Home and car owners can take every effort to protect their property, but sometimes it still ends up damaged through no fault of their own. So what happens if a neighbor mows their lawn and kicks up a rock that shatters your windshield? Who's responsible and who pays?

While a New Jersey independent insurance agent can help you get protected by the right home insurance and car insurance, we can get started by answering this question first. Here's a closer look at who'd be responsible for the damage to your windshield in this unique situation.

Who’s Responsible If My Neighbor’s Lawnmower Kicks Up a Rock That Shatters My Windshield?

Your neighbor's insurance would technically be responsible for covering the damage. Your neighbor could either file a claim through their homeowners insurance to reimburse you through the "property damage to others" coverage section, or they could write you a check from their own bank account. In many cases, your neighbor may actually take the latter option to avoid having a claim on their insurance history.

Am I Responsible for Covering Any Damage Caused by My Neighbor?

Your neighbor would be responsible for covering the damage 100%. They'd either reimburse you with their own money or with a payout from their homeowners insurance. You could approach your neighbor after the incident and ask them to file a liability claim through their policy to pay you back.

Another option, however, is to file a claim through your own car insurance policy. But you'd have to have comprehensive coverage to protect against windshield breakage and disasters other than collision. If you filed a claim through your car insurance, you'd have to pay the deductible amount yourself before you got reimbursed for any damage.

What Does Car Insurance Cover in New Jersey?

Drivers in New Jersey are required by law to insure their vehicles with liability coverage, personal injury protection, and uninsured motorist coverage. Standard car insurance policies come with the following protections:

- Property damage liability: Reimburses the vehicle's owner for lawsuits arising from hitting someone else's property.

- Uninsured motorist coverage: Reimburses the vehicle's owner for accidents involving another driver who doesn't carry any or adequate car insurance of their own.

- Bodily injury liability: Reimburses the vehicle's owner for injuries to another driver and their passengers after an accident.

- Personal injury protection: Reimburses the vehicle's owner for their own injuries and their passengers' injuries after a car accident.

Other important, yet optional, add-on car insurance coverages in New Jersey include:

- Comprehensive coverage: This covers the cost to repair or replace your vehicle if it gets damaged or totaled by a non-collision event such as a hailstorm or theft.

- Collision coverage: This covers the cost to repair or replace your vehicle if it gets damaged or totaled in a collision, regardless of fault.

Make sure to work with a New Jersey independent insurance agent to get your vehicle equipped with every type of protection it needs.

What If I Don’t Have Comprehensive Coverage on My Vehicle?

In the scenario of your neighbor shattering your car's windshield due to their lawnmower kicking up a rock, it wouldn't really matter if you didn't have comprehensive car insurance. You'd start by asking your neighbor to file a claim through their home insurance, but if they preferred, they could just pay you themselves. Going through your personal car insurance is likely to be a last resort in this situation so you could avoid paying your deductible and having a claim on your history.

What If I Was Sitting in the Vehicle and Got Seriously Injured?

If you were sitting in the vehicle and got seriously injured by the rock your neighbor's lawnmower kicked up, they could still cover the incident with their homeowners insurance. Not only would their property damage to others coverage section pay for the replacement of your car's windshield, but their liability coverage would also pay for bodily injury and required medical treatment for their neighbor. Your neighbor would have to pay their policy's deductible before reimbursement would begin, but they'd be covered up to their limits in each category.

Comprehensive Car Insurance Stats

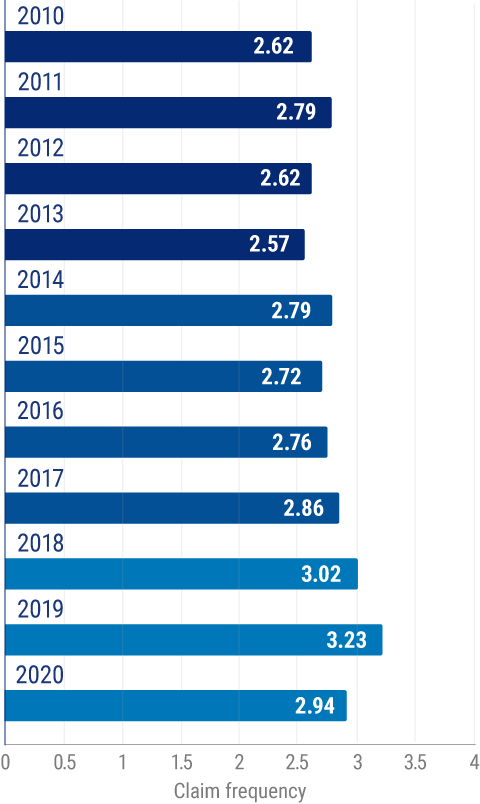

Comprehensive car insurance claims are frequent across the US as a whole, and they're actually getting more common as the years go by. If you need further proof, just check out the chart below.

Frequency of private passenger comprehensive auto insurance claims for physical damage in the US

At the turn of the last decade, there were an average of 2.62 comprehensive auto insurance claims filed per 100 car years. In one recent year, there were 2.94 comprehensive auto insurance claims filed per 100 car years. This number decreased a bit from the previous year (at 3.23 claims filed per 100 car years). The cause was probably the reduction in traffic due to the COVID-19 pandemic.

Since comprehensive auto insurance claims have become more frequent over time, it's more important than ever to talk to your New Jersey independent insurance agent about adding this coverage to your car insurance. Comprehensive coverage is critical to protect you from many threats to your vehicle other than collision, including breaks in your windshield after your neighbor kicked up a rock with their lawnmower.

Why Choose a New Jersey Independent Insurance Agent?

New Jersey independent insurance agents simplify the process by shopping and comparing insurance quotes for you. Not only that, but they’ll also cut the jargon and clarify the fine print so you know exactly what you’re getting.

New Jersey independent insurance agents also have access to multiple insurance companies, ultimately finding you the best car insurance coverage, accessibility, and competitive pricing while working for you.

Author | Chris Lacagnina

https://www.state.nj.us/mvc/vehicles/insurancerequirements.htm

https://www.statista.com/statistics/830114/comprehensive-car-claim-frequency-physical-damage-usa/

https://www.iii.org/fact-statistic/facts-statistics-auto-insurance

© 2025, Consumer Agent Portal, LLC. All rights reserved.