New Jersey is home to 9,900 farms. If you own a farm, you want to do everything you can to protect your crops from any risks that could result in you being unable to harvest them. Crop insurance is necessary coverage if you have valuable commodities on your farm.

Crop insurance comes in a few shapes and sizes, and some coverage can only be purchased through the Federal Crop Insurance Program. Fortunately, a New Jersey independent insurance agent knows all about finding crop insurance, so you don't have to. Let's talk more about protecting your crops.

What Does Crop Insurance Cover In New Jersey?

Crop insurance pays for any damage that occurs to your crops from a number of covered losses. There are several options when it comes to purchasing crop insurance, and each will provide different coverage.

- Multi-peril crop insurance: Purchased federally and pays for damage from natural disasters such as extreme weather, fire, flood, disease, and more.

- Crop-hail insurance: Privately purchased coverage that protects your crops from hail damage.

When working with your New Jersey independent insurance agent, you'll discuss the crops you have and the risks your farm faces to determine which policies are best for you.

Why New Jersey farmers need crop insurance

- New Jersey crops contribute $1.1 billion to the state’s economy

- 149,196 acres protected

- $81.8 million in liability protection provided

- $1.8 million paid by farmers for coverage

- $2.5 million paid out by crop insurers for losses

What Doesn't Crop Insurance Cover In New Jersey?

Every crop insurance policy will outline specific coverages and exclusions. Typically, the following are not covered under crop insurance.

- Negligence

- Damage from poor farming practices

- Pesticide drift

- Some flooding events

- Hail damage without crop-hail insurance

"Crop insurance is a federal program that you don't have any control over," explained insurance expert Paul Martin. "There may be windows when it's unavailable for purchase, which is why you need someone who understands crop insurance to help you purchase it."

How Much Is Crop Insurance in New Jersey?

There are multiple factors related to your farm, crops, and the farming industry as a whole that impact crop insurance premiums.

Common factors that impact crop insurance rates

- Farm size

- Number of crops

- Type of crop

- Location

- Age of farm

- Whether you harvest crops or not

The Federal Crop Insurance Program will look at the projected price of a crop, per bushel, to help determine potential premiums.

What Is Multi-Peril Crop Insurance?

Multi-peril crop insurance is the most popular form of crop insurance for farmers. It is offered through the Federal Crop Insurance Program. Referred to as MPCI, it covers the following losses:

- Extreme weather

- Drought

- Disease

- Fire

- Flooding

- Insect Damage

MPCI can be purchased through private crop insurance companies and insurance agents that have partnered with the Federal Crop Insurance Program.

MPCI quick facts

- Must be purchased every growing season

- Protects more than 120 crops

- Includes exclusions of certain crops in specific geographic regions

- Must be purchased before a crop is planted

- Payouts are based on the value of the specific crop

The federal program will set purchasing deadlines for crop insurance based on a crop's growing season. That's why it's important to speak with your New Jersey independent insurance agent to get protection.

What Is Rain and Hail Crop Insurance?

Rain and hail, or crop-hail insurance, can be purchased in addition to or instead of MPCI. Crop-hail insurance will cover any non-harvested crops against the following causes of loss:

- Hail

- Fire

- Lightning

- Theft

- Wind

- Vandalism

- Malicious mischief

"Crop-hail insurance differs from MPCI in that it's purchased by the acre and can be bought from private companies," explained insurance expert Paul Martin. Crop-hail insurance can also be purchased at any time in the growing season.

For farmers who are in high-risk areas for hail, it may be more affordable to only purchase a crop-hail policy vs, an MPCI policy.

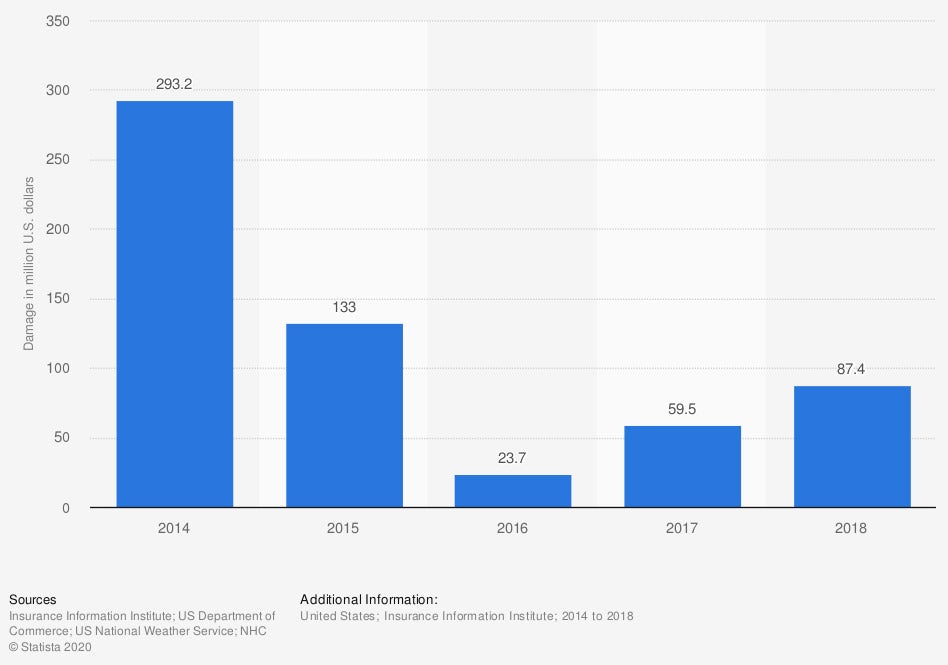

Crop damage from hail in the US

In recent years, the US has experienced crop hail damage of more than $87 million.

How Does Revenue Crop Insurance Work In New Jersey?

If your crops have a low-yield year or the purchase price of crops is low, you can benefit from a revenue crop insurance policy. This coverage can help you protect what you would be earning from your farm from drastic price changes in crops.

When you purchase revenue crop insurance, you are guaranteed a certain amount of revenue that is based on market prices and your actual yield.

How Can a New Jersey Independent Insurance Agent Help?

Protecting your crops and your farm is a top priority. Working with a New Jersey independent insurance agent, you'll be certain that you're getting the coverage you need. They will speak with you, free of charge, to understand your crops and your farm.

They can recommend which crop insurance is right for you and they know the private-sector companies that can sell crop insurance. They'll take the stress out of shopping for coverage and quickly get you the protection you need.

Author | Sara East

Article Reviewed by | Paul Martin

https://www.nass.usda.gov/Quick_Stats/Ag_Overview/stateOverview.php?state=NEW%20JERSEY

https://www.nj.gov/agriculture/about/overview.html#

https://cropinsuranceinamerica.org/new-jersey/

© 2025, Consumer Agent Portal, LLC. All rights reserved.