You spend the first 16 years of your child's life protecting them from different risks, and now you're looking for the best way to protect them behind the wheel. But is your child covered under your existing New Jersey car insurance policy? The answer isn't exactly black and white, but fortunately, a New Jersey independent insurance agent can help you understand when your child is covered under your policy and when they are not.

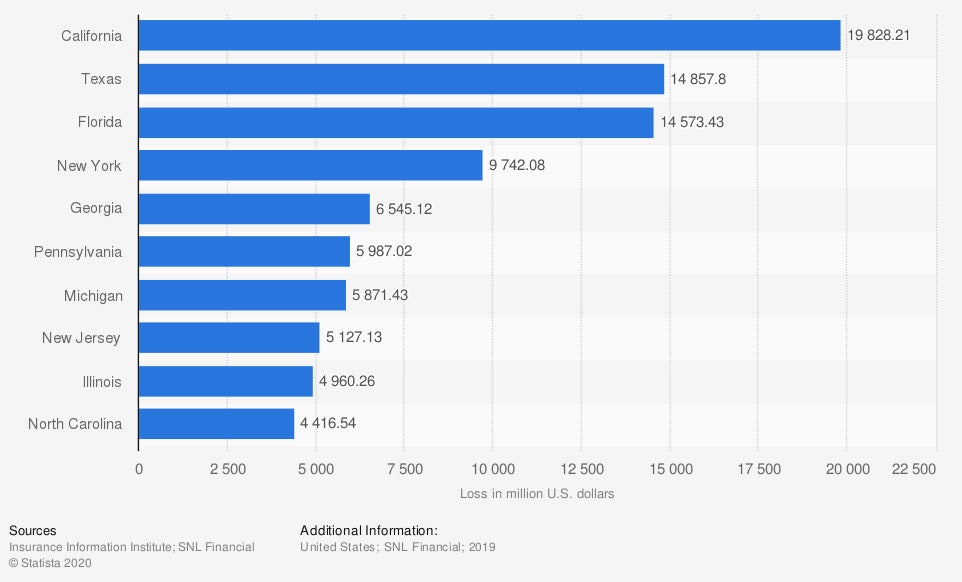

Incurred losses for private passenger auto insurance in the United States in 2019

(in million US dollars)

In 2019, New Jersey private auto insurance companies paid out more than $5 million dollars in claims.

Q: Is My Child Covered under My Car Insurance in New Jersey?

Car insurance is designed to protect whoever is behind the wheel of a vehicle should the person be in an accident. However, that doesn't mean that anyone who is driving is automatically covered, even if they're family. Children are covered under car insurance policies in different ways depending on their age and whether they have their license.

When it comes to children, any child that is not yet licensed will typically be automatically covered under your car insurance policy. Once a child gets their own driver's license, they can remain covered under your insurance, but you'll need to add them to your policy as a covered driver. Insurance expert Jeffrey Green confirms that "while coverage can vary by company and state, you should always list licensed family members living with you, or anyone who will be regularly driving the vehicle on the policy."

Q. Do I Need Full Auto Coverage to Protect My Child?

If you choose to add your child to your car insurance policy, they'll receive the same amount of protection that you already have stated in your policy. You cannot customize your policy for different drivers. However, if you plan on adding a child driver to your policy, it's a good idea to work with your independent insurance agent to go over your existing policy and determine whether you should increase your coverage.

In New Jersey, the minimum required coverage includes bodily injury liability, property damage liability, personal injury protection, and uninsured motorist coverage. While these coverages are thorough and will provide financial protection if your child is in an at-fault accident, they will not pay for any damage that is done to your vehicle if it's damaged in a collision or by theft, vandalism, or if your child runs into a wild animal. For these scenarios to be covered, you'll need to purchase collision and comprehensive insurance.

If you're unsure whether you need a more comprehensive insurance package, just keep in mind that the risk for an auto accident is highest among drivers age 16-19 and that drivers of this age are nearly three times more likely to be in an accident than drivers age 20 or over. Here are some additional stats on teen drivers in 2018.

- Nearly 2,500 teens were killed in auto accidents.

- 285,000 teens were treated in emergency rooms for injuries sustained in an auto accident.

- 237 drivers age 15 to 19 were involved in distracted driving fatal accidents.

- 400,000 teens were injured in accidents related to distracted driving

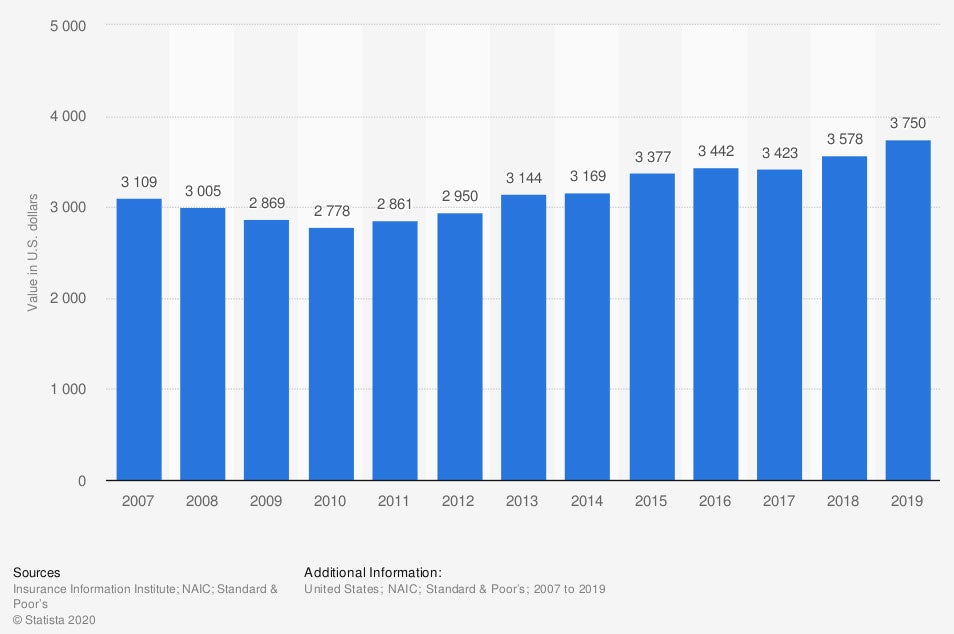

Average value of private passenger auto collision insurance claims for physical damage in the United States from 2007 to 2019 (in US dollars)

In 2019, the average private passenger auto collision claim for physical damage amounted to $3,750 in the United States.

Q. What Coverage Does My Child Have If They Are in the Wrong?

Any driver who is listed under your policy will have the same amount of coverage that is outlined in your policy. If you or your child are in an at-fault accident, your New Jersey auto liability coverage, collision and comprehensive insurance will provide the following protection.

- Bodily injury liability: Pays for injuries to third parties. This includes medical bills and even lost wages if the person is unable to return to work.

- Property liability: Pays for any damage to the other person's vehicle or property.

- Personal injury protection: Pays for any medicals bills for you or your passengers.

- Collision insurance: Pays for any damage that is done to your vehicle during an accident.

- Comprehensive insurance: Pays for any damage to your vehicle as a result of anything "other than collision."

New Jersey is considered a no-fault state which means that any injuries that are sustained in a car accident must be covered by the driver's own insurance company regardless of who the at-fault driver is.

Q. How Can an Independent Insurance Agent Help?

Adding a teen driver to your insurance policy is possible, but might not always be the best decision. Teen drivers are expensive to insure because of the risks they pose behind the wheel. Fortunately, an independent insurance agent in New Jersey is an expert in car insurance and can help you determine whether adding your child to your policy or putting them on their own policy is the best choice for you.

If you decide to add your child to your policy, these agents can help you understand the coverage you have and what your child will receive so that you can rest assured that you and your children are always protected while on the road.

Article Reviewed by | Jeffery Green

https://www.statista.com/study/32369/car-insurance-in-the-us-statista-dossier/

Iii.org

https://www.nhtsa.gov/road-safety/teen-driving

https://www.cdc.gov/transportationsafety/teen_drivers/teendrivers_factsheet.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.