For the 884,000 small businesses in New Jersey, there's an 11% they'll be sued by an employee. Employee lawsuits can be financially devastating, which is why you need protection with a special New Jersey business insurance policy.

An employment practices liability policy can help protect your business if an employee sues you, but you still need to find the best policy for you. Fortunately, a New Jersey independent insurance agent knows how to prepare your business from any potential lawsuits.

What Is Employment Practices Liability Insurance?

Employment practices liability insurance (EPLI) is a type of New Jersey business insurance that protects employers who are sued by employees.

This type of insurance is not included in your general liability policy, because it focuses on lawsuits regarding discrimination, harassment, retaliation and wrongful termination.

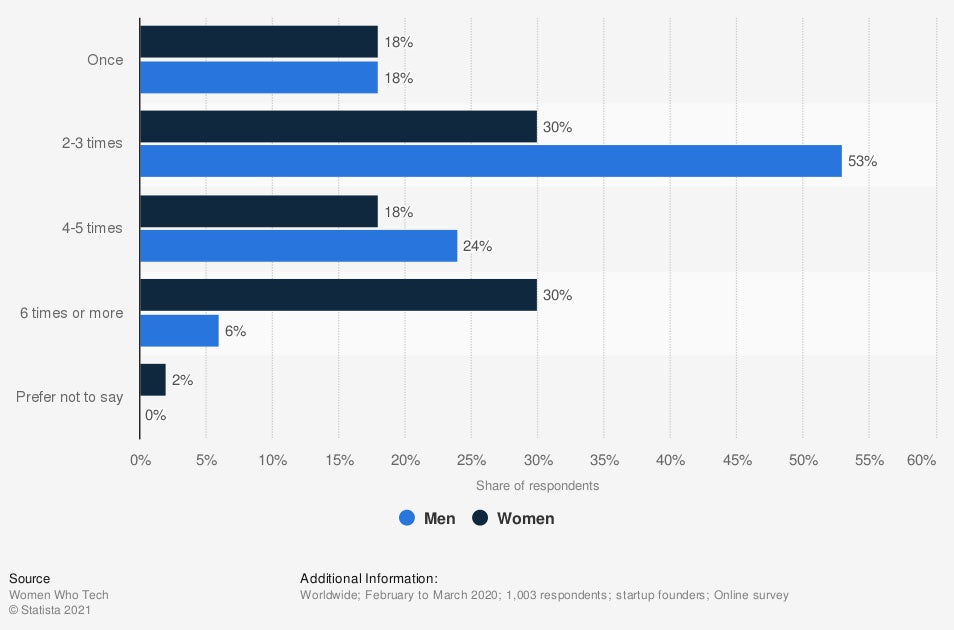

Frequency of harassment in the workplace experienced by male and female startup founders worldwide in 2020

Workplace harassment can happen to men or women, but more frequently affects females.

What Does Employment Practices Liability Insurance Cover in New Jersey?

Responding to a lawsuit can be expensive for a business. In fact, the average cost of settling an employment claim out of court is $75,000.

Employment practices liability insurance covers any of the fees associated with defending an employee claim in court. This includes court fees, lawyer fees, administrative costs, settlement and judgment costs.

Your EPLI policy will pay the legal costs associated with the following claims

- Discrimination

- Sexual harassment

- Wrongful termination

- Retaliation

- Breach of contract

- Emotional damage

"If somebody accuses your business of sexual harassment, you have to handle the accusation through the US Equal Employment Opportunity Commission," explained insurance expert Paul Martin. "You might get to court and then you'll end up draining $50,000 to 60,000 in defense. Whether you win or not, your policy pays out to defend the business and settle the claim, so it's protection worth having."

What Doesn't Employment Practices Liability Insurance Cover in New Jersey?

Employment practices liability insurance provides essential coverage for your business, but policies do have some exclusions.

Common exclusions on an EPLI policy include

- Punitive damages

- Bodily injury and property damage claims

- State unemployment insurance claims

- Workers' compensation

- Professional liability claims

- Criminal fines

- Data breaches

Your New Jersey independent insurance agent can help you better understand the types of claims that would and would not be covered by your employment practices liability insurance.

Employers Liability Insurance vs. Employment Practices Liability

Although they sound similar, employers liability insurance differs greatly from employment practices insurance.

- Employers liability insurance: Helps pay for costs associated with a lawsuit if an employee sues your business for a work-related injury or illness.

- Employment practices insurance: Helps pay for costs associated with a lawsuit if an employee sues for discrimination, harassment, or similar.

"Employers liability is typically worked into your New Jersey workers' compensation policy," explained Martin. "Most workers' compensation policies say you cannot sue your employee for additional payouts. However, there are exceptions. If your business is sued because of an exception, then employers liability insurance covers the claim."

Employment Practices Liability Insurance Cost in New Jersey

Insurance carriers use a variety of personal and professional details to determine insurance policy costs. Every New Jersey business insurance policy is personalized to fit your business's specific needs.

Insurance premiums are determined by the following factors

- Type of business you own

- Services you offer

- Safety practices that are already in place

- Existing discrimination/sexual harassment training

- Your claims history

- Your hiring and termination processes

A New Jersey independent insurance agent can provide you with a direct quote on the price of an employment practices liability policy.

New Jersey Employment Practices Liability Insurance Claim Examples

With 1,800,000 small business employees in the state, New Jersey businesses are no stranger to employee claims. Many times an EPLI claim that goes to trial ends in favor of the employee.

Largest employment claim jury verdicts and settlements in New Jersey

- $2.3 million dollar judgment: An employee sued for retaliation after complaints of illegal workplace activities, for filing claims for workers' compensation and handicap discrimination.

- $2.25 million dollar verdict: A policy dispatcher sued for handicap discrimination.

- $704,800 verdict: An employee sued the employer for retaliation for reporting illegal workplace activities.

- $225,000 settlement: An individual sued the New Jersey State Police for race discrimination and racial profiling.

- $75,000 settlement: A woman sued her employer for sexual harassment.

Plaintiffs win 51% of the time when employment practices liability (EPLI) claims go to trial. That's why it's important for businesses to have the proper business insurance coverage.

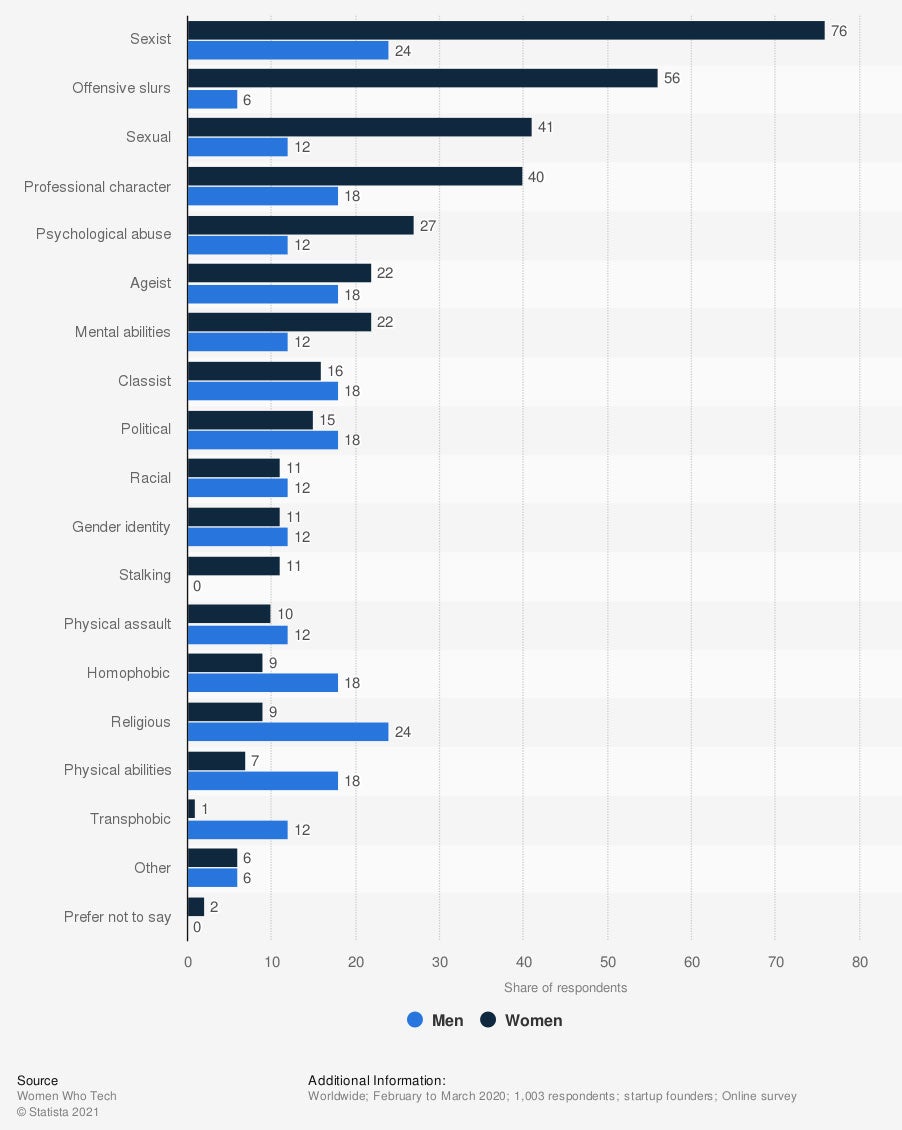

Types of workplace harassment experienced by male and female founders globally in 2020

In 2020, female founders experienced significantly more sexist and sexual harassment in the workplace than male founders.

How Can a New Jersey Independent Insurance Agent Help?

The average defense costs for an employment practices liability lawsuit is around $300,000. In addition, employment claims are increasing every year. You don't want to leave your business exposed without employment practices liability insurance.

A New Jersey independent insurance agent understands all aspects of New Jersey business insurance. They can shop carriers and help you choose a policy that best fits your business. Should you need to file a claim, they'll help out with that as well.

Article Author | Sara East

Article Reviewed by | Paul Martin

https://www.schaerlaw.com/jury-verdicts-and-settlements.html

https://riskandinsurance.com/employee-lawsuits-are-costly-win-or-lose-these-4-trends-are-making-the-risks-more-severe/

https://www.irmi.com/term/insurance-definitions/employment-practices-liability-insurance

© 2024, Consumer Agent Portal, LLC. All rights reserved.