As a good neighbor, you try to be respectful of everyone else's property. Unfortunately, sometimes even the professionals you hire can end up damaging your neighbor's home in some way. So what happens if a tree trimmer you hired drops a limb on your neighbor's shed?

Though a New Jersey independent insurance agent can help you get protected with the right home insurance, it's also important to understand the answer to this question first. Here's a breakdown of who'd be responsible if your tree trimmer damaged your neighbor's property.

If My Tree Trimmer Causes Damage to My Neighbor’s Property, Who’s Responsible?

Really it would be the tree trimmer's responsibility to pay for damage to your neighbor's shed or other property that occurred because of their work. Hopefully you hired a tree trimmer that was properly licensed and insured, because they would go through their own business insurance or LLC insurance to cover the damage. If they weren't insured, things could get more complicated.

Either you or your neighbor could then file a claim through your homeowners insurance to cover the damage. The home insurance company would sue the tree trimmer's business to recoup the losses through their insurance policy first. But your neighbor's homeowners insurance could also pay to remove the tree limb from their shed and clean up any debris left behind.

How Does Tree Trimming Insurance Work?

Tree trimming businesses in New Jersey are required to be covered by general liability insurance to protect them in case of lawsuits, as well as workers' comp coverage to protect workers from injuries and illness on the job. When hiring a tree trimmer, always ask for proof of insurance up front. Never hire a worker that won't provide proof of insurance, because in case of an incident like this one, you could end up in a lot of trouble.

In the scenario of your tree trimmer dropping a branch on your neighbor's shed, their general liability insurance would be necessary to pay for their attorney, court, and settlement fees. This coverage would provide the reimbursement your neighbor needed to get their property repaired. Workers' comp would also protect the trimmer if any workers got injured by the fallen limb, or during the cleanup.

If the Hired Tree Company Wasn’t Insured, Am I on the Hook for the Damage?

Either you or your neighbor could file a claim through your homeowners insurance after this incident if the tree trimmer wasn't properly covered. Whoever filed the claim through their home insurance would first have to pay their deductible amount out of pocket before reimbursement would kick in. The damage would then be covered up to the policy's limits in each category.

Your neighbor's shed would be likely to fall into the dwelling coverage category of their policy, but if property stored inside of it got damaged as well, that would extend into their contents coverage. It's important to know what your policy's limits are in every category in case disaster occurs. Talk with your New Jersey independent insurance agent about your home insurance limits, especially if you think you might want to add more coverage just in case.

What If the Damage Causes Serious Injury and Litigation?

The severity of the accident wouldn't affect who was held responsible, unless it could be proven that you as the homeowner were somehow at fault for the damage. If your neighbor or someone on their property got injured by the fallen limb, the tree trimmer's general liability insurance would pay for lawsuit costs relating to bodily injury. This could include reimbursement for medical treatment to your neighbor and their family or guests.

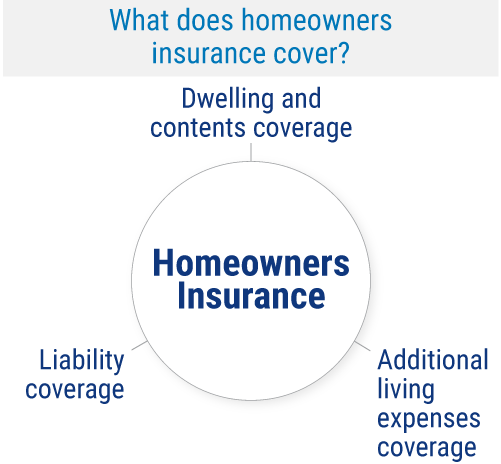

What Does Homeowners Insurance Cover in New Jersey?

Homeowners insurance protects residents in New Jersey from many incidents beyond just tree trimming accidents. Standard homeowners insurance policies include these core coverages:

- Dwelling and contents coverage: The structure of your home as well as your personal property like furniture, etc. are protected by these property coverages against many catastrophes like fire and more.

- Liability coverage: This coverage protects homeowners against lawsuits filed by third parties for claims of bodily injury or personal property damage caused.

- Additional living expenses coverage: Home insurance also covers additional costs if a homeowner must live somewhere else while their home's being repaired for a covered disaster like a major fire or storm.

Make sure to work with a New Jersey independent insurance agent to get set up with a home insurance policy that protects you in all necessary areas.

Does New Jersey Homeowners Insurance Offer Full Coverage for My Neighbor’s Property?

Home insurance would cover all aspects of the incident on your neighbor's property, including the property damage itself and other elements like:

- Tree limb removal: Called "tree damage cleanup" coverage, this pays for the cost of removing fallen tree limbs, etc. from your property after a covered peril.

- Debris cleanup: This coverage would also pay to clean up the rest of the mess, like bits of broken glass, twigs, and leaves left behind after the limb was removed.

Even if this catastrophe occurred and destroyed your neighbor's shed, at least the two of you could rest assured that home insurance would cover the damage even if the tree trimmer didn't have their own coverage. But it's always important to not only hire properly insured help to work on your home, but also to ensure that you have your own coverage, just in case.

Why Choose a New Jersey Independent Insurance Agent?

New Jersey independent insurance agents simplify the process by shopping and comparing insurance quotes for you. Not only that, but they’ll also cut the jargon and clarify the fine print so you know exactly what you’re getting.

New Jersey independent insurance agents also have access to multiple insurance companies, ultimately finding you the best home insurance coverage, accessibility, and competitive pricing while working for you.

Author | Chris Lacagnina

https://jacksontreestl.com/what-kind-of-insurance-should-a-tree-service-have/#:~:text=a%20great%20question.-,The%20short%20answer%20is%2C%20your%20tree%20care%20company%20should%20have,substantial%20damage%20to%20your%20property.

https://alpinetreenj.com/how-new-jerseys-tree-work-law-affects-you/#:~:text=On%20April%2017%2C%202017%2C%20New,Tree%20Care%20Operator%20(LTCO).

© 2025, Consumer Agent Portal, LLC. All rights reserved.