New Jersey drivers need to be prepared for accidents that can happen on and off the road. Flooding can cause severe damage to a vehicle, and understanding how your car insurance covers flood damage can help get you back on the road.

Fortunately, a New Jersey independent insurance agent knows exactly what coverage you need to be protected against flooding. Agents can also ensure that your policy is up to date with the best possible coverages against all potential risks.

Does New Jersey Car Insurance Include Flood Protection?

Car insurance will cover damage from flooding under certain situations and if you have the right coverage. First, you need to have comprehensive coverage.

- Comprehensive coverage: This covers the cost to repair or replace your vehicle if it is damaged or totaled by a non-collision event such as a hailstorm or theft.

Comprehensive coverage is an optional policy that you can work with your independent insurance agent to purchase.

Assuming you have comprehensive coverage, it would assist if you experienced flood damage, as long as it was due to a covered peril, such as hail or flooding. Car insurance would not cover damage from leaving your window down during a rainstorm or something similar.

If your car is deemed totaled from the flood damage, your comprehensive coverage will replace your vehicle at the car's actual cash value at the time of the flooding.

Do I Have to Pay for Any Damage?

With comprehensive coverage, you would be responsible for your deductible. Once that was paid, you'd receive coverage up to your policy limits. If the repairs went above and beyond your policy limits, you would be financially responsible for the remaining costs.

Deductibles can be adjusted when selecting an insurance policy. An agent can advise you on a proper deductible amount and talk you through how lowering or increasing your deductible would impact your policy. Typically, the higher your deductible, the lower your premiums are, but the more you'd be responsible for out of pocket before insurance would cover an incident.

It's also likely that your auto insurance premiums would increase after filing a flood claim. Once you file a claim, your carrier assumes you're more likely to file another claim in the future. Should your insurance increase significantly, your agent can help you shop for discounts or a new policy to try to lower your premiums.

What If I Only Have Liability Coverage?

All New Jersey drivers are required to have liability coverage. It is designed to help pay for third-party bodily injury and property damage claims. It would not assist you if your vehicle were damaged because of flooding.

If you only had liability coverage, you'd be left paying for all damage out of pocket. The best way to avoid this is to work with an agent to purchase optional coverages like comprehensive insurance and collision insurance. Comprehensive insurance can assist in most non-collision events, and collision insurance can help if you're in an at-fault accident that damages your vehicle.

What Isn't Covered by Car Insurance?

Car insurance will not cover certain flood situations. These are typically categorized as flooding that results from negligence. In addition to certain flood situations, car insurance does not cover the following:

- Intentional damage

- Other damage from negligence

- General maintenance

- Driver injuries unless you have the proper coverage

- Damage to your vehicle unless you have collision insurance

- Damage caused by a hit and run or uninsured motorist unless you have uninsured motorist coverage, property damage, or collision coverage

- Damage from non-collision events unless you have comprehensive coverage

The good news is that most exceptions to auto coverage can be covered by adding optional policies. An agent can help review your insurance policy and recommend coverages and policy limits to fully protect you.

Why Does New Jersey See So Many Floods?

New Jersey is at increased risk of flooding due to changing weather patterns, population density, and massive sinking. In recent years, the population in the state has grown immensely, resulting in a high density of buildings and infrastructures. In addition, the Jersey Shore sea level has risen twice as fast as the global average over the last century.

The state only had 67 square miles of dry land in the “danger zone,” but more than 154,000 people live in those areas, putting the Garden State at risk.

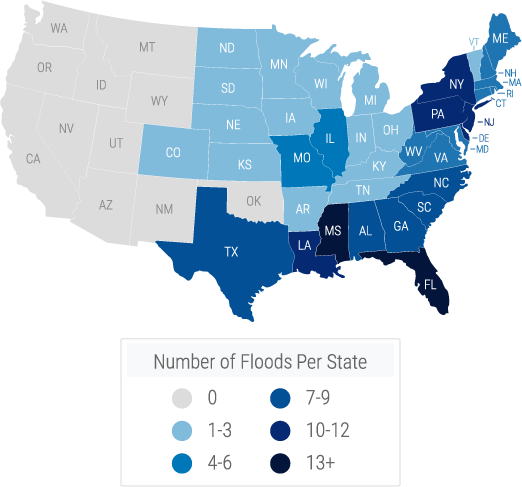

US Flood Risk Map

Are There Any Additional Coverages I Should Consider for Flooding?

If your home is located in a high-risk flood zone, or you're especially worried about flood damage to your vehicle, you can increase your policy limits on your comprehensive coverage.

In addition, if you're concerned about your vehicle flooding, you're likely to have similar concerns about your home. To receive protection for your home against flood damage, you can look into flood insurance through the National Flood Insurance Program or through private flood insurance companies. Keep in mind that New Jersey home insurance does not cover flood damage from natural waters.

How Can an Independent Insurance Agent Help?

Car insurance comes in many shapes and sizes alongside required and optional coverages. A New Jersey independent insurance agent can help you navigate cost and coverages and assist in selecting a policy.

Agents work with carriers across the state and know which providers have a good reputation for offering quality coverage at affordable rates. After shopping multiple insurance quotes, they'll present you with car insurance options and recommendations to fit your needs and budget.

Article reviewed by | Jeffrey Green

https://www.iii.org/article/what-is-covered-by-collision-and-comprehensive-auto-insurance

https://www.motortrend.com/features/does-car-insurance-cover-flood-damage/