You might be relaxing in your dining room, enjoying a nice meal, when all of a sudden a golf ball comes hurtling through your window, leaving shattered glass behind. For these unexpected disasters, sometimes it's confusing to determine how they should be handled. So who'd be responsible if a neighbor sent a golf ball through your window?

While a New Jersey independent insurance agent can help you get covered by the right homeowners insurance, we can start by helping to answer this question. So here's a breakdown of who'd be responsible for paying if one of your neighbors hit a golf ball through your home's window.

Who’s Responsible for Paying for the Damage If a Golf Ball Breaks My Window?

You could go to your neighbor and ask them to file a claim through their homeowners insurance to cover the damage. It'd most likely be a liability claim through your neighbor's home insurance that paid for the damage to your home. However, if it’s only a broken window, your neighbor would most likely compensate you out of pocket.

Your neighbor might determine that the cost of replacing your window would be less than going through their home insurance and paying that deductible amount. So they might choose to write you a personal check or hand over cash from their own pocket instead. When determining if a home insurance claim is worth it, it's helpful to weigh how much the damage would cost to repair on your own, and if this amount exceeds your policy's deductible enough.

Will Homeowners Insurance Fully Cover the Damage to My Window?

If the damage is only to one small window, your neighbor probably wouldn't want to file a claim and risk raising their premiums. Just one claim against a home insurance policy can raise the premium by an average of 9%, or $150 a year. Also, your neighbor would have to pay their policy's deductible amount out of pocket before reimbursement would kick in.

For policies with high deductible amounts, it often makes more sense to just pay for small repairs yourself instead of filing a claim. Not only do you not have to pay the deductible, but you'll also erase the chance of your premiums spiking. If you need help weighing your options, your New Jersey independent insurance agent can help you consider the potential drawbacks vs. the benefits.

When Would I Want to File a Homeowners Claim?

Your neighbor would be likely to want to file a claim through their home insurance for your broken window if the damage was significant or caused a huge catastrophe, like if the golf ball not only broke a window, but also injured a family member inside, or knocked over a candle and burned down your home. In that case, their home insurance should definitely be contacted.

Am I Responsible for Covering Any Damage Caused by the Golf Ball?

You shouldn't have to cover any of the damage yourself if your neighbor is honest and takes ownership of the disaster. But they'd have to pay their deductible amount themselves, if they chose to file a homeowners insurance claim. Deductibles must be met on a per-claim basis.

Many folks find that it's easier and cheaper to just cover simple property damage themselves, instead of filing a claim. Make sure to be familiar with your policy's coverage limits and deductible amount that you're responsible for paying for each claim. If you're not certain of these numbers, your New Jersey independent insurance agent can find this information for you easily.

If I Live on a Golf Course, Are Broken Windows My Responsibility?

If you live on a golf course, there's obviously an extremely increased risk of finding golf balls and shattered glass on your living room or kitchen floor. According to insurance expert Paul Martin, it's likely that your home insurance policy would still cover the damage even with the increased risk, but your deductible amount would probably be way too high to make filing a claim worth it. You'd need to review your specific home insurance policy with the help of your New Jersey independent insurance agent to be certain whether you were covered..

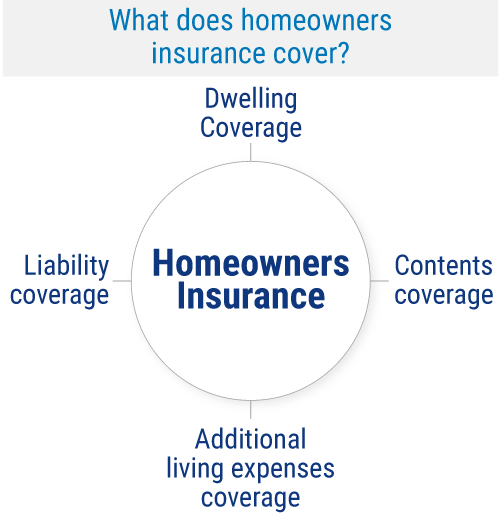

What Does Homeowners Insurance Cover in New Jersey?

Homeowners insurance covers multiple facets of your home, not just the exterior walls. While policies can vary, the standard protections offered in New Jersey include:

Key Coverages of Home Insurance in New Jersey:

- Additional living expenses: Covers the homeowner and their family in case of disaster that requires them to live somewhere else, like a hotel, while extensive repairs are being made to their home.

- Dwelling coverage: Covers your home's exterior or building from many disasters like fire, etc.

- Liability coverage: Covers you against lawsuits filed by third parties for claims of property damage or bodily injury.

- Contents coverage: Covers your belongings like clothing and furniture for many listed disasters like theft, fire, and more.

Your New Jersey independent insurance agent can help you get equipped with the right homeowners insurance policy to protect against much more than stray golf balls damaging your property.

Why Choose a New Jersey Independent Insurance Agent?

New Jersey independent insurance agents simplify the process by shopping and comparing insurance quotes for you. Not only that, but they’ll also cut the jargon and clarify the fine print so you know exactly what you’re getting.

New Jersey independent insurance agents also have access to multiple insurance companies, ultimately finding you the best home insurance coverage, accessibility, and competitive pricing while working for you.

Author | Chris Lacagnina

https://www.today.com/money/broken-window-think-twice-about-claim-home-insurance-8c11432388

https://www.rocketmortgage.com/learn/homeowners-insurance-deductible#:~:text=When%20it%20comes%20to%20homeowners,on%20each%20of%20those%20claims.

https://www.iii.org/article/understanding-your-insurance-deductibles

© 2025, Consumer Agent Portal, LLC. All rights reserved.