When you work for yourself, you’ve got to take on a few more responsibilities than if you had a traditional employer. However, being self-employed also comes with many freedoms, including the ability to choose your own coverage. It’s important to start off with the right self-employed insurance.

Luckily a New Jersey independent insurance agent can help you get set up with all the self-employed insurance you need. They’ll also get you equipped with coverage before you ever need to use it. But first, here’s a deep dive into this critical coverage.

What Is Self-Employed Insurance?

Self-employed insurance often refers to the health insurance needed by individuals who work for themselves. According to insurance expert Jeffery Green, if you’re self-employed, you can deduct your entire health insurance premium from your taxable income. A New Jersey independent insurance agent can help you find the coverage that works best for you.

What Does Self-Employed Insurance Cover in New Jersey?

What your self-employed insurance covers will depend on the type of coverage you purchase. Health insurance plans come with many different coverage options, limits, deductibles, and more. Working together with a New Jersey independent insurance agent is the best way to get the right coverage for you.

Self-employed insurance in New Jersey often covers the following:

- Health check-ups

- Various medical bills

- Certain hospital costs

- Various medical procedures

Your New Jersey independent insurance agent will work together with you to review all your self-employed coverage options, and find the one that’s right for you.

What’s Not Covered by Self-Employed Insurance in New Jersey?

Green said that the exclusions in your self-employed insurance will depend entirely on your specific policy. Health insurance plans vary so widely, it’s hard to provide a common list of exclusions. However, coverage exclusions may be certain types of ailments, or preexisting conditions, for example.

A New Jersey independent insurance agent can help you find a self-employed health insurance policy that has the fewest exclusions possible. They’ll make sure you walk away with a policy that fits your needs.

Self-Employed Stats for New Jersey

Wondering which industries have the highest rates of self-employed workers? Here are some stats for self-employed individuals in the US overall.

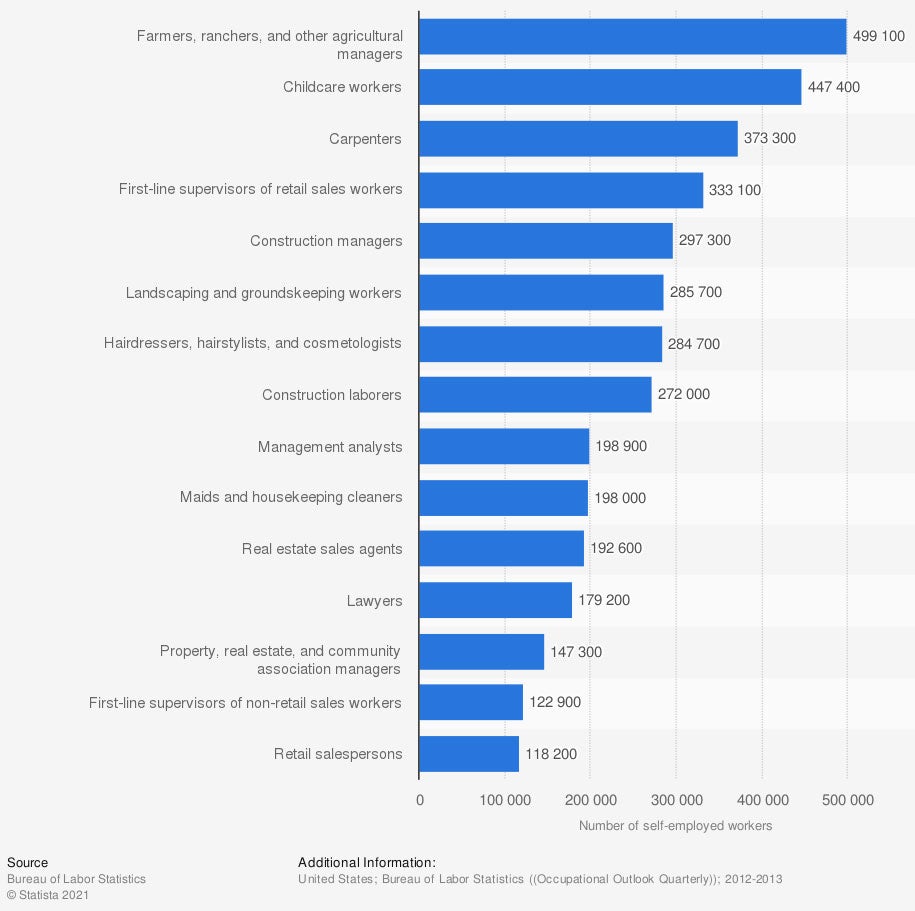

Projection of the occupations with the most self-employed workers in the US

Projections indicate that next year, farmers, ranchers, and other agricultural workers will make up the great majority of the self-employed market, with 499,100 employees total. Second will be childcare workers, followed by carpenters in third place.

With so many industries containing hundreds of thousands of self-employed workers, self-employed insurance is truly critical coverage.

Self-Employed Health Insurance Cost in New Jersey

It’s difficult to predict the cost of your self-employed health insurance, since policies vary so widely. However, the cost of your policy will be determined by considering these factors as they apply to you:

- Age

- Current health status

- Occupation and job risks

- Specific location

- Lifestyle choices

- Any dangerous hobbies

That said, a common range of self-employed health insurance premiums is between $200 to $500 monthly. A New Jersey independent insurance agent can help you find exact quotes for self-employed health insurance in your area.

Do Self-Employed Workers Need Workers’ Compensation in New Jersey?

Green said that certain occupations in New Jersey do require workers’ comp coverage. Contractors might be required to have workers’ comp before they can sign a customer contract.

Health insurance sometimes excludes work-related injuries, which makes workers’ comp coverage important, even for self-employed folks. You also might want workers’ comp coverage if you’re on your spouse’s health insurance plan and are self-employed, yourself.

Disability Insurance for Being Self-Employed

Self-employed disability insurance will vary depending on your occupation. Lawyers will have different self-employed disability insurance from contractors. A lot of documentation is often required when signing up for self-employed disability insurance, too.

Green said that many self-employed disability insurance companies will ask for tax returns and proof of self-employment for at least the past couple of years. Your New Jersey independent insurance agent can help you gather all the necessary documents before shopping for self-employed disability insurance.

Here’s How a New Jersey Independent Insurance Agent Can Help

When it comes to protecting self-employed workers against healthcare costs and other financial stresses, no one’s better equipped to help than an independent insurance agent. New Jersey independent insurance agents search through multiple carriers to find providers who specialize in every type of self-employed health insurance, deliver quotes from a number of different sources, and help you walk through them all to find the best blend of coverage and cost.

*** Independent insurance agents are fully equipped to protect self-employed workers against commonly faced liabilities. New Jersey independent insurance agents shop multiple carriers to find providers who specialize in self-employed health insurance.

They can deliver quotes from a number of different sources and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Jeffery Green

stats - https://www.statista.com/statistics/207331/forecast-of-the-number-of-self-employed-us-workers-by-occupation/

https://www.iii.org/article/can-i-deduct-my-health-insurance-premiums-my-income-tax-return

https://www.irmi.com/articles/expert-commentary/the-workers-compensation-self-insurance-decision

© 2024, Consumer Agent Portal, LLC. All rights reserved.