When you’re responsible for storing and repairing vehicles that belong to others, it’s crucial to make sure you’re equipped with the proper protection. Whether or not you’re actually responsible for damage that happens to a customer’s car, you could still be held liable. That’s why garage keepers insurance is so important.

Fortunately a New Jersey independent insurance agent can help you find the right garage keepers insurance for your business. They’ll get you equipped with all the protection you need long before you need to use it, too. But before we jump that far ahead, here’s a deep dive into this crucial coverage.

What Is Garage Keepers Insurance?

Garage keepers insurance is basically a form of New Jersey business insurance that’s set up to protect auto repair shops and other garages. Vehicles that are in the custody or care of a garage are vulnerable to accidental damage, theft, and more. These incidents may even happen while the shop is closed. That’s why it’s so important to talk to a New Jersey independent insurance agent about getting the right garage keepers insurance.

Is Garage Keepers Insurance Different from Garage Liability Insurance?

Actually yes, garage keepers insurance is different from garage liability insurance, and it’s important to know how the coverages differ. Here’s a simple breakdown:

- Garage liability insurance is designed to protect garages from third-party lawsuits for claims of personal property damage or bodily injury caused by the business. It also covers damage caused by the products sold by an auto shop.

- Garage keepers insurance is designed to protect garages from damage that may happen to a customer’s vehicle while it’s in the business’s care. Garage keepers insurance is a more comprehensive policy than garage liability insurance.

A New Jersey independent insurance agent can further advise you on which form of coverage makes the most sense for your garage.

What Doesn’t Garage Liability Insurance Cover?

Garage liability insurance has its own set of exclusions, just like any other coverage. According to insurance expert Jeffery Green, garage liability insurance doesn’t cover weather damage to a vehicle or incidents of theft when the garage isn’t legally responsible for the disaster. If a vehicle was properly locked and stored by the auto shop when a disaster occurred, it may not be considered the business’s responsibility, so it would not be covered under garage liability.

Garage Keepers Stats for New Jersey

Knowing the importance of coverage in your industry is helpful when shopping for coverage. Check out some auto repair shop and garage stats for the US below.

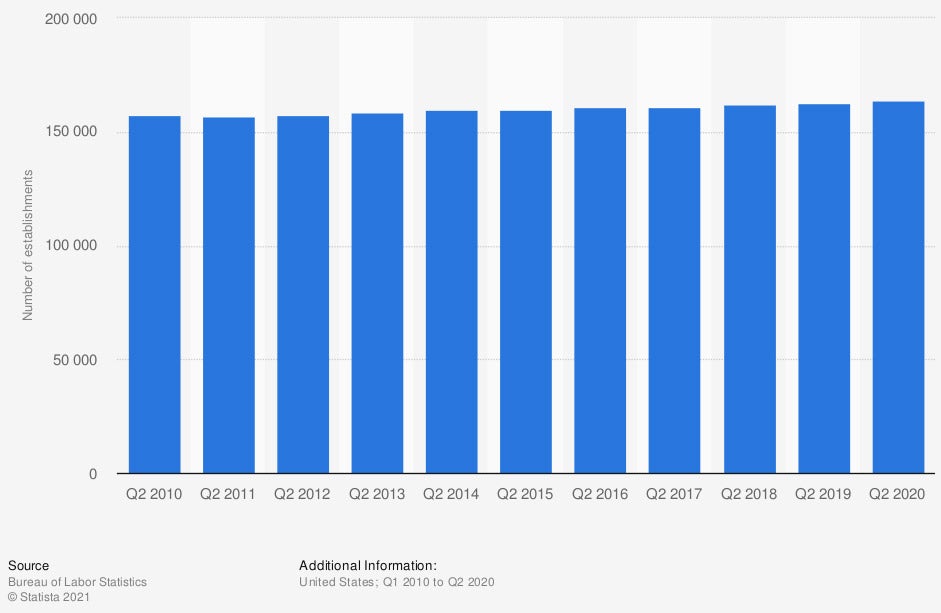

Number of auto repair and maintenance establishments in the US from 2nd quarter 2010 to 2020

Though the number of auto repair and maintenance shops remained quite consistent over the past decade, it did continue to increase over the years. By 2020, the number of auto repair shops had grown to 164,090 total for the US, up from 157,529 businesses in 2010.

Top services performed at auto repair shops by spending

Customers were found to most commonly pay auto repair shops to replace parts of their vehicles following a crash, followed by paying for repair services for paint jobs. Having adequate garage keepers insurance is crucial to protecting your shop’s reputation, whether you’re performing the jobs on this list or not.

Calculating Garage Keepers Insurance Limits in New Jersey

To choose the limits on your garage keepers insurance that work best for your business, enlist the help of a New Jersey independent insurance agent. Together, you’ll assess the average value of any customer vehicles in your garage’s care at a given time and how many vehicles would be your responsibility at once. So, if your shop commonly has 10 vehicles in its care valued at $30,000 each, you’d want a policy that offers $300,000 or more in coverage.

What Is Direct Primary Garage Keepers Insurance?

Green explained that direct primary garage keepers insurance covers a garage for incidents to customer vehicles in their care no matter if the business is liable or not. So, disasters like theft or collisions or even storm damage would be covered even if the shop was not actually liable for them — as long as the vehicles were properly secured on the premises. This coverage essentially fills in gaps that would be left by a garage liability insurance policy.

Here’s How a New Jersey Independent Insurance Agent Can Help

When it comes to protecting auto repair shops and garages against liability risks to customer vehicles and all other disasters, no one’s better equipped to help than an independent insurance agent. New Jersey independent insurance agents search through multiple carriers to find providers who specialize in garage keepers insurance, deliver quotes from several sources, and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Jeffery Green

https://www.irmi.com/term/insurance-definitions/garagekeepers-coverage

chart - https://www.statista.com/statistics/436416/number-of-auto-repair-and-maintenance-shops-in-us/

stats - https://brandongaille.com/29-auto-repair-industry-statistics-and-trends/

© 2024, Consumer Agent Portal, LLC. All rights reserved.