Average Cost of Business Insurance in New Jersey

Because you can customize your commercial insurance policy to meet your company’s specific coverage needs, rates for this insurance will vary significantly from one business to the next. Some factors that can influence rates include details about your business, including its industry, size, revenues, and number of employees; the value of the assets you need to insure; and your company’s liability risks. A local independent agent can help you navigate through you various options to ensure that your policy does not leave you with unintentional coverage gaps.

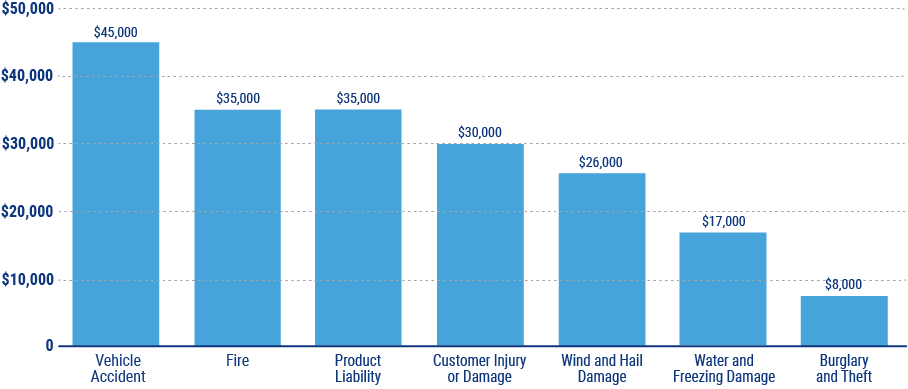

Average Cost for the Top Business Insurance Claims