As homeowners know, sometimes the worst incidents to occur on your property are caused by professionals. So what happens if your home's gutters weren't installed right and caused indoor flooding in your basement? Who's responsible for the mess and pays for the damage?

While a New Jersey independent insurance agent can help protect you with the right homeowners insurance, it's important to first understand this specific situation. Here's a deep dive into who'd be responsible for a faulty gutter install that led to basement flooding.

How Do Gutters Cause Indoor Flooding?

When considering the causes of indoor flooding, especially in the basement, you might not suspect your gutters to be one of them. However, there are several ways gutters can lead to basement flooding.

Top gutter issues leading to flooding:

- Poor downspouts: Downspouts that weren't installed correctly can lead to backups and eventually indoor flooding.

- Loose gutters: Gutters that are loose to the touch and not snugly fit up against the house can allow water to enter through cracks in windows and the foundation.

- Clogged gutters: Clogged gutters can also lead to water backups that result in indoor flooding or damage to the exterior of the home.

- Poor pitches: When your gutters don't have properly installed or functioning pitches, water can't pass through the downspouts, which can lead to backups and basement flooding.

- Missing splash blocks: Without splash blocks, the water that passes through the downspouts can pool up around the home's foundation and eventually cause basement flooding.

Make sure to inspect your gutters regularly to spot any clogged, loose, or otherwise malfunctioning parts. Doing this can help prevent basement and other indoor floods before they occur.

Who’s Responsible if the Gutters Flood My Basement?

Though the contractor or builder who installed your gutters would technically be at fault, it would still be your responsibility to press charges against them or file a homeowners insurance claim. Fortunately, your insurance company could likely reimburse you by suing the contractor's business's insurance for the damages. Though your insurance company may need to conduct an investigation first to prove that it was the installer's fault.

Knowing this, it's imperative to only ever hire contractors and other professionals that show you proof of insurance first. If the contractor didn't have any insurance, you could be stuck with the mess all on your own. Ask for proof of insurance and official licensing every time before you allow anyone to make repairs or alterations to your home.

Does My Home Insurance Cover Basement Flood Damage?

Homeowners insurance in New Jersey covers basement flood damage if the cause of the flooding was due to a peril listed on the policy. Examples include:

- Busted plumbing

- Ice dams on the roof

- Wind-driven rain

- "Sudden and accidental" incidents*

*This type of incident could involve an appliance like a washing machine that suddenly breaks down, leading to an indoor flood. Because of the likelihood of these perils, it's a good idea to get set up with New Jersey homeowners insurance as soon as you can.

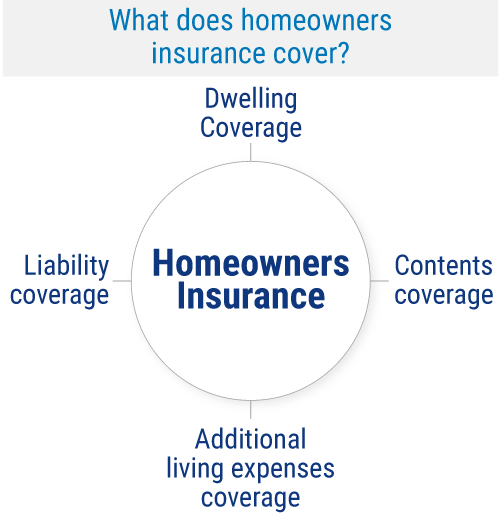

What Does Home Insurance Cover in New Jersey?

Your home insurance policy covers many aspects of the home, whether you live in New Jersey or anywhere else. Here are some of the main coverages provided by standard homeowners insurance:

- Dwelling coverage: Your home's structure is protected against many threats like fire damage, lightning, and more.

- Additional living expenses: Homeowners are protected against unexpected costs like hotel charges if they must live somewhere else while their home gets repaired after a covered disaster.

- Liability coverage: Homeowners are also protected against lawsuits filed against them by third parties for claims of bodily injury or property damage.

- Contents coverage: Your personal belongings stored in and around the home, and sometimes in storage units, are protected against numerous perils as well, including theft and fire.

It's always a safe practice to be covered by homeowners insurance to avoid having to pay for hefty property damage costs out of your own pocket. A New Jersey independent insurance agent can help you get set up today.

What about Other Common New Jersey Forms of Floods?

Home insurance covers some causes of basement and indoor flooding, but not all. Check out this list of common sources of flooding in New Jersey and whether or not they're covered.

Top 6 most common disasters leading to home flooding in New Jersey:

- Broken pipes: Home insurance does cover indoor flooding caused by burst pipes and plumbing.

- Faulty drainage: Sewers that don't drain properly can lead to backups and flooding, but you'd need a sewer backup endorsement for your home insurance to cover these issues.

- Clogged gutters: Unfortunately, home insurance doesn't often cover basement or other indoor flooding caused by clogged gutters.

- Broken appliances: Home insurance does cover indoor flooding caused by broken appliances, in many cases.

- Damaged foundation: Cracks and other damage to your home's foundation is often considered a maintenance issue by the homeowner and resulting flooding is not covered by insurance.

- Natural disasters: Home insurance covers many types of damage caused by natural disasters, but flooding is not one of them.

Knowing which types of basement flooding are covered by your homeowners insurance can help you better prepare yourself in case a disaster occurs. You'll know when you can file a claim and when you can't. If you still have questions about which types of indoor flooding are covered, your New Jersey independent insurance agent can help answer them.

Does Flood Insurance Cover All Types of Floods in New Jersey?

Flood insurance is important to protect your home from sources of natural flooding, especially because New Jersey is prone to hurricanes and other water-heavy storms. But just like home insurance, flood insurance doesn't cover all types of flooding. Flood insurance typically only considers a flood to be a buildup of water on normally dry land.

To be covered, the excess water must also affect two or more properties or two or more acres of land. This means that flood insurance won't cover water damage to your home caused by busted plumbing, faulty gutters, etc. Flood insurance is designed instead to protect you against hurricanes, tsunamis, and other natural sources of flooding.

Where Do I Buy Flood Insurance?

Flood insurance is available through the National Flood Insurance Program (NFIP), which is a part of FEMA. But you can ask your independent insurance agent to help you find coverage.

The average cost of flood insurance is $700 annually.

Flood insurance sold by the NFIP usually comes with a limit of $250,000 in coverage for your home and personal property together. But your independent insurance agent may also be able to find you private coverage with a higher limit. To determine how much coverage you need, you'll want to consider the value of your home and property, and how much you could afford to pay out of your own pocket after a flood disaster.

Why Choose a New Jersey Independent Insurance Agent?

New Jersey independent insurance agents simplify the process by shopping and comparing insurance quotes for you. Not only that, but they’ll cut through the jargon and clarify the fine print so you know exactly what you’re getting.

New Jersey independent insurance agents also have access to multiple insurance companies, ultimately finding you the best home and flood insurance coverage, accessibility, and competitive pricing while working for you.

Author | Chris Lacagnina

https://www.iii.org/press-release/water-damage-whats-covered-whats-not-111809

https://www.accurateleak.com/6-common-causeshome-flooding/

© 2025, Consumer Agent Portal, LLC. All rights reserved.