Many incidents involving your property can occur outside of your control, such as if you have renters staying over. Imagine that the renters at your vacation home actually broke your boat during their stay. Who'd be responsible for the incident and for paying for the damage?

While a New Jersey independent insurance agent can help you get protected with the right boat insurance, we can start by helping to answer this question. So here's a breakdown of who'd be responsible if renters broke the boat at your vacation home.

Who’s Responsible If Renters Damage My Boat at My Vacation Home?

According to insurance expert Paul Martin, your own boat insurance policy would probably cover the damage to your vessel by renters, if you purchased hull coverage. But your policy might specifically exclude other operators and only cover you and your family's use of the boat. That's why you should double-check your specific personal watercraft policy with the help of your New Jersey independent insurance agent to be certain.

Who’s Responsible If Out-of-Towners Rent My Boat on Summer Vacation and Damage It?

A rental business that offers boats to out-of-towners on vacation is often equipped with their own insurance, but requirements vary by state. The business's boat insurance would probably only cover repairs to their own watercraft and other property, not necessarily liability the renter encounters if they injure someone else or damage another boat. So while the boat rental business would be protected against lawsuits, the renter may not.

Another interesting scenario is if the renter who broke the boat at your vacation home had their own boat insurance policy for a vessel they had at their home. Paul Martin noted that their personal watercraft policy would be likely to extend to cover the damage to your boat if you both owned a similar type of vessel. But if the renter had a policy for a bass fishing boat and you owned an expensive yacht, they wouldn't have enough coverage.

How Common Are Boating Incidents in New Jersey?

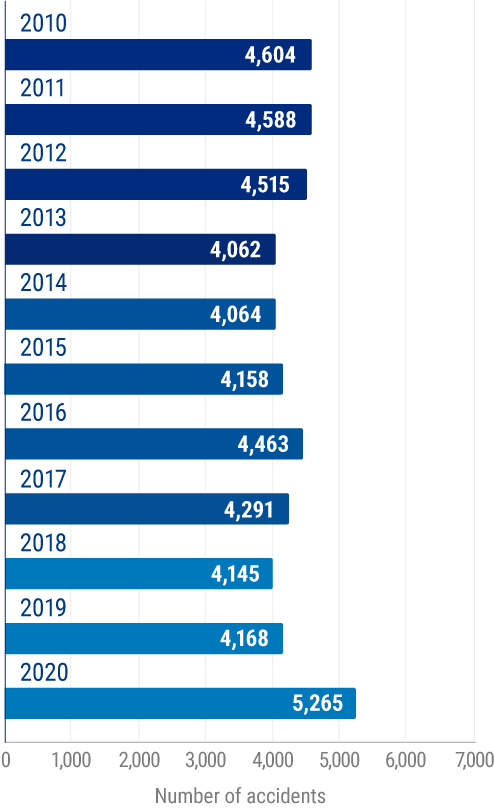

Boating incidents happen more often than many folks might expect, not just in New Jersey, but in the nation as a whole. Just check out the graph below to see for yourself.

Number of recreational boating accidents in the US

Recreational boating accidents are once again increasing in frequency, after a decline for several years. In just one recent year, there 5,265 recreational boating accidents were reported. That's an average of more than 14 boating accidents per day in the US. This was a substantial increase from the previous year, when 4,168 recreational boating accidents were reported.

With recreational boating accidents occurring so often, you might want to get in touch with your New Jersey independent insurance agent to get covered with the right boat insurance, sooner rather than later.

What Does Boat Insurance Cover in New Jersey?

Having the right boat insurance can protect you against many disasters beyond just accidents caused by renters.

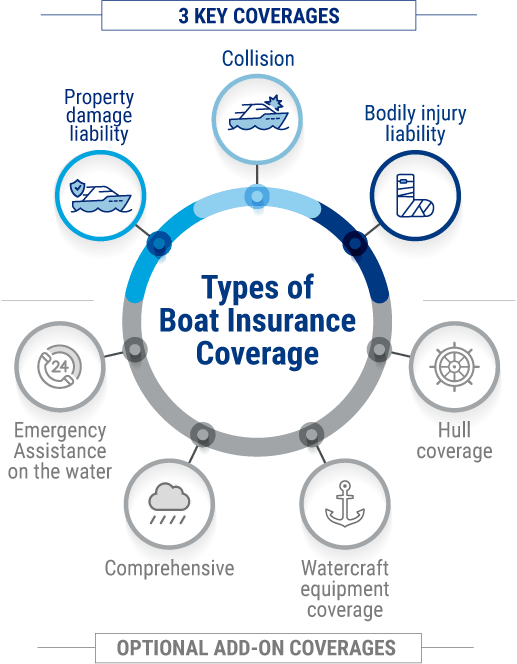

Boat insurance provides these three key coverages:

- Property damage liability: This covers property damage you cause to third parties with your boat, including to other boats, homes, equipment, docks, etc.

- Collision: This covers physical damage to your vessel after you cause an accident.

- Bodily injury liability: This covers third-party bodily injuries caused by your watercraft.

Optional add-on coverages to boat insurance include:

- Emergency assistance on the water: This covers towing and other emergency assistance if you break down while out on the water.

- Comprehensive: This covers your boat for many threats other than collision, including hail or wind damage, vandalism, and more.

- Watercraft equipment coverage: This covers your boat's equipment like life vests, etc. from many disasters like fire, etc.

- Hull coverage: This covers damage to your boat's hull, equipment, and machinery caused by many types of incidents.

A New Jersey independent insurance agent can help you create a personal watercraft insurance policy that best meets your needs.

What Does Rental Home Insurance Cover in New Jersey?

Homeowners insurance is evolving with the times to include more coverage for rental homes. To insure your rental home, you'd add endorsements to your existing homeowners insurance to cover the increased risks. These endorsements would add property damage coverage and extend your liability coverage to protect you against disasters caused by your renters, as well as incidents that could happen to them, such as an injury on your premises.

Do I Need Boat Insurance along with My Home Insurance to Receive Coverage?

If your home insurance or rental home insurance provides any coverage for your boat, it's probably very limited. So you would probably need to be equipped with boat insurance along with your home insurance to receive reimbursement for damage done to your vessel, whether it be by you or renters. Especially if you want full replacement coverage for your boat, you'd want to make sure you were equipped with a personal watercraft policy.

If You Run an Airbnb, Does Their Coverage Provide Any Financial Protection?

If you run an Airbnb, the business does offer several types of insurance designed to protect you as a host in different ways. Airbnb's host damage protection offers the following coverages for you as the host:

- Lost income from canceled bookings after a guest severely damages your property.

- Losses due to property damage by guests to your rental home's dwelling or contents.

- Losses due to required cleanup after negligent guest behavior and damage.

Airbnb's host damage protection offers $1 million in coverage for your property if it gets damaged by your renters. However, if you don't run an Airbnb, make sure to talk with your New Jersey independent insurance agent to get equipped with all the rental home insurance and boat insurance you need to be protected in any circumstance.

Why Choose a New Jersey Independent Insurance Agent?

New Jersey independent insurance agents simplify the process by shopping and comparing insurance quotes for you. Not only that, but they’ll also cut the jargon and clarify the fine print so you know exactly what you’re getting.

New Jersey independent insurance agents also have access to multiple insurance companies, ultimately finding you the best personal watercraft insurance coverage, accessibility, and competitive pricing while working for you.

Author | Chris Lacagnina

https://www.iii.org/article/insuring-marine-businesses-and-cargo

https://www.airbnb.com/help/article/279/host-damage-protection

https://www.statista.com/statistics/240630/recreational-boating-accidents-in-the-us/

https://uscgboating.org/library/accident-statistics/Recreational-Boating-Statistics-2020.pdf

© 2024, Consumer Agent Portal, LLC. All rights reserved.