There’s no question about it. People love shoes, and shoppers in New Jersey are no exception. With the shoe store industry generating $35 billion in revenue annually, clearly the market is huge. Though shoe stores face many typical risks associated with most businesses, they also come with their own unique set of perils. It’s important to be familiar with all aspects of shoe store insurance in New Jersey so you can equip your business with the right kind of coverage.

What Does Shoe Store Insurance Cover in New Jersey?

Shoe store insurance is essentially a special type of business insurance customized to protect owners of shoe stores in New Jersey, similar to how it would anywhere else in the country. The agreement between the insurance company and the shoe store states that the insurer will cover financial losses that befall the shoe store and/or its owner. Of course, only specific perils stated in the policy will be covered by the insurance company.

How to Insure a Shoe Store in New Jersey

The thing about shoe store insurance coverage is that one policy won’t work for every type of shoe store or each specific business owner. With the help of your New Jersey independent insurance agent, you’ll work together to assemble a package of different coverages to protect you and your business against risks unique to you. Shoe store insurance is designed to keep your business afloat following a huge disaster such as property destruction or lawsuits.

Your independent insurance agent will help identify the right types of coverage for you as they learn more about your specific shoe store and its operations. Since shoe store insurance is so customizable, you’ll be able to work together to build a policy that fits not only your business’s needs but also the needs of your bank account.

What Does Shoe Store Insurance Cover in New Jersey?

Shoe store insurance is set up to protect business owners against potential threats. This includes shoe stores in New Jersey. Your policy will include the basics of business insurance coverage with several specific coverages tailored to your unique business added on. The more risks involved in your business, the more coverage you’ll need. But here are a handful of commonly selected coverages in shoe store insurance packages to start off.

Your shoe store insurance package can be assembled from a combination of the following coverages available in New Jersey:

- General liability: This coverage protects you against property damage or injury claims made by a third party.

- Workers’ compensation: If your employees become ill, get injured, or die from a work-related incident, this aspect of shoe store insurance will cover the financial ramifications. This coverage is mandatory in New Jersey.

- Property Insurance: Covers loss of or damage to your physical property, including your storefront and often the inventory inside it. Protected mishaps include fires, storms, and more.

- Commercial/business auto: Provides protection for any company vehicles against things like theft, vandalism, and damage from natural disasters. If your shoe store makes home deliveries, for example, you need this coverage.

- Business income: A part of property insurance, this shoe store insurance aspect covers the financial loss suffered while the business is closed due to fire damage or other disasters.

- Signage coverage: A shoe store’s signage is often expensive to either install or replace. Since signs live outside of the store’s building, they’re constantly vulnerable to the elements of nature and thieves/vandals. This coverage provides reimbursement in the event you need to repair/replace your shoe store’s signage due to a covered peril.

- Disability insurance: Businesses in New Jersey are required by law to purchase this coverage for their employees to protect them in the event they become disabled due to workplace conditions or operations.

- Unemployment insurance: If your shoe store has any employees (which it most likely does), as soon as you, the owner, start officially paying state taxes, your business will automatically be buying mandatory New Jersey unemployment insurance.

- Product liability: If your shoe store sells a product that ends up causing injury, illness, or property damage to your customers, you could get slapped with a lawsuit. This coverage protects you against the legal ramifications of offering faulty products or services.

- Cyber liability: In the event your shoe store’s computer system is compromised, sensitive or personal data may be stolen and even sold to third parties. This can include things like credit card numbers or personal employee records. Aside from having to pay to clean up your network’s security, your shoe store could also face a lawsuit. Coverage protects against financial and legal ramifications following a cyberattack.

Your shoe store insurance package will be assembled by selecting the coverages that work for your unique business from a big list of available options in New Jersey. Coverage applies to everything from lost business revenue to potential legal/court fees and beyond.

What Does Shoe Store Insurance Not Cover in New Jersey?

Though shoe store insurance covers a lot of components necessary for business owners in New Jersey, it doesn’t cover just anything. The following are examples of commonly excluded perils under shoe store insurance policies in New Jersey:

- Employee dishonesty

- General wear and tear of equipment, etc.

- Routine maintenance fees

- Earthquake damage

- Nuclear reaction and war

- Power failure (unless it causes damage to computer systems)

- Robbery

- Pollution

- Temperature/humidity changes

- Inexplicably lost inventory

- Flood damage*

*In a state like New Jersey that’s prone to flooding, you’ll most likely want to purchase additional flood coverage for your shoe store, or you may even be required to have it by your mortgage lender. Your New Jersey independent insurance agent can give you more information about finding coverage to add to your shoe store insurance package.

What Are the Benefits of Shoe Store Insurance in New Jersey?

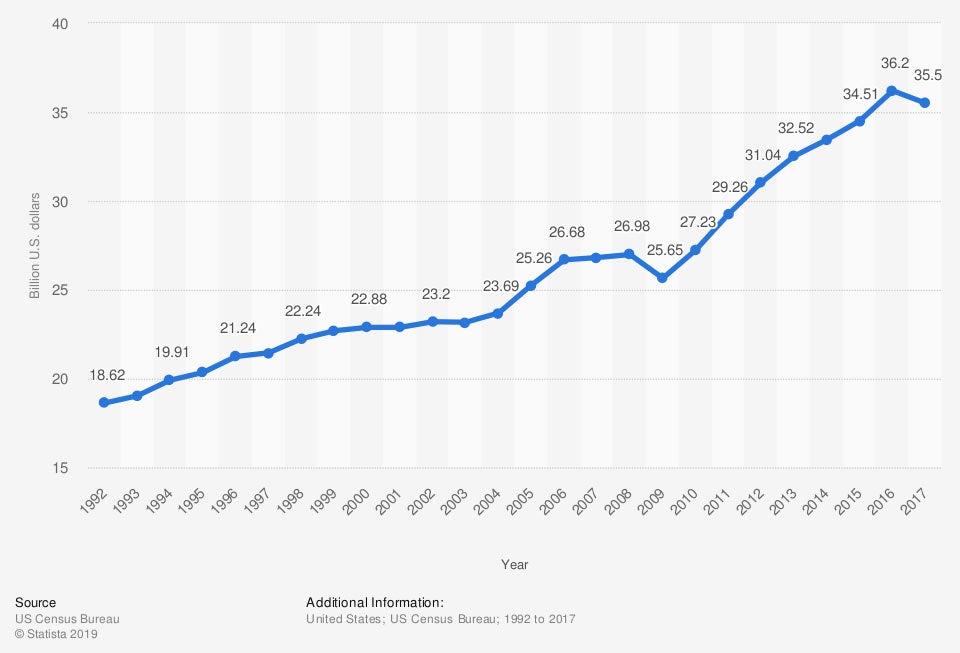

Shoe store sales in the United States from 1992 to 2017 (in billion US dollars)

Shoe store sales have nearly doubled since 1992. Just under three decades ago, shoe store sales totaled 18.62 billion annually. In 2017, annual revenue had shot up to 35.5 billion. With such a profitable market, it’s all the more important to have the right coverage for your business.

Shoe store insurance provides protection to New Jersey business owners in a number of ways. Beyond the store’s physical assets and building, many components of your business stand to be destroyed or otherwise harmed by common threats. There are three major benefits to having shoe store insurance in New Jersey:

- Protection against legal trouble: A costly and damaging event like a fire could send a business into the red without the proper coverage. If the business became unable to pay off their loans, vendors, or employees, they could face serious legal consequences in New Jersey. Shoe store insurance helps prevent these ugly matters from surfacing.

- Protection against a damaged reputation: Often times, huge incidents affecting shoe stores and other businesses end up in the media. When it comes to customers’ personal property getting lost, damaged or destroyed, word about their upset could spread quickly and even turn from gossip into media coverage. Having the right shoe store insurance can help prevent your business’s reputation from going up in flames.

- Protection against bankruptcy: Imagine a severe storm or other terrible incident like an airplane crash that literally wipes out your business’s entire storefront. Without the right insurance, a business owner could easily be forced into bankruptcy in New Jersey. Shoe store insurance helps businesses stay open, stay afloat, or rebuild following massive destruction.

Your New Jersey independent insurance agent can help you review your shoe store insurance policy to answer any remaining questions about your coverage. They’ll also be able to help you figure out whether you’ve got enough coverage or if you should purchase more.

How Much Does Shoe Store Insurance Cost in New Jersey?

Really, it depends on a number of factors. Shoe store owners might pay somewhere in the low thousands annually if they run a small, stand-alone shoe store that faces relatively few risks, while giant shoe store chain owners might pay up into the ten thousands or even much more per year.

Shoe stores located in New Jersey, however, might pay quite a bit more for shoe store insurance coverage than business owners further inland due to the state’s increased risk of weather-related perils. Businesses in New Jersey, including shoe stores, face a higher threat of flood or hurricane damage than in many other states.

Of course, it’s hard to offer an average figure since each shoe store is unique. But really, it all depends on a number of factors, like:

- The type of shoe store: This involves more than just whether the shoe store sells discounted/used shoes or designer/high-end shoes. The kind of equipment your shoe store uses and the specific operations taking place will affect its risk level to insure. Obviously, more danger means more money for shoe store insurance.

- The location of the shoe store: Larger cities tend to have higher costs for shoe store insurance, but it goes beyond that. Depending on where you are specifically in New Jersey, your location may be more prone to various weather-related risks. Shoe stores right along the Jersey Shore, for example, may have premiums up to 20% higher due to risk of hurricane damage.

- The number of employees: The more you've got, the more workers' comp you’ll need. Simple as that.

- How much business you generate: Premiums are calculated based on business projections for the upcoming year. If your workload doubles, most likely your premium will too.

Your agent can work with you to find a shoe store insurance policy that fits within your shoe store’s budget. Have your financial restrictions in mind before you start shopping for coverage to help speed the process along.

Why Work with a New Jersey Independent Insurance Agent?

In order to get the protection you need and deserve, you’ll want to work with a trusted expert. And who could be better for the job than a local agent who shares your area code? Independent insurance agents act as your own personal insurance shoppers, offering you tons more options than one-policy companies. With just one call, they’ll hook you up with multiple quotes.

New Jersey independent insurance agents are armed with knowledge on what coverage is needed in your area, and they’ll get you set up with just enough of it — not too little, not too much. They’ll handle all the heavy lifting so you can rest assured you’ll be set up with the right coverage at the right price.

They’re not just there at the beginning, either. If disaster strikes, your New Jersey agent will be there to help walk you through the claims process and make sure you’re getting the benefits you're entitled to. Now that’s thinking ahead.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

Statista

iii.org

nj.com