In New Jersey, 80% of the population resides in the coastal zone. While the 130-mile coast can be a beautiful place to live, homes in this area and other parts of the state are at increased risk of flooding. Specific home aspects, like having a basement, can add to a homeowners concern about flooding.

If you're worried about flooding in your home and whether owning a basement makes the cost of insurance more expensive, a New Jersey independent insurance agent can help. An agent can help you find the right home and flood insurance to protect you.

Why Is Home Insurance so Expensive in High Flood Risk Homes?

Home insurance premiums are calculated based on several factors, but ultimately, the insurance company is trying to discover how large of a risk your home presents. The more likely you are to file a claim, the higher the premium will be.

For New Jersey homeowners who live in a high-risk flood zone, insurance can be more expensive because the risks of a flood event causing damage are higher than for a home that's not in a flood zone. Other factors that play into home insurance rates include:

- Age of home

- Foundation of home

- Local crime rates

- Value of your home

- Home safety features

- Your deductible

- Amount of coverage you need

A high flood risk home can increase the cost of home insurance and may also require the owner to purchase flood insurance. The average flood insurance policy in New Jersey is $949 a year. This is another added insurance cost that homeowners should consider.

Do I Need Flood Insurance in New Jersey to Help Minimize the Risk?

If your home is at risk of flooding in New Jersey, you may be required by your mortgage lender to purchase flood insurance to qualify for a mortgage. Even if you're not required, flood insurance is worth discussing with your insurance agent, considering New Jersey's high risk of flooding statewide.

More than 217,000 properties in New Jersey are currently protected with flood insurance through the National Flood Insurance Program (NFIP). Of all the NFIP claims made in the state, approximately 73% are from homes in the coastal zone.

These stats show that homes located in the coastal zone should consider flood insurance, but other homes in the state can also benefit from flood insurance.

What Does Flood Insurance Cover?

Flood insurance is designed to cover what home insurance does not: damage from natural floodwaters. The NFIP is a standardized flood insurance program that FEMA created to provide affordable flood coverage for all homeowners who need it.

The NFIP partners with communities across the US to offer flood insurance. If your home experienced damage from natural floodwaters, you would receive coverage for the structure of your home and the contents inside your home.

Specifically, flood insurance includes building and contents coverage that covers the following:

- Damage to/loss of your home: This includes the home's foundation, electrical systems, indoor plumbing, built-in appliances, installed flooring, and detached structures.

- Damage to/loss of your stuff: This includes built-in furniture, freestanding furniture, personal appliances, valuable clothing, artwork, and similar possessions.

Any depreciation of your property's value will be factored into what the insurance policy pays towards reimbursement for damage.

What Isn't Covered by Flood Insurance?

Homeowners often wonder if and how their basement will be covered in the event of a flood. There are some exclusions for coverage for the basement, which will be outlined in your policy.

Ultimately, flood insurance would not cover any improvements to the basement or your personal property in the basement. Coverage is typically limited to necessary appliances and units such as AC, water heaters, sump pumps, furnaces, etc.

Other things that are not covered under flood insurance include:

- Damage from burst pipes

- Damage from other in-home leaks such as an overflowed tubs or toilets

- Damage caused by moisture, mildew, or mold

- Property that's located outside the insured building, like patios, decks, landscaping, swimming pools, and fences

Fortunately, New Jersey home insurance will cover flood damage from frozen burst pipes, broken appliances, leaky water heaters, and similar events.

Why Does New Jersey See So Many Floods?

New Jersey's increasing flood danger is a result of multiple factors. First, population density has resulted in a high density of buildings and infrastructures. Second, the state is experiencing massive sinking. The Jersey Shore sea level has risen twice as fast as the global average over the last century. This, combined with changing weather patterns, has made New Jersey an increasing target for severe flood weather.

New Jersey only has 67 square miles of dry land in the “danger zone,” but more than 154,000 people live in those areas, putting the Garden State at risk.

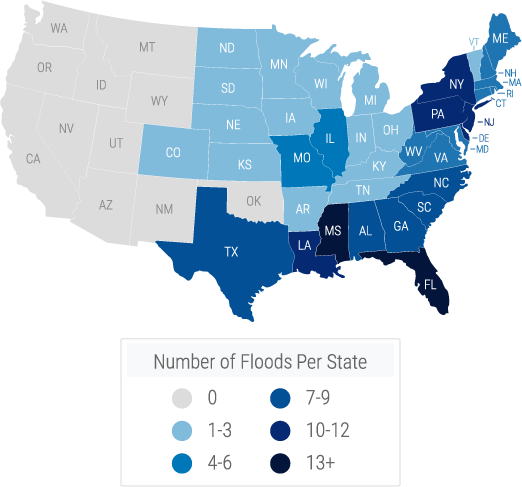

US Flood Risk Map

How Much Does Flood Insurance Cost?

In New Jersey, the average homeowner pays $949 a year for flood insurance. However, there are multiple factors that can impact flood insurance rates.

Factors that impact flood insurance rates

- Whether your home is in a flood zone

- Claims history

- Flood history

- Amount of coverage purchased

- Elevation of your property

Of course, the largest factor is where your home is located and its risk for flooding. Your agent can help you understand what it would cost to purchase flood insurance for your home.

How Can a New Jersey Independent Insurance Agent Help?

Flooding in New Jersey impacts homeowners across the state. Whether you live on the coast or inland, understanding your homeowners insurance coverage can help you determine whether you need to purchase flood insurance.

A New Jersey independent insurance agent will chat with you about your home and make recommendations for coverage. If you need to purchase flood insurance, they can secure that for you. Agents are also available to assist you if you need to file a claim. They're with you every step of the way.

Article Reviewed by | Paul Martin

https://www.documentcloud.org/documents/20685817-nj-climate-change-resilience-strategy-draft

https://www.nj.com/news/2021/10/the-cost-of-fema-flood-insurance-policies-is-going-up-but-taxpayers-are-still-helping-to-foot-the-bill.html

https://www.consumerreports.org/flood-insurance/what-flood-insurance-does-and-does-not-cover-a7199062056/

https://www.fema.gov/press-release/20210318/what-does-flood-insurance-cover-basement

https://njclimateresourcecenter.rutgers.edu/climate_change_101/sea-level-rise-in-new-jersey-projections-and-impacts/