Sometimes the most unexpected home disasters are the most costly. Elements running beneath your home that you never even think about, like sewer lines, can cause a catastrophe. So who's responsible if your home's sewage line busts?

While a New Jersey independent insurance agent can help you get covered by the right homeowners insurance, we can start by answering this question. So here's a closer look at what would happen if your home's sewage line busted.

How Common Are Sewage Line Busts in New Jersey?

FACT: More than 850 sewage line breaks happen every day in the North America.

Though you may never see the sewage lines beneath your home, there are many reasons they can actually break and lead to a visible mess. Here are just a few of the most common.

7 common signs of sewer line problems

- Toilet and tub backups: One of the most common signs of a sewage line problem is a backup that occurs every time you flush your toilet or run your faucet.

- Wafting sewer odors: Smelling gas and other odors from the sewer is always a bad sign, since they're designed to be airtight when there are no cracks or breaks.

- Mold: Spotting mold in your home can also indicate a sewage line break in your walls.

- Slow draining sinks: A slow drain in a sink that happens on a regular basis can also point to a blockage or backup in your sewer line.

- Exceptionally healthy grass: If you notice certain spots on your lawn that appear more green or lush than others, it could indicate a sewage leak that's impacting that area.

- Foundation cracks: Sewage leaks that are left untreated for long enough can eventually cause visible, large cracks in your home's foundation.

- Rodent and insect problems: Noticing rats, roaches, or other pests can also be an indication that you're suffering from a sewage line break that allows these critters to enter your home.

Knowing some common signs of sewer line problems is critical to help you get to the problem and start repairs before things get really out of hand.

Who’s Responsible If My Home’s Sewage Line Busts?

Most likely you as the homeowner will be held responsible for any issues your sewage line causes. At the very least, you'd need to file a claim through your homeowners insurance to cover the cleanup and repairs. But it's important to keep in mind that your homeowners insurance usually won't cover this disaster unless you added a sewer line backup endorsement to your policy.

Is It Ever the City or State's Responsibility?

Sometimes breaks in your sewer line can actually be the city's responsibility. It depends on where specifically the break or crack is, though. The city is technically responsible for sewer lines past the point of the main sewage pipe.

The portion of the sewer line the city is responsible for transports waste and water to the treatment plant. This portion of the sewer line often lies beyond your home's property lines. So, if the break occurs past your property line, it's likely to be the city's responsibility.

How Much Does Sewage Line Repair or Replacement Cost?

The average cost to repair a sewage line is $2,556, but extensive repairs and replacements can range from $3,000 to $25,000. The cost depends on the damage done and how much of a repair is necessary. The cost per foot ranges from $50 to $250, which is why overall repairs and replacements are so expensive.

Repairs can take an average of one to three days, but they can range from a few hours to five days or more. Simple breaks can be fixed by inserting an inflatable tube covered with epoxy, while larger cracks or busts require the whole pipe to be replaced. You might not be able to live at home while repairs are going on, depending on the location of the break or other damage. If you do stay at home, you won't be able to run your water until repairs are complete.

How Much of the Damage Is My Responsibility?

It really depends on the type of homeowners insurance you have and the extent of the damage. Many standard home insurance policies cover sewer line busts caused by defective plumbing by paying for cleanup costs for the sewage, but maybe not for repairs to the plumbing itself.

To have protection from many kinds of sewer problems, it's critical to consider adding a sewer backup endorsement to your homeowners insurance. With an endorsement, your home insurance company would reimburse you for the cleanup of the mess and the repairs or replacement to the sewage line caused by many perils.

Will My Rates Be Affected Even Though I’m Not Responsible for the Bust?

In many cases, even filing a single claim against your homeowners insurance can result in premium hikes of at least 9%. However, the insurance company would consider the cause of the sewer line break, and might not punish you with more expensive coverage if it was outside of your control.

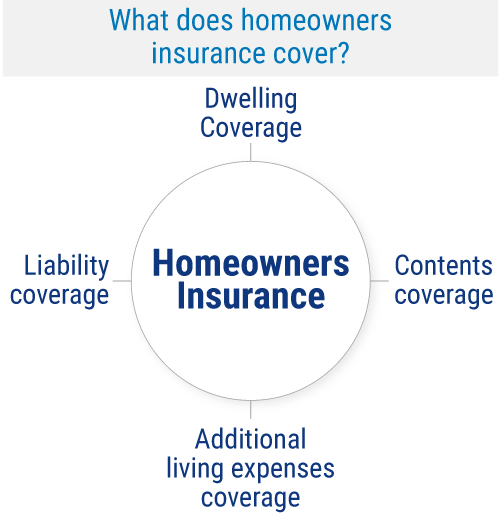

What Does Homeowners Insurance Cover in New Jersey?

Home insurance can protect you against many different disasters, not just messy sewer issues. Here are the standard coverages offered by home insurance in New Jersey.

- Additional living expenses: This coverage would reimburse you for the costs of living somewhere else while repairs were going on for a covered disaster. In the case of a busted sewage line, it could really come in handy.

- Liability protection: This coverage protects homeowners from lawsuits filed against them by third parties for claims of property damage or bodily injury.

- Dwelling coverage: This coverage protects the structure of your home against many threats like fire damage.

- Contents coverage: This coverage protects your home's contents, or your stuff, from many threats like theft, fire, etc.

A New Jersey independent insurance agent can help you get set up with all the home insurance you need.

Why Choose a New Jersey Independent Insurance Agent?

New Jersey independent insurance agents simplify the process by shopping and comparing insurance quotes for you. Not only that, but they’ll also cut the jargon and clarify the fine print so you know exactly what you’re getting.

New Jersey independent insurance agents also have access to multiple insurance companies, ultimately finding you the best home insurance coverage, accessibility, and competitive pricing while working for you.

Author | Chris Lacagnina

https://www.watermainbreakclock.com/

https://fletchbarney.com/how-much-does-it-cost-to-dig-up-and-replace-sewer-line/

https://pipelt.com/sewer-repair/10-symptoms-of-a-damaged-sewer-pipe/

https://homex.com/ask/how-long-does-it-take-to-fix-a-sewer-pipe

https://www.thisoldhouse.com/plumbing/21303078/sewer-line-repair

https://money.cnn.com/2014/10/19/real_estate/homeowners-insurance-claims/

© 2024, Consumer Agent Portal, LLC. All rights reserved.