Whether you drive your vehicle 500 or 50,000 miles a year, if you plan on hitting the road you'll need proper car insurance. This is because it's not only required in the state of New Jersey, but it also protects you, your vehicle, and any passengers in the event that you're in an accident.

When it comes to car insurance, you'll have to buy what's state-mandated. You'll also have the option to add additional coverages, which is why a New Jersey independent insurance agent can help you get the proper coverage. Let's start by talking more about car insurance in New Jersey.

Why consider car insurance coverage in New Jersey?

- Total crashes in 2019: 276,861

- Total injury crashes in 2019: 59,850

- Total fatal crashes in 2019: 524

- Total crashes related to cell phone usage in 2019: 1,001

Q: What Does Car Insurance Cover in New Jersey?

Every licensed driver in New Jersey is required to have three types of mandatory insurance: liability insurance, personal injury protection insurance, and uninsured motorist insurance. These three coverages will protect you in the following ways.

- Liability insurance: Pays for any damage and medical bills for the other driver if you're in an accident where you're at fault. There are two types of liability coverage, bodily injury and property damage. Bodily injury pays for claims and lawsuits by anyone who is injured in an accident where you're at fault. Property damage pays for claims and lawsuits by people whose property was damaged in an accident you caused, such as a fence or mailbox.

- Personal injury protection (PIP): Pays for any injuries or medical bills if you or other people inside your vehicle are injured in an accident whether or not you're at fault.

- Uninsured motorist coverage: If you're in an accident with someone who does not have proper insurance coverage, uninsured motorist coverage will pay for the cost of the damage to your vehicle.

In addition to these mandatory coverages, you can also purchase car insurance policies that add additional protection. The most common are collision and comprehensive insurance and they cover different things.

- Collision insurance: Pays for any damage that is done to your vehicle in the event of a collision with another vehicle or an object.

- Comprehensive insurance: Known as "other than collision," this will pay for the damage done to your vehicle in the event of theft, vandalism, flooding, fire, or colliding with an animal.

- Underinsured motorist coverage: Slightly different from uninsured motorist coverage, underinsured provides coverage if you're in an accident with someone who does not have sufficient insurance to pay for the damage to your vehicle or property.

Even though they're not required, most insurance experts, including insurance expert Paul Martin, recommend purchasing collision coverage, as most accidents are the result of a collision. Your independent insurance agent can help you understand what's included in each package and determine what will work best for you.

A reported 14.9% of drivers in New Jersey are uninsured. This is 1.9% higher than the national average of 13%.

Q: What Isn't Covered in New Jersey Car Insurance?

Car insurance is designed to cover a variety of different scenarios and perils, but there are exclusions that you will want to be aware of. According to insurance expert Paul Martin, the following are the most common exclusions you can expect to find in your standard car insurance policy.

- Routine maintenance: Any general repairs or routine maintenance are your financial responsibility and will not be covered by car insurance.

- Ridesharing vehicles: If you use your vehicle to drive for rideshare companies like Lyft or Uber, you'll need to purchase rideshare insurance, which is a special form of auto coverage. Many rideshare companies offer the coverage themselves, but it may also be purchased separately.

- Business use: Once you start using your vehicle for business reasons. you need to step into commercial auto coverage. Your personal policy will not cover an accident if the reason you're driving is for business purposes.

- Personal belongings: If you leave your laptop in your vehicle and it's stolen, your car insurance will not pay to replace your stolen property. Personal property is typically covered under a New Jersey homeowners insurance or renters insurance policy.

Your New Jersey independent insurance agent can fill you in on other coverage exclusions under standard car insurance policies.

Q: How Much Does Car Insurance Cost in New Jersey?

The average New Jersey driver will pay $1,595 annually for car insurance. However, this number can increase or decrease based on a variety of factors that insurance companies use when calculating premium costs.

- Driver age

- Vehicle make and model

- Driver accident and claim history

- Driver credit history

- Number of miles driven each year

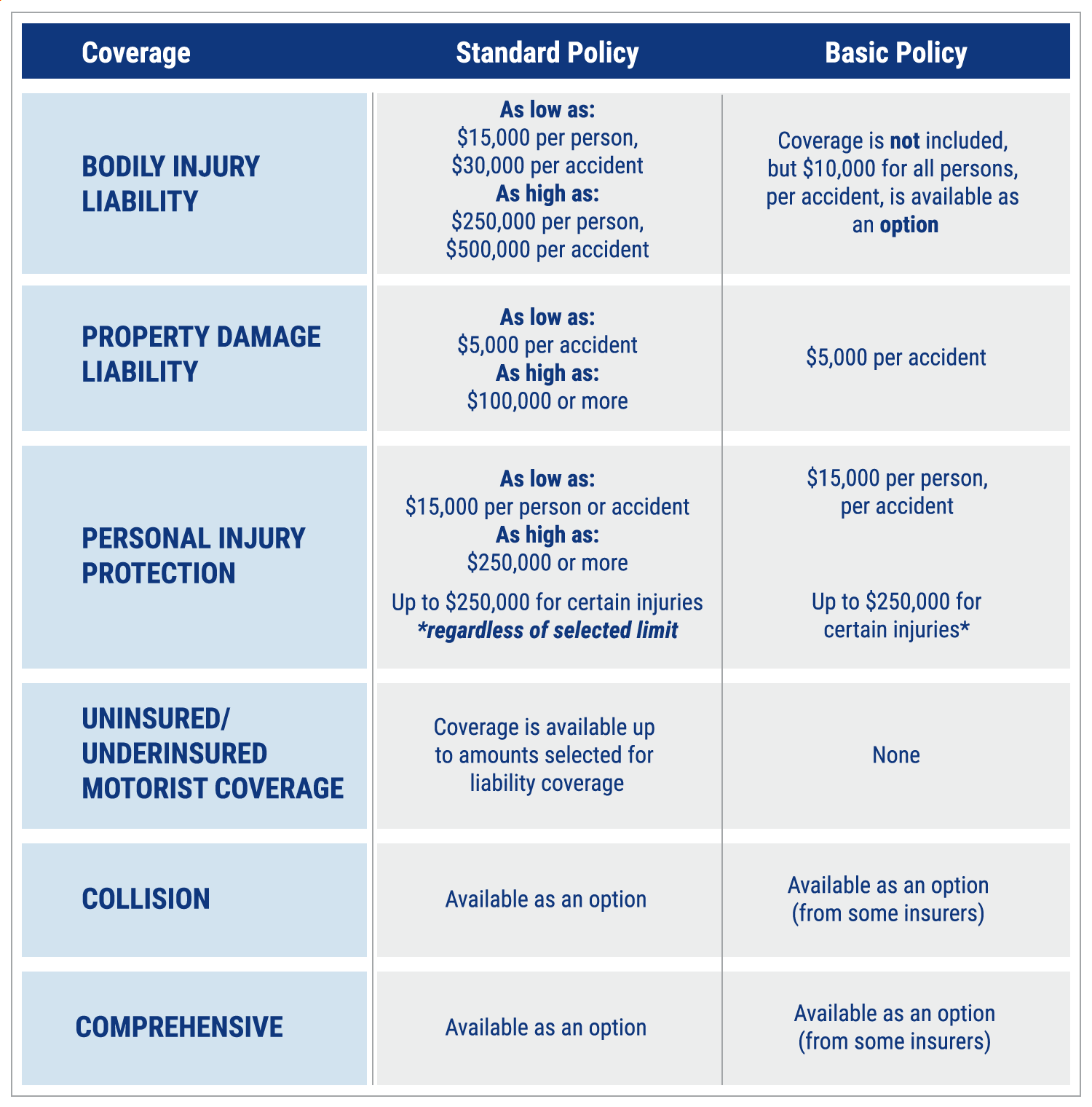

If you have multiple accidents or citations on your driving record, you can expect to pay a higher premium than a driver who has a clean driving record. New Jersey also offers two types of insurance coverages, a standard policy and a basic policy. The basic policy is much more affordable than a standard policy, but will not include as comprehensive of coverage as a standard policy would.

New Jersey standard vs. basic policy comparison

*for permanent or significant brain injury, spinal cord injury or disfigurement, or for medically necessary treatment of other permanent or significant injuries rendered at a trauma center or acute care hospital immediately following an accident and until the patient is stable, no longer requires critical care, and can be transferred to another facility in the judgment of the physician.

Q: What Are the Legal Requirements for Car Insurance in New Jersey?

Every driver in New Jersey is required to have liability, PIP, and uninsured motorist coverage. However, alongside these mandatory coverages comes a required amount of coverage for each policy depending on whether you're purchasing the standard policy or the basic policy.

For the standard policy, the minimum amount of insurance a driver must purchase is $15,000/$30,000/$5,000. This means that in the event of a covered incident, your bodily injury limits are $15,000 per person, with a total maximum of $30,000 per incident. It also covers up to $5,000 in damage coverage to another person's property.

If you opt for the basic policy, it does not include bodily injury protection, but you can choose to purchase $10,000 in coverage for all persons, per accident. You'll receive $5,000 in property damage coverage and $15,000 per person per accident in personal injury protection.

Q: Does New Jersey Car Insurance Cover Damage Caused by a DUI?

Most car insurance policies are designed to cover any accident caused by the driver as a result of negligent driving. However, it is possible for an insurance company to claim that someone driving under the influence was doing so intentionally, and that would be a reason for the insurance company to deny a claim related to DUI. This includes any injuries sustained by you or your driver as well as your own losses.

It's likely that your insurance will greatly increase or your company will drop you as a policyholder after an incident like a DUI. Your New Jersey independent insurance agent can help you understand the repercussions of driving under the influence and what it would mean for your insurance coverage.

Q: Am I Covered If I'm Hit by a Hit and Run Driver in New Jersey?

If you're driving and you get rear-ended and the driver takes off, who pays for the damage to your vehicle? Incidents like this are why insurance expert Paul Martin believes that drivers should purchase collision insurance. According to Paul, "If you have a collision insurance policy, then a hit and run is covered because collision covers any collision you experience, whether you're at fault or not. Without collision coverage, you'll be paying for that damage yourself."

If you do not have collision insurance, it's less likely that your insurance company will cover the damage, but you can still try to file a claim.

Q: Here’s How a New Jersey Independent Insurance Agent Can Help

When it comes to protecting drivers against accidents, theft, and all other perils, no one’s better equipped to help than an independent insurance agent. New Jersey independent insurance agents search through multiple carriers to find providers who specialize in auto insurance, deliver quotes from a number of different sources, and help you walk through them all to find the best blend of coverage and cost.

Article Reviewed by | Paul Martin

https://www.state.nj.us/mvc/vehicles/insurancerequirements.htm

Iii.org

https://www.nj.gov/dobi/division_consumers/pdf/autoguide02.pdf

Source: https://www.nj.gov/dobi/division_consumers/pdf/autoguide02.pdf

© 2024, Consumer Agent Portal, LLC. All rights reserved.