Hail can leave your vehicle with dents, broken windows, and several thousand dollars in repairs. While you can't control a hailstorm, you can control the type of New Jersey car insurance coverage you have. The good news is that your car insurance will cover hail damage, but only if you have the proper policy.

For New Jersey drivers, an independent insurance agent can help you determine how much car insurance you need and whether you should purchase coverage to protect against hail. To start, here's what you should know about hail damage and car insurance.

Q: What Does New Jersey Car Insurance Cover?

Accidents can happen to anyone on the road, which is why car insurance exists. For most scenarios you'll get into on the road there's a type of car insurance that will cover you. The main types of benefits you'll get from car insurance include:

- Paying someone else's medical bills

- Paying your own medical bills

- Fixing your car

- Fixing someone else's car

- Paying to repair your property

- Paying to repair someone else's property

Of course, you have to have the right blend of insurance coverage in order to receive coverage for all of the above. For drivers in New Jersey, the state requires three types of insurance, and several other coverages are optional.

The following coverages are state-mandated in New Jersey

- Liability insurance: Bodily injury and property damage liability will pay for damage and medical bills for the other driver and their property if you're in an at-fault accident.

- Personal injury protection (PIP): If you or your passengers are injured in an accident, PIP insurance will help pay for medical bills and injuries no matter who is at fault.

- Uninsured motorist coverage: Covers any costs associated with an accident with an uninsured motorist.

The following coverages are optional for drivers in New Jersey

- Collision insurance: Pays to repair or replace your vehicle if you collide with another vehicle or object.

- Comprehensive insurance: Pays to repair or replace your vehicle if it gets damaged by hail, fire, colliding with an animal, vandalism or theft.

Insurance experts like Paul Martin recommend thoroughly discussing your car insurance options before purchasing. Just because coverage is optional doesn't mean it's not worth getting.

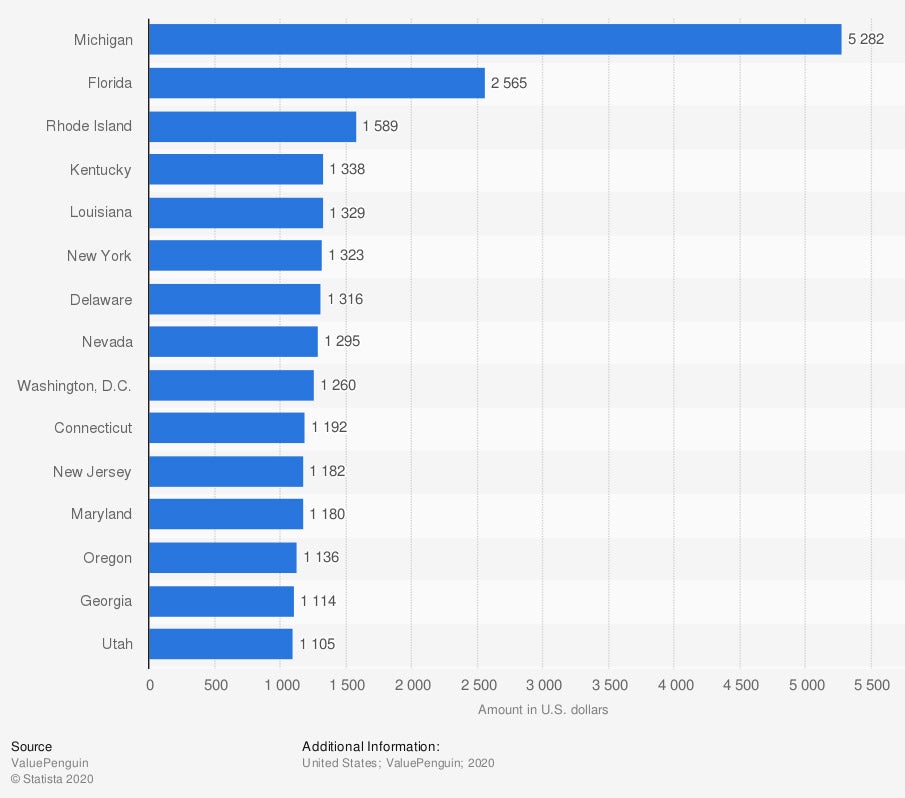

Estimated annual car insurance premiums in the United States in 2020, by state (in US dollars)

The average cost of car insurance in New Jersey is $1,182 a year.

Q: What Isn't Covered by Car Insurance in New Jersey?

While you can purchase insurance to cover most events and risks you'll face in your vehicle, there are some exceptions that no policy will cover. They include:

- If you're in an accident while using your vehicle for business purposes

- If your personal belongings are stolen out of your vehicle or damaged

- Any repairs, upgrades, and damage that are considered routine maintenance

- If you use your vehicle as a rideshare and are in an accident while on the job

Insurance expert Paul Martin reminds New Jersey drivers that you also will not receive coverage for physical damage to your vehicle unless you pay for collision or comprehensive coverage.

Q: Does New Jersey Car Insurance Cover Hail?

Yes, it does. However, hail is only covered if you purchase comprehensive coverage, which is not a required coverage by the state of New Jersey. This means you'll want to work with your independent insurance agent to make sure you're adding the coverage to your policy.

"Comprehensive coverage actually has language in it that addresses hail damage," says insurance expert Paul Martin. "Comprehensive coverage is designed to cover everything other than a collision, which is why it's usually referred to as 'other than collision' insurance. Hail is something that is out of your control, so that's why it falls under comprehensive insurance."

Q: Should You Consider Getting Hail Coverage in New Jersey Based on Stats?

New Jersey is a common state for severe weather patterns. The most common are high winds, tornadoes, thunderstorms, hailstorms, and extreme temperatures. While hailstorms can happen on their own, many weather events result in hail as well. The following stats show why a comprehensive car insurance policy could be beneficial to New Jersey drivers.

- The state has between 1 and 99 severe hailstorm days every year

- In 2019, Sicklerville, NJ had the most hail claims among cities in New Jersey

- Locations in New Jersey experience between 20 and 30 thunderstorm days each year

- The average hail repair cost on a vehicle is $2,500

Even though New Jersey is not known for hail damage, its location on the coast and general susceptibility to natural disasters make it worth purchasing comprehensive insurance.

Q: How Much Does Car Insurance in New Jersey Cover?

When you purchase car insurance, you'll determine your policy limits. This is the amount that your insurance will cover in damage before you have to pay out of pocket. For New Jersey drivers, the minimum coverage amount is $15,000/$30,000/$5,000. This means you must purchase a minimum amount of $15,000 bodily injury coverage per person, $30,000 max per incident, and $5,000 minimum coverage for damage to another person's property. In any covered event, your insurance will always cover up to your policy limits after you pay your deductible.

Q: Why Go With An Independent Insurance Agent?

Car insurance is designed to protect you on the road, and independent insurance agents are there to help you put together the best car insurance package possible. Every driver will require different coverage types and limits, which is why a New Jersey independent insurance agent is there to shop quotes and put together options for you to choose from.

If you do find yourself in an incident where you need to use your insurance, your independent insurance agent is there to help walk you through the process and can help you adjust your policy at any time.

Article Reviewed by | Paul Martin

https://www.nicb.org/news/news-releases/top-5-states-hail-claims-2017-2019-data

http://ready.nj.gov/mitigation/pdf/2019/mit2019_section5-10_Severe_Weather.pdf

Iii.org

© 2024, Consumer Agent Portal, LLC. All rights reserved.