Being on the coast, New Jersey is unfortunately prone to several types of storms. This makes it extra-important that your home and other property are guarded against the natural elements in case of disaster. That’s why it’s critical to get set up with the right storm insurance ASAP.

Fortunately, New Jersey independent insurance agents can help you get set up with enough storm insurance to protect your home. They’ll also make sure you walk away with all the coverage necessary long before you’d ever need to file a claim. But before we jump too far ahead, let’s take a closer look at storm insurance.

What Is Storm Insurance?

While standard New Jersey homeowners insurance already comes with some built-in coverage for windstorm damage, the state is actually one of 19 that requires residents to have a separate windstorm deductible. Because coastal states like New Jersey are no stranger to storms like hurricanes, separate policies to cover only windstorm damage are available.

When you hear the term “storm insurance,” it’s most likely referring to these “wind only” policies, according to insurance expert Paul Martin. A New Jersey independent insurance agent can help you find the storm insurance you need to make sure your home is fully protected against all the elements of nature.

What Does Storm Insurance Cover in New Jersey?

Windstorm coverage is included in many homeowners insurance policies in New Jersey, but a separate storm insurance policy can increase your wind coverage. If a windstorm severely damages your home and exhausts the limit on your homeowners insurance, your storm insurance is likely to cover the rest. A New Jersey independent insurance agent can further explain how your storm insurance policy works.

What Isn’t Covered by Storm Insurance in New Jersey?

Storm insurance is only designed to cover wind damage to your home. However, hurricanes typically have two components — wind and heavy rain. But storm insurance doesn’t offer protection for natural water damage.

To cover natural flooding, you’ll need to work with a New Jersey independent insurance agent to get a separate flood insurance policy. Flood insurance can protect your home from flood damage caused by hurricanes and other storms. Homeowners insurance also does not cover flooding by itself.

How Common Are Hurricanes?

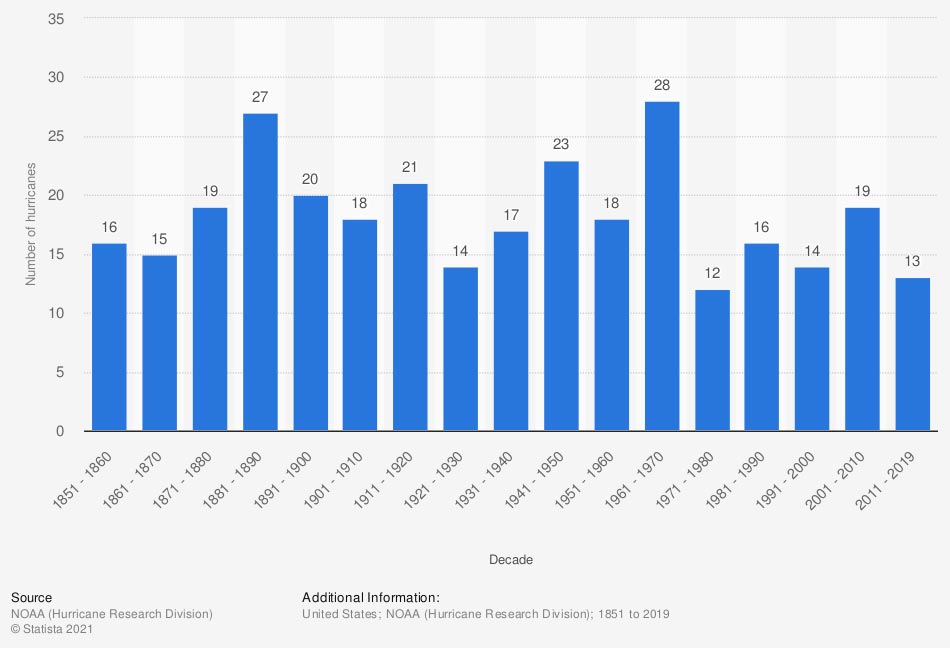

Number of hurricanes that made landfall in the United States from 1851 to 2019

Since 1851, at least a dozen hurricanes have made landfall in the US every single decade. From 2011 to 2019, a reported total of 13 hurricanes made landfall in the US.

Hurricanes are fairly common in New Jersey and the US overall, and they’re highly devastating and costly threats when they do hit land. That’s why it’s so critical to get set up with the right storm coverage before a storm warning ever appears. A New Jersey independent insurance agent can help.

Does Homeowners Insurance Cover Storm Damage in New Jersey?

Yes, homeowners insurance in New Jersey covers damage for several types of storms and other risks, including:

- Windstorms

- Hail

- Lightning

- Fire

- Blizzards

- Ice

Again, it’s important to note that your New Jersey home may require additional coverage for wind damage, hence the potential need for a separate storm insurance policy. Double-check with your New Jersey independent insurance agent to be certain.

Does Car Insurance Cover Storm Damage in New Jersey?

Whether your car insurance policy will cover storm damage depends entirely on the type you purchase. To protect your vehicle against storm damage, you’ll have to get New Jersey comprehensive car insurance.

Comprehensive coverage protects against damage due to the following:

- High wind

- Hail

- Flooding

- Fire and explosions

- Riots or vandalism

- Windshield damage

- Falling objects

- Missiles

- Collisions with large animals

Make sure to talk to your New Jersey independent insurance agent about getting equipped with comprehensive car insurance, so your vehicle can have the protection it deserves against all types of storms, as well as other disasters.

How Much Is Storm Insurance in New Jersey?

The cost of your storm insurance policy depends on several factors, such as your location. However, the average annual premium for windstorm insurance in New Jersey is just under $1,200. Of course, your specific policy may vary, based on the following:

- The value of your property

- Any prior claims

- The age of your property

- Your exact location

If your home is located right along the coast of New Jersey, you might pay up to 15% more for your storm insurance, Martin said. Properties located on the coast are at even higher risk of certain storms, like hurricanes.

Also, folks residing in larger cities can typically expect to pay a bit more for their coverage, since property values tend to be higher. Your New Jersey independent insurance agent can help you find storm insurance quotes.

Here’s How a New Jersey Independent Insurance Agent Can Help

When it comes to protecting homeowners and car owners against storm damage losses and other disasters, no one’s better equipped to help than an independent insurance agent. New Jersey independent insurance agents search through multiple carriers to find providers who specialize in storm insurance, deliver quotes from a number of different sources, and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

chart - https://www.statista.com/statistics/621238/number-of-hurricanes-that-made-landfall-in-the-us/

https://www.iii.org/fact-statistic/facts-statistics-homeowners-and-renters-insurance

© 2024, Consumer Agent Portal, LLC. All rights reserved.