No matter how much you try to protect your car, you never know when an unexpected catastrophe can occur despite your hard work. Sometimes even the trees on your neighbor's property can damage or destroy your car. So what happens if your neighbor's tree falls on your car? Who pays?

Though a New Jersey independent insurance agent can help protect you with the right car insurance, we can start by helping to answer this question. So here's a closer look at who'd be responsible for covering the damage if a neighbor's tree fell on your car.

Who’s Responsible If a Neighbor’s Tree Falls on My Car?

It really depends on why the tree fell on your car in the first place. If the tree fell due to a hurricane or other act of nature, you couldn't really hold your neighbor responsible for it. But your car insurance should cover the damage if you purchased the correct type of coverage.

Now, if your neighbor's tree fell on your car due to their own negligence, they could be held responsible. So if they had a dead or decaying tree sitting on their property for years and it fell, it would be their fault. Then your neighbor would have to reimburse you through their property damage liability under their homeowners insurance.

What If the Neighbor Was Trimming a Branch from the Tree and It Fell on My Car?

If your neighbor was trimming their tree when a branch fell on your car, it may be more likely to put the responsibility on them. You would then go to your neighbor and ask them to file a claim against their homeowners insurance. Their policy's property damage liability coverage would respond and reimburse you for the damage to your car.

Will My New Jersey Car Insurance Fully Cover the Damage to My Car?

It's a good idea to equip your car with comprehensive coverage to be more certain of protection from a falling tree limb. You'd have to first pay your car insurance's deductible amount out of pocket before you got reimbursed for repairs, though.

So if it was just minor damage done to your car, it might not be worth it to file a claim at all. Your neighbor might also be willing to just pay you out of their own pocket to cover the damage, so they wouldn't have to file a claim either. They also might want to avoid having to pay their deductible amount out of pocket, which is necessary on a per-claims basis.

What Does Car Insurance Cover in New Jersey?

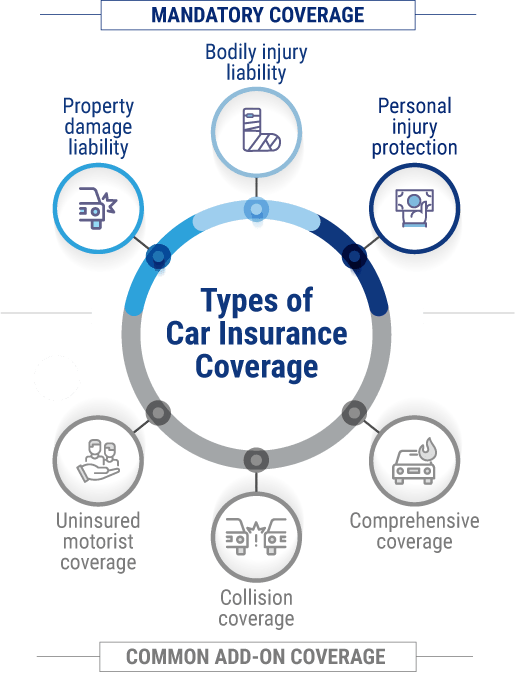

Car insurance requirements vary by state. In New Jersey, the following coverages are mandatory for all drivers to carry:

- Bodily injury liability: Protects you from medical costs relating to injuries to other drivers and their passengers if you get into an accident.

- Property damage liability: Protects you from repair costs for property damage to others done with your vehicle, such as to fences or buildings.

- Personal injury protection: Protects you from medical payments for your own injuries and your passengers' injuries after an accident.

Some common add-on car insurance coverages in New Jersey include:

- Comprehensive coverage: This covers the cost to repair or replace your vehicle if it gets damaged or totaled by a non-collision event such as a hailstorm or theft.

- Collision coverage: This covers the cost to repair or replace your vehicle if it gets damaged or totaled in a collision, regardless of fault.

- Uninsured motorist coverage: This coverage protects you if you get into an accident with a driver who doesn't carry any or adequate car insurance of their own to reimburse you properly.

Work with a New Jersey independent insurance agent to get equipped with all the car insurance coverage you need to be safe on and off the road.

What Doesn't Car Insurance Cover in New Jersey?

Your New Jersey car insurance protects you from many potential catastrophes, but it still excludes coverage for:

- Routine maintenance costs: Your car insurance company won't cover maintenance costs for your vehicle, which are considered your responsibility.

- Business use: Your car insurance is designed to protect a personal vehicle. You'd need a commercial auto insurance policy to protect a car used for business purposes.

- Personal belongings: Your car insurance won't cover the personal property you store in your car against theft and other disasters, but a home insurance policy often will.

- Ridesharing vehicles: Your car insurance won't cover your vehicle fully if you use it to transport paying passengers, such as for Uber or Lyft. You'd need a ridesharing insurance policy for that.

If you're concerned about your car insurance's exclusions, talk to your New Jersey independent insurance agent about potentially adding more policies to fully cover you.

What If My Car Doesn’t Have Comprehensive Coverage, Can My Home Insurance Cover It?

You wouldn't be likely to file a claim for your car's damage through your home insurance, especially if your neighbor could easily be found responsible for the incident. But insurance expert Paul Martin said that your car would probably still be covered in this case by your car insurance's property damage section, even if you didn't have comprehensive coverage. Having comprehensive coverage is important either way, though, to protect your vehicle against many threats, including theft, windshield breakage, and more.

Comprehensive Car Insurance Stats

If you're not yet convinced about the importance of having comprehensive car insurance, check out the following stats and you might just change your mind.

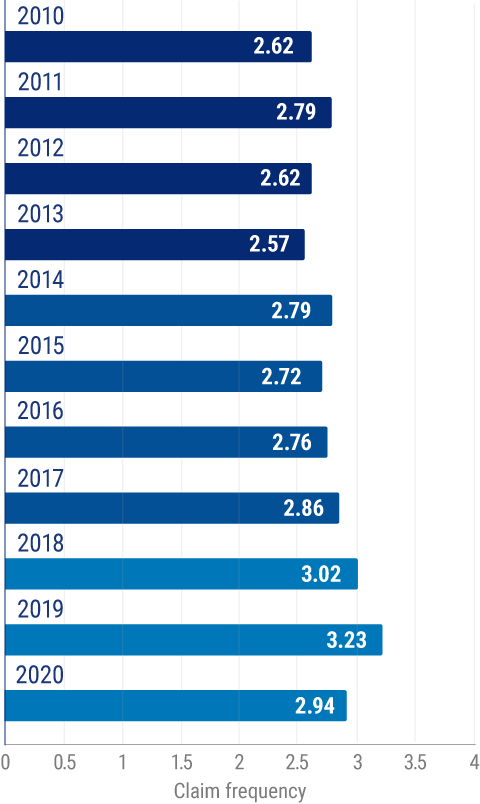

Frequency of private passenger comprehensive auto insurance claims for physical damage in the US

At the beginning of the observed period, the frequency of comprehensive auto insurance claims was 2.62 per 100 car years. Last year, this number had increased to 2.94 claims per 100 car years. While the frequency of comprehensive car insurance claims has fluctuated a bit over the past couple of decades, it has consistently remained above 2.5 claims per 100 car years annually.

Without comprehensive auto insurance, these drivers would have had to pay to cover damage out of their own pockets. To ensure that your ride is as protected as possible, speak with your New Jersey independent insurance agent about the importance of comprehensive auto insurance.

Why Choose a New Jersey Independent Insurance Agent?

New Jersey independent insurance agents simplify the process by shopping and comparing insurance quotes for you. Not only that, but they’ll also cut the jargon and clarify the fine print so you know exactly what you’re getting.

New Jersey independent insurance agents also have access to multiple insurance companies, ultimately finding you the best car insurance coverage, accessibility, and competitive pricing while working for you.

Author | Chris Lacagnina

https://www.caranddriver.com/car-insurance/a36465592/new-jersey-car-insurance-laws/

https://www.statista.com/statistics/830114/comprehensive-car-claim-frequency-physical-damage-usa/

https://www.iii.org/fact-statistic/facts-statistics-auto-insurance

© 2025, Consumer Agent Portal, LLC. All rights reserved.