When you own a home, there are several elements you could encounter. New Jersey homeowners insurance may have protection against a hurricane, but what about the flooding that could occur? There are specific policies you'll need in place beforehand to have proper insurance.

Fortunately, a New Jersey independent insurance agent can help. They work with several highly rated carriers so that you get the best deal in town. Connect with a New Jersey independent insurance agent for free.

What Is Flood Insurance?

In New Jersey, if you want protection against flooding, you'll have to add it in most cases. Contrary to popular belief, your homeowners policy doesn't have coverage for a true flood. Check out how flood insurance can help:

- Flood insurance: This type of property insurance covers a structure for losses due to a flood. This is caused by snow melting, storm surges, heavy rainfall, storm drainage system failures, and even levee dam system failures.

What Does Flood Insurance Cover in New Jersey?

When you purchase a flood insurance policy in New Jersey, it will provide certain coverages that won't come automatically in other insurances. Check out what your New Jersey flood policy will cover:

- Electrical and plumbing systems

- Furnaces and water heaters

- Appliances

- Vehicles

- Detached garages

- Personal belongings

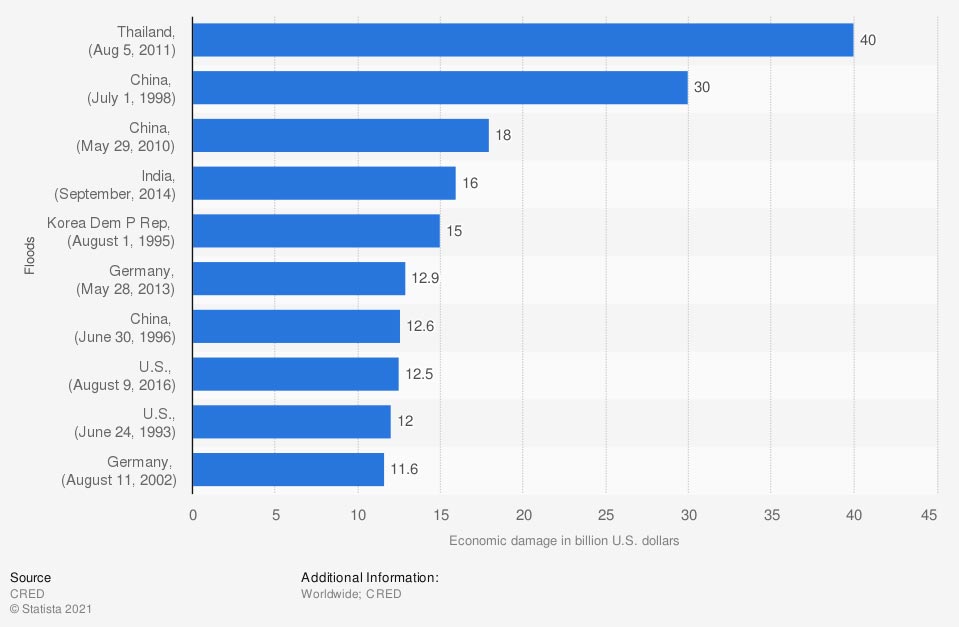

Economic damage caused by significant floods worldwide

If you're hoping for coverage against a flood, you'll need to add a separate flood policy. This can be done in addition to your homeowners insurance.

What Doesn't Flood Insurance Cover in New Jersey?

Your policies will come with a list of exclusions. In New Jersey, you'll have items not included under your home and flood insurance policies. First, it's vital to understand what a flood is:

- What is considered a flood: A flood is an excess of water on land that is usually dry. This typically is classified as affecting two or more acres of land or two or more properties.

Not all floods are created equal when it comes to classifying a claim. Floods that happen due to water/ sewer back-ups, burst pipes, waterline malfunctions, or roof leaks are not something covered under your flood policy. However, some of those may be insured with your home coverage.

Where Can I Buy Flood Insurance in New Jersey?

Flood insurance is a federally funded policy and can be purchased through a licensed agent. Items that may affect your New Jersey flood insurance rates are:

- The location of your property

- The flood zone of your property

- Whether the property is residential or commercial

- Your insurance score

- Your loss history

- Prior coverage history

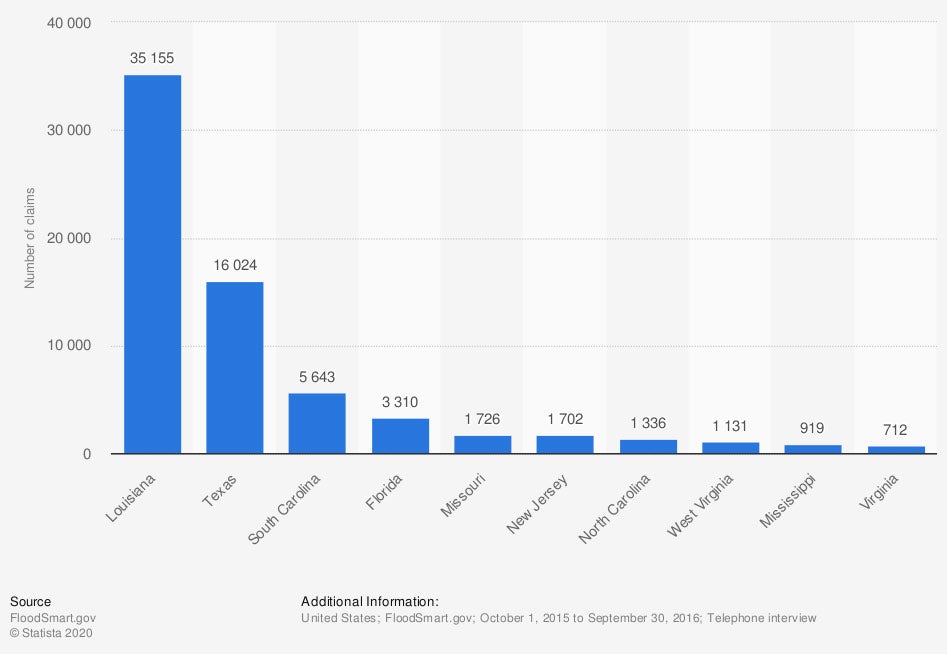

US states with the highest number of flood insurance claims

Flood catastrophes can happen anywhere in any home. The key to avoiding a sizeable out-of-pocket loss is to be proactive with the proper coverage.

Does Flood Insurance Cover a Hurricane in New Jersey?

In order to have enough coverage when a hurricane strikes, you'll need flood insurance. A hurricane can easily cause flood damage to your property, but won't be covered under your primary homeowners policy.

Flood insurance will come with standard limits of coverage set by FEMA. There are maximum allowances for each property type you own. They are as follows:

- Flood insurance for your home: Flood carriers usually offer $250,000 for the building and $100,000 for the building contents.

- Flood insurance for your business: Flood carriers usually allow $500,000 for the building and $500,000 for the building contents.

- Flood insurance as a renter: Flood carriers typically offer $100,000 for contents-only coverage.

How an Independent Insurance Agent Can Help in New Jersey

When you own a home, there are several risk factors you'll have to take into account. Proper protection is necessary and can be confusing if you're not a licensed professional. Fortunately, you're not alone, and a trained adviser can help for free.

A New Jersey independent insurance agent has access to numerous carriers at once, giving you options. They'll even do the shopping at no additional cost so that you save time and money. Connect with a local expert on trustedchoice.com for custom quotes in minutes.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

https://www.statista.com/statistics/267750/economic-damage-caused-by-floods-worldwide/

https://www.statista.com/statistics/192348/top-10-us-states-for-flood-insurance-claims-2010/

http://www.city-data.com/city/New-Jersey.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.