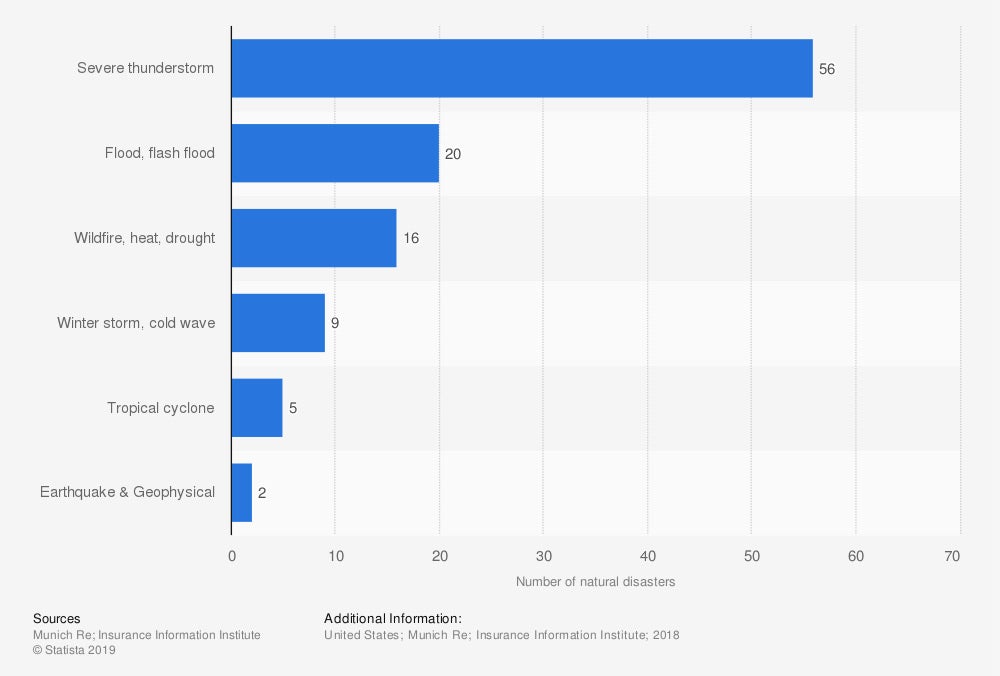

Number of natural disasters in the United States in 2018, by type

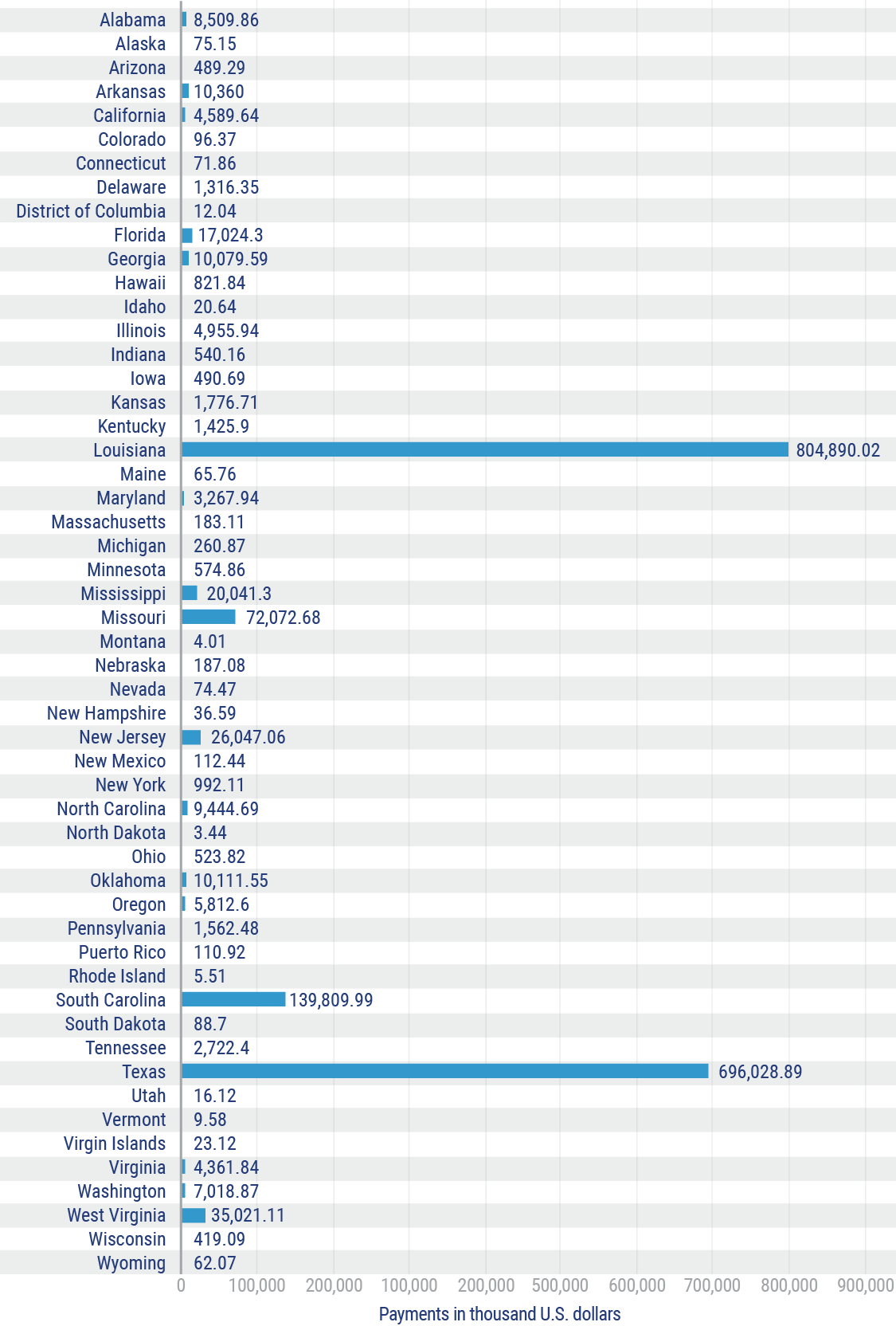

Flood insurance claim payments in the United States from October 1, 2015, to September 30, 2016 by state (in thousand US dollars)

In 2018, floods and flash floods were the second-most common natural disaster in the US behind severe thunderstorms. Flooding costs the US billions of dollars in damage each year as well as tragic deaths and severe property destruction.

Some quick and general flood statistics for the US:

- In 2019, flood insurance claims cost the US over $2 billion.

- Flash flooding causes over 200 deaths per year and is the leading cause of weather-related deaths.

- More than half of flood-related deaths occur in vehicles.

- Even properties located in low-to-moderate flood risk areas account for over 20% of flood insurance claims.

- Just one inch of standing water within a home can cause up to $20,000 in damage.

Because of New Jersey’s location on the Atlantic Coast, the state’s at a much higher risk of flooding than many other areas of the country. New Jersey residents should take the threat of these natural disasters seriously.

Here are some quick flood statistics for New Jersey:

- Between October 1st, 2015, and September 30th, 2016, flood insurance claims paid out a total of $26,047.06 for damage in New Jersey alone.

- A total of 207 flood insurance claims were made between October 1st, 2014, and September 30th, 2015, in New Jersey alone.

- In 2018, Business Insider ranked New Jersey as the number one most expensive state for projected flood damage by 2030.

- The National Oceanic and Atmospheric Administration projects New Jersey to suffer $10.4 billion in property damage due to flooding by the year 2030.

- New Jersey downpours commonly dump more than five inches of rain in certain areas.

Clearly, flooding is a common and costly issue for New Jersey. Understanding the state’s flood zones can help keep you safe during these disasters.

How to Find Your Flood Zone in New Jersey

In order to better prepare for flooding, it’s a good idea to find out if you live or work in a flood zone. Flood zones are determined by FEMA according to various criteria and are marked on the official website’s map.

- A-Zones: Indicate inland flood zones. These areas are not located along the coast but are still at risk of flooding.

- V-Zones: Indicate beach zones. These areas are commonly struck by waves and storms and carry a much higher risk of flooding.

- X-Zones: Indicate areas that are remote or not expected to flood. That being said, 30% of all FEMA’s payouts for flood damage go to properties within these zones.

You can easily locate your specific flood zone through FEMA’s Map Service Center on their official website. Just input your address to view your community’s map. It’s important to determine not only your specific zone but also the surrounding zones and any potentially hazardous areas near you.

What are the Most Flooded Areas in New Jersey?

While it’s easy to pull up an official map online, it’s also helpful to be familiar with areas of your state that are famously prone to flooding. New Jersey has a few flooding hotspots that you may want to avoid in times of heavy rainfall, such as:

- Areas along the Passaic river

- Wayne Township

- Lincoln Park

- Pompton Lakes

- Little Falls

- The Jersey Shore (especially the Wildwood beachside communities)

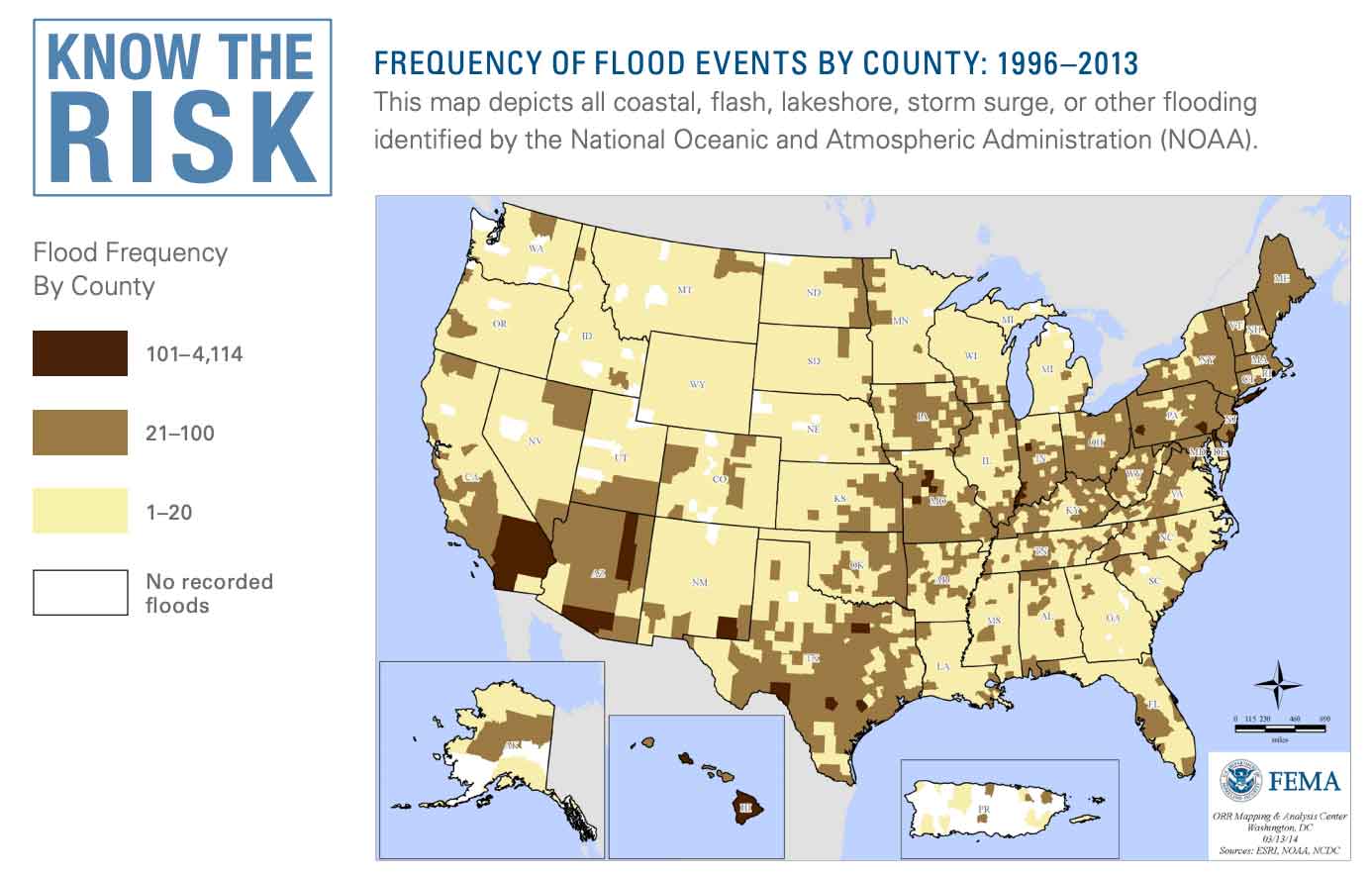

That being said, pretty much the entire state is at risk of frequent flooding. Check out this map from FEMA, indicating the flood frequency per county in each state:

Frequency of Flood Events by County: 1996-2013

Basically all of New Jersey falls into the 21-100 range, with a few counties nestled in the 101-4114 range. So while knowing your specific flood zone is important, in a state like New Jersey it’s best to be prepared for flooding no matter where you reside.

Is Flood Insurance Required in a New Jersey Flood Zone?

Typically properties located within A or V flood zones as designated by FEMA require their owners to carry flood insurance. Since these zones include not only beachfront and coastal properties but also those within areas otherwise prone to flooding, having adequate flood protection is crucial. Even properties located within low-to-moderate risk areas should consider getting coverage, especially in a coastal state like New Jersey.

Flood insurance covers the following:

- Damage to your home: Coverage of your home includes the foundation of the structure, electrical systems, indoor plumbing, built-in appliances, and additional installed flooring, like carpeting.

- Damage to your stuff: This includes furniture, certain appliances, some food, valuables, and clothing.

Flood insurance also covers total destruction of your home or personal property by flood waters up to your policy’s limit.

Why Work with a New Jersey Independent Insurance Agent?

In order to get the protection you need and deserve, you’ll want to work with a trusted expert. And who could be better for the job than a local agent who shares your area code? Independent insurance agents act as your own personal insurance shoppers, offering you tons more options than one-policy companies. With just one call, they’ll hook you up with multiple quotes.

New Jersey independent insurance agents are armed with knowledge on what coverage is needed in your area, and they’ll get you set up with just enough of it — not too little, not too much. They’ll handle all the heavy lifting so you can rest assured you’ll be set up with the right coverage at the right price.

They’re not just there at the beginning either. If disaster strikes, your New Jersey agent will be there to help walk you through the claims process and make sure you’re getting the benefits you're entitled to. Now that’s thinking ahead.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

www.fema.gov

www.iii.org

www.floodsafety.com

© 2025, Consumer Agent Portal, LLC. All rights reserved.