New Jersey crop insurance helps protect the $1 billion dollar crop industry in the state. Farmers pay more than $1.8 million for crop coverage, so it's worth knowing if the money you're paying towards crop insurance premiums is tax-deductible.

Whether you're looking to insure new crops or reassess your existing coverage, a New Jersey independent insurance agent can help. Here's how to secure this important coverage.

What Is New Jersey Crop Insurance?

Crop insurance is a type of New Jersey farm and ranch insurance that protects farmers from loss to their crops. Crop insurance is managed by the USDA Risk Management Agency (RMA) and sold through private insurance carriers that have entered a partnership with the RMA.

"Crop insurance is unique, so you need an independent insurance agent who has experience in the farming industry," explained insurance expert Paul Martin. "Not all agents know farming, so you'll want to make sure you work with one who has helped farmers purchase crop insurance before."

Value of crops in New Jersey

What Does Crop Insurance Cover In New Jersey?

There are two main types of crop insurance, multi-peril crop insurance and crop-hail insurance. Multi-peril insurance is purchased through the RMA and crop-hail can be purchased separately through individual insurance carriers.

Multi-peril insurance provides coverage against:

- Diseases and wildlife

- Drought

- Freezing

- Floods

- Fire

- Insects

- Loss of revenue due to a decline in crop price

Crop-hail insurance provides coverage against:

- Hail

- Fire

- Lightning

- Theft

- Wind

- Vandalism

- Malicious mischief

Crop insurance covers more than 120 different crops and 38 specialty crop categories including types of fruits, vegetables, tree nuts, and nursery crops. All crops must be planted in order to be covered.

Is Crop Insurance Tax-Deductible in New Jersey?

Some farmers may be able to receive some tax relief when reporting their yearly crop income.

Cash-basis farmers who are working on the cash accountant system can tax their crop insurance proceeds when they are received. Cash accounting is the method of recognizing revenue and expenses as they are received or paid out.

In addition, the IRS offers a deferral provision for any insurance proceeds that farmers receive as a result of "destruction or damage to crops." If your crops are damaged or destroyed, you can choose to claim your gross income in the following tax year.

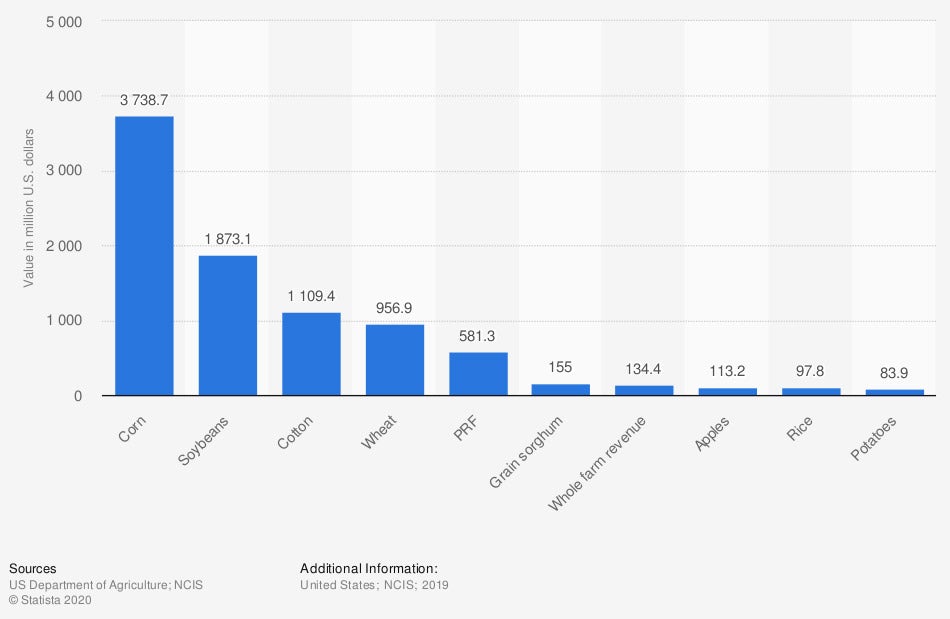

Value of crop insurance premiums in the United States

The value of crop insurance premiums for soybeans in the United States amounted to $1.87 billion in one recent year. Soybeans are one of the top crops grown in New Jersey.

Is Crop-Hail Insurance Tax-Deductible in New Jersey?

Crop-hail insurance works the same way as general crop insurance in that farmers must claim any insurance proceeds from their crops.

Farmers with crop-hail insurance can also utilize the deferral provision if they qualify.

Are There Any Liabilities That Can Influence My Deductible?

For farmers who purchase federal crop insurance, a deductible must be met before any payments for loss will be made. As with any insurance, you'll choose your deductible when selecting your plan with your independent insurance agent.

Farmers that purchase crop-hail insurance will not have a deductible. Crop-hail insurance is purchased on an acre-by-acre basis. It protects individual crops based on the actual cash value of the crop.

For these reasons, crop insurance deductibles are not highly influenced by liabilities. When working with your New Jersey independent insurance agent, you'll look at the total value of your crops and choose policy limits based on that price.

How Can a New Jersey Independent Insurance Agent Help?

Crop insurance is a unique type of farm and ranch insurance that not all insurance agents are familiar with. A New Jersey independent insurance agent who understands crop insurance can save you time and money.

They'll sit down with you, free of charge, to discuss your farm and the crops you're looking to insure. If you need to file a claim, they can help you through that process as well. Find an experienced crop insurance agent on TrustedChoice.com today.

Author | Sara East

Article Reviewed by | Paul Martin

https://cropinsurance.org/wp-content/uploads/2017/01/Myth-v-Fact-Crop-Insurance-Requires-a-deductible-to-be-met.pdf

https://cropinsuranceinamerica.org/new-jersey/

https://www.maloneynovotny.com/featured-news/crop-insurance-proceeds/

© 2024, Consumer Agent Portal, LLC. All rights reserved.