There are many risks on the road, and some are just outside of your control. While taking a joy ride may seem appealing, it's important that you have the right protection beforehand. New Jersey car insurance can help in instances like hitting a deer.

A New Jersey independent insurance agent will do the shopping at zero cost, which means you save time and money. They work with numerous markets so that you don't have to. Connect with a local expert to get started for free.

What Is Car Insurance?

If you hit an object or animal while driving, it can be a shock. The proper protection on your auto policy will help pave the way to a loss being covered. Take a look at how car insurance can help:

- Car insurance: This policy comes with many coverage options and protects against a lawsuit arising from bodily injury, property damage, or physical damage.

What Does Car Insurance Cover in New Jersey?

Most states mandate car insurance in some form or fashion. Check out what New Jersey requires below:

- Minimum limits of auto liability in New Jersey: $15,000 per person/ $30,000 per accident/ $5,000 property damage

- Property: Coverage for damage to vehicles and outside property

- Liability: Coverage for bodily injury or property damage

- Medical: Coverage for your medical expenses due to an at-fault loss

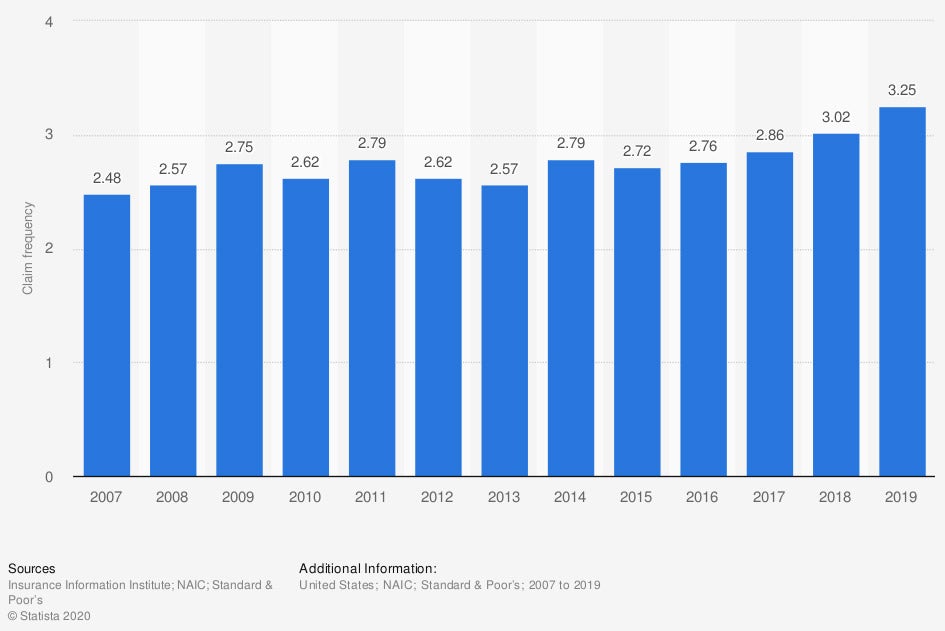

Frequency of private passenger comprehensive auto insurance claims for physical damage in the US

If you hit a deer on the road, coverage for any damage to your vehicle will fall under one of two limits. These are optional coverages that must be added beforehand.

What Doesn't Car Insurance Cover in New Jersey?

In New Jersey, $4,866,771 in car insurance claims were paid in one year alone. When you need more than the minimum required liability limits, it has to be added to your policy. Check out optional car insurance coverages you should consider:

- Gap coverage: Pays for the difference between your remaining loan balance and the market value when a total loss occurs.

- Tow coverage: Will pay for a tow truck to tow a covered auto due to a loss.

- Rental car coverage: Will provide reimbursement for a rental car when your covered auto is damaged.

- Comprehensive coverage: Will pay for property damage to your vehicle that is hit by an unavoidable obstruction. It also pays for fire, theft, vandalism, and severe weather damage.

- Collision coverage: Pays for property damage to your car in the event of a crash when you're at fault.

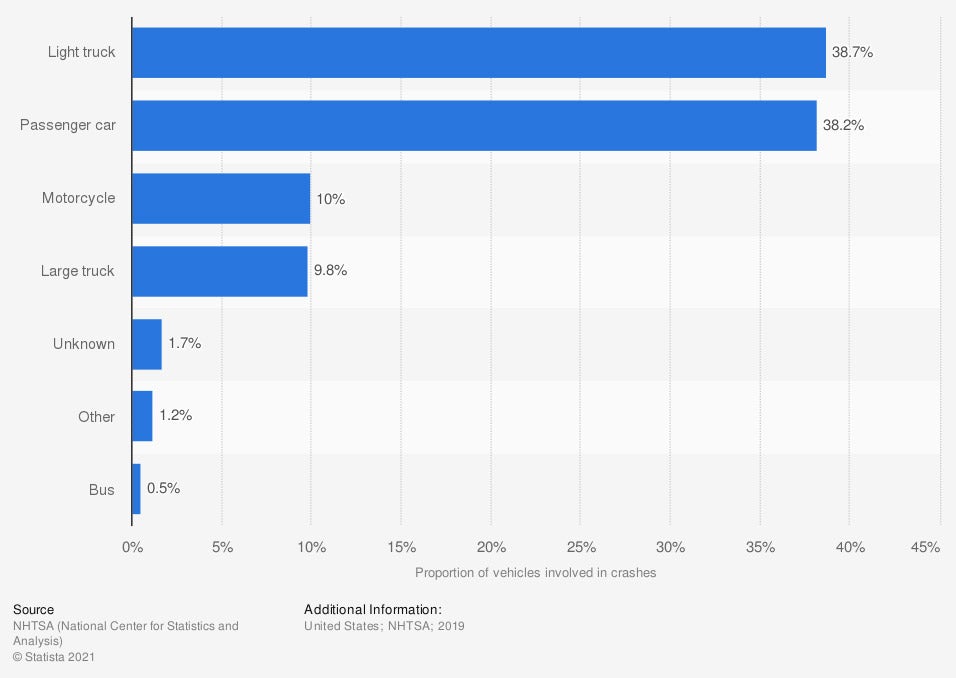

Distribution of vehicles involved in fatal traffic crashes in the US

Many car accidents can turn fatal, which makes it necessary to have the right policy in place. When you're proactive, it can help soften the blow of a major loss.

Does Car Insurance Cover Hitting a Deer in New Jersey?

In New Jersey, you'll only have coverage for the physical damage to your vehicle if you add it. The cost to replace or repair your car when it's not another party's fault falls under two limits. Comprehensive and collision coverage will pay for damage caused when you hit a deer with your car.

When you add these two coverages to your auto policy, it typically doubles the cost of insurance. This is known as a full coverage car policy and is necessary if you want protection for your vehicle.

How to File a Claim after Hitting a Deer in New Jersey

The sinking feeling after a car accident occurs can leave you dazed and confused. When you're unsure of what to do next, follow these simple steps to file a claim after hitting a deer in New Jersey:

- Step 1: Get to a safe place and seek medical attention if necessary.

- Step 2: Call your independent insurance agent to file a claim.

- Step 3: Obtain information from your agent about a replacement rental vehicle if needed.

- Step 4: Set up a meeting with your assigned adjuster to go over the damage to your vehicle.

How an Independent Insurance Agent Can Help You in New Jersey

To obtain the perfect car insurance for you and other drivers in your family isn't impossible if you know who to trust. Fortunately, a licensed adviser can help review your insurance for free. There are several optional coverages you'll need to consider when purchasing a policy.

A New Jersey independent insurance agent does the shopping for you at no cost, making it super-easy. They'll go over the limits required for your state and what they recommend in addition. Connect with a local expert on trustedchoice.com for fast results without the hassle.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

https://www.statista.com/statistics/830114/comprehensive-car-claim-frequency-physical-damage-usa/

https://www.statista.com/statistics/192089/vehicles-involved-in-traffic-crashes-in-the-us/

http://www.city-data.com/city/New-Jersey.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.