Fault for car accidents might seem clear-cut in the case of hit and runs, but unfortunately this isn't always the case. Even if you can obviously point a finger at the other driver for causing a collision and fleeing the scene, you'll still be stuck with the damage to figure out on your own.

That's why it's so important to get set up with the right car insurance by a New Jersey independent insurance agent. But first, here's a breakdown of who's responsible if the other driver takes off after an accident in your state.

Who’s Responsible If I Get into a Car Accident in New Jersey and the Other Driver Takes Off?

In terms of who caused the accident, obviously anyone could pinpoint that it was the driver who struck your vehicle with theirs and then fled. But without anyone else on the scene, you’re left with the responsibility and need to file a claim through your own car insurance. Fortunately if you have the proper coverage, you should get reimbursed.

Since you probably don't want to start a high-speed chase after the guilty driver who took off, you'd instead file a claim through your New Jersey car insurance. You'd need uninsured/underinsured motorist coverage, specifically, to protect you in an incident like this one. A New Jersey independent insurance agent can get you covered, if you're not already.

Do I Need to Have Specific Coverage for Hit and Run Accidents?

Yes, uninsured/underinsured motorist is the specific type of car insurance that can protect you from hit and run accidents. Coverage works by reimbursing you for damage to your vehicle caused by another driver who didn't have any or enough insurance of their own to fully cover the costs. So even if a driver totaled your car and then sped off, never to be heard from again, with uninsured/underinsured motorist coverage, you could still recoup your losses, at least.

What Other Accident Coverages Does My Car Insurance Include?

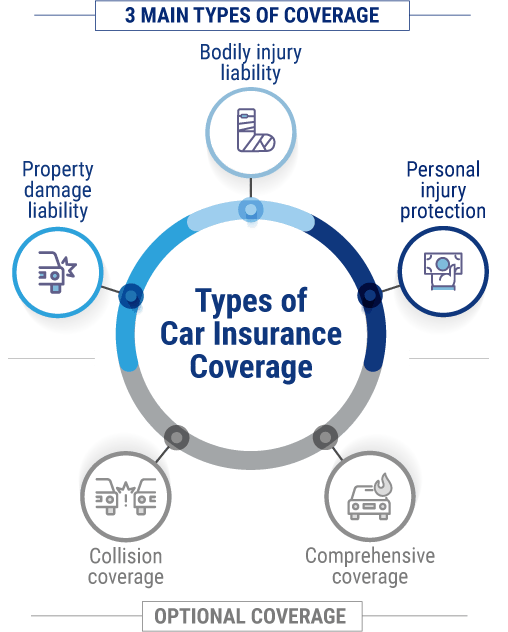

Complete car insurance policies include several types of coverage that all protect you in different ways. Some of these are:

- Roadside assistance: This coverage pays for towing and other roadside assistance services if you break down on the side of the road.

- Rental reimbursement: This coverage pays for rental cars necessary after a covered disaster happens to your vehicle, like a serious accident that leads to required repairs.

- Personal injury protection: This coverage pays for your own injuries or injuries to your passengers after an accident.

A New Jersey independent insurance agent can recommend even more coverages that can be important to add to a standard car insurance policy.

Will My Car Insurance Rates Be Affected Even after a Hit and Run?

Luckily your car insurance rates aren't likely to increase after a hit and run accident. The catch is, you're often required to report the accident to the police within 24 hours to avoid increased insurance rates. It's well worth the effort to go ahead and file a report, though, since a single car accident can otherwise lead to increases of up to 50%, which is huge.

Are Uninsured Drivers Common in New Jersey?

Fortunately for residents in New Jersey, uninsured drivers aren't common at all. Check out the chart below.

Top 10 Highest and Lowest States by Estimated Percentage of Uninsured Motorists

| Rank | Highest State | % uninsured | Rank | Lowest State | % uninsured |

|---|---|---|---|---|---|

| 1 | Mississippi | 29.4% | 1 | New Jersey | 3.1% |

| 2 | Michigan | 25.5% | 2 | Massachusetts | 3.5% |

| 3 | Tennessee | 23.7% | 3 | New York | 4.1% |

| 4 | New Mexico | 21.8% | 4 | Maine | 4.9% |

| 5 | Washington | 21.7% | 5 | Wyoming | 5.8% |

| 6 | Florida | 20.4% | 6 | Pennsylvania | 6.0% |

| 7 | Alabama | 19.5% | 7 | New Hampshire | 6.1% |

| 8 | Arkansas | 19.3% | 8 | Connecticut | 6.3% |

| 9 | District of Columbia | 19.1% | 9 | Utah | 6.5% |

| 10 | California | 16.6% | 10 | South Dakota | 7.4% |

New Jersey actually ranked as the state with the lowest percentage of uninsured motorists several years ago. That's great news for New Jersey drivers, who have to worry about just 3.1% of folks on the road not being properly insured. In contrast, the states with the highest percentage of uninsured drivers were Mississippi (29.4%), Michigan (25.5%), and Tennessee (23.7%).

Even though uninsured drivers are extremely uncommon in New Jersey, it's still important to consider adding uninsured motorist coverage to your car insurance. There's still a chance you could get hit by an uninsured driver, and that accident could cost you thousands out of your own pocket without the right coverage.

What Does Car Insurance Cover in New Jersey?

Like all other states, New Jersey has its own set of required car insurance coverages for all drivers, including:

- Bodily injury liability: New Jersey drivers are required to have $15,000 per person and $30,000 per accident of bodily injury liability insurance to protect against injury to others with their vehicle.

- Property damage liability: New Jersey drivers are required to have at least $5,000 per accident of property damage liability insurance to protect against damage to others' property, including fences, etc., with their vehicle.

- Personal injury protection: New Jersey drivers are required to have at least $15,000 per person in personal injury protection to protect against injuries to themselves and their passengers after an accident.

Some important but optional add-on car insurance coverages in New Jersey include:

- Comprehensive coverage: This coverage protects against other hazards to your vehicle, including theft and flood damage. Basically, it covers damage "other than collision."

- Collision coverage: This coverage protects against damage to your vehicle if you're involved in a collision..

A New Jersey independent insurance agent can help you get set up with all the car insurance you need to feel well protected behind the wheel.

Is New Jersey a No-Fault State?

New Jersey is considered a choice no-fault state that allows drivers an "unlimited right to sue" after an accident. This allows drivers to file lawsuits against another party who caused an accident and recoup the full extent of their losses. Drivers in New Jersey can sue others for their "pain and suffering" in a physical, emotional, or mental capacity following an accident.

So, if a driver in New Jersey suffered from anxiety or depression after an accident as well as a broken leg, they could sue the at-fault driver for all of their harm, mental and physical alike. Not all no-fault states offer drivers this option. If you have further questions about how your car insurance works in your state, get in touch with your New Jersey independent insurance agent.

Why Choose a New Jersey Independent Insurance Agent?

New Jersey independent insurance agents simplify the process by shopping and comparing insurance quotes for you. Not only that, but they’ll also cut the jargon and clarify the fine print so you know exactly what you’re getting.

New Jersey independent insurance agents also have access to multiple insurance companies, ultimately finding you the best car insurance coverage, accessibility, and competitive pricing while working for you.

Author | Chris Lacagnina

https://www.alllaw.com/articles/nolo/auto-accident/who-pays-hit-run.html

https://www.caranddriver.com/car-insurance/a37169560/how-much-does-insurance-go-up-after-an-accident/

https://www.iii.org/fact-statistic/facts-statistics-uninsured-motorists

https://www.caranddriver.com/car-insurance/a36465592/new-jersey-car-insurance-laws/

https://www.nolo.com/legal-encyclopedia/new-jersey-no-fault-car-insurance.html

https://www.nolo.com/legal-encyclopedia/what-pain-suffering-personal-injury-case.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.