If you're a licensed driver, you know the pain of paying for coverage. It can be challenging to find protection that doesn't break the bank. Fortunately, New Jersey car insurance premiums can be calculated with a trusted adviser.

A New Jersey independent insurance agent has access to multiple markets so that your policy is affordable. They'll do the shopping for free, making it a no-brainer. Connect with a local expert to get started in minutes.

What Is Car Insurance?

In New Jersey, you'll have to follow the rules of the road, which includes having car insurance. Take a look at how coverage works:

- Car insurance: Pays for a bodily injury or property damage lawsuit caused by a motor vehicle accident.

- Minimum liability limits required in NJ: $15,000 per person bodily injury limit/ $30,000 per accident bodily injury limit/ $5,000 for property damage per accident.

What Is the Average Cost of Car Insurance in New Jersey?

What you'll pay for car insurance is different from anyone else. That's because coverage is individualized and based on your risk factors. Check out the rates below:

- National average cost of car insurance: $1,311

- New Jersey average cost of car insurance: $1,595

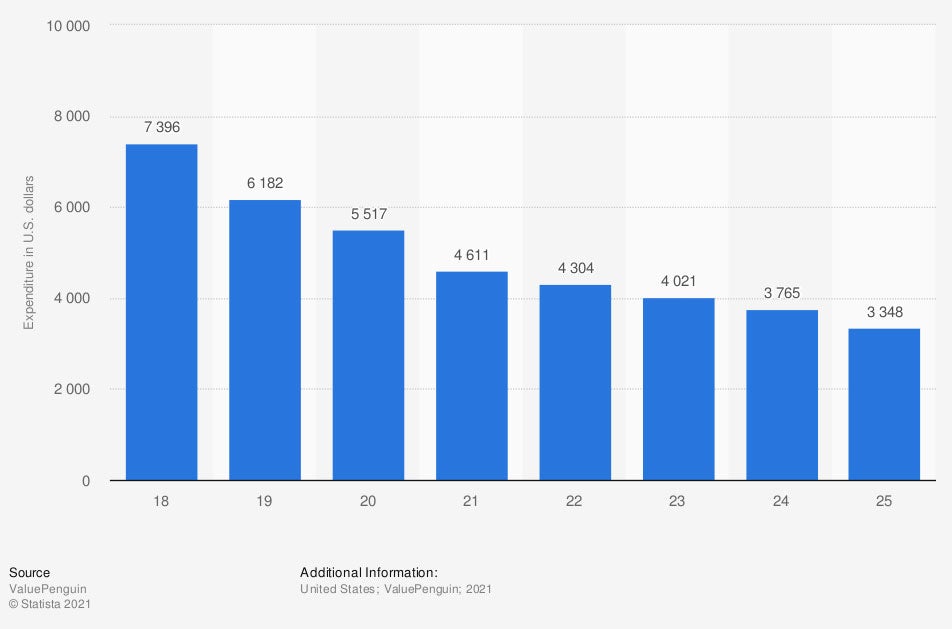

Average auto insurance expenditure in the US, by age

When you want exact pricing, insurance companies look for specific items. Things like your loss history, driving record, the value of the cars, and coverage selected will determine your costs.

How Is Your Car Insurance Calculated in New Jersey?

Your New Jersey car insurance rates will be unique, and there's not a one-size-fits-all approach. When calculating your costs, carriers look at how well you drive, your experience, violations, and outside factors like local crime. Check out the vehicle theft rates:

- National vehicle theft rates: 2.29 per 1,000 people

- New Jersey vehicle theft rates: 1.24 per 1,000 people

How Are Additional Coverages Calculated in New Jersey?

In New Jersey, you'll be required to carry the minimum liability limits and uninsured/underinsured motorist coverage. If you want protection for your vehicles or roadside assistance, you'll need to add it.

Optional car insurance coverages:

- Gap coverage: Pays for the difference between your remaining loan balance and the market value when a total loss occurs.

- Tow coverage: Will pay for a tow truck to tow a covered auto due to a loss.

- Rental car coverage: Will provide reimbursement for a rental car when your covered auto is damaged.

- Comprehensive coverage: Will pay for property damage to your vehicle that is hit by an unavoidable obstruction. It also pays for fire, theft, vandalism, and severe weather damage.

- Collision coverage: Pays for property damage to your car in the event of a crash when you're at fault.

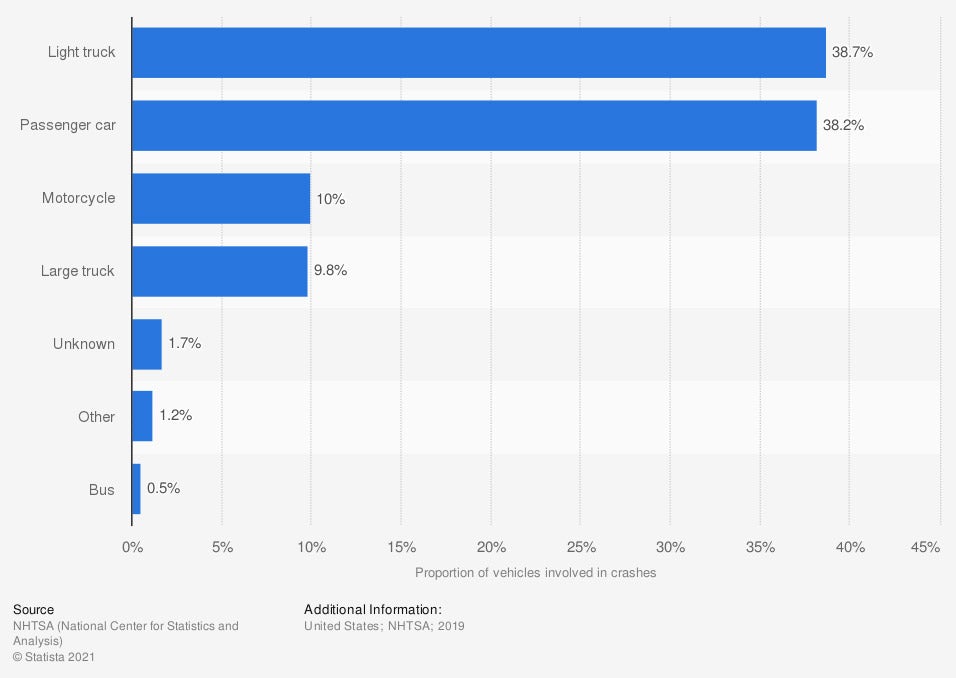

Distribution of vehicles involved in fatal traffic crashes in the US

Accidents can occur no matter where you live or how safe a driver you are. In order to help soften the blow and expense of what an accident can cause, proper protection is necessary.

Reasons Why Your Car Insurance Rates May Be Higher in New Jersey

There are several exposures that insurance companies look for when figuring out your premiums. If your rates are higher, it could be for a number of reasons.

Things that could make your car insurance more expensive in New Jersey:

- An at-fault accident in the past 3 to 5 years

- A driving record with some history on it

- Youthful drivers on your policy

- The type of coverage you select

- The value of your vehicles

- How safe your location is

How a New Jersey Independent Insurance Agent Can Help

If you're searching for the best car insurance that doesn't cost a fortune, then you'll need to do some shopping around. Premiums can vary from person to person, making it necessary to have a knowledgeable adviser. Fortunately, you're not alone, and there is a licensed professional that can help.

A New Jersey independent insurance agent will have access to several carriers at once, saving you time and giving you options. They'll even do the comparing for you at no cost, making it super-simple. Connect with a local expert on trustedchoice.com to get started.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

https://www.statista.com/statistics/555827/auto-insurance-costs-usa-by-age/

https://www.statista.com/statistics/192089/vehicles-involved-in-traffic-crashes-in-the-us/

http://www.city-data.com/city/New-Jersey.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.